Macau Mania: Worthy of a Bet?

Yesterday, several gaming and casino-related stocks stole the spotlight, providing investors with serious gains.

But why?

The surge in share price can be attributed to recent news out of Macau, often referred to as the world’s gambling capital.

City officials from Macau announced that China aims to pull back pandemic-related travel restrictions, finally opening the floodgates for players to return.

It was a massive deal; Macau casinos have been undergoing turbulence since the pandemic’s beginning as China put a laser focus on mitigating further COVID-19 outbreaks.

It’s been nearly three years since the city allowed mainland tour groups, so it goes without saying that players are ready to get back.

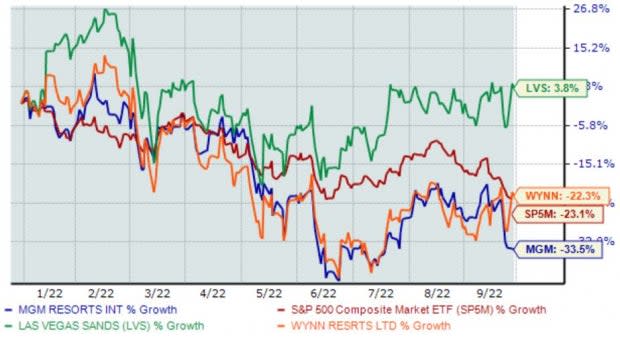

Three stocks that popped yesterday on the news include Las Vegas Sands LVS, Wynn Resorts WYNN, and MGM Resorts International MGM. Below is a chart illustrating the year-to-date performance of all three stocks with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, LVS shares have been notably strong, with MGM shares being the weakest.

It raises a valid question: should investors try to tap into the resurgence of Macau? Let’s take a deeper look.

Wynn Resorts

Wynn Resorts is a leading casino resort developer, owner, and operator. The company owns and operates casino hotel resort properties Wynn Macau and the Wynn Palace, located in the Special Administrative Region of Macau.

Wynn also owns and operates casino hotel resort properties Wynn Las Vegas and Encore in Las Vegas.

Investors took the news well; yesterday, shares closed up 12%.

The announcement comes at a critical time – WYNN has struggled to exceed quarterly estimates, missing the Zacks Consensus EPS Estimate in eight of its previous ten quarters.

However, the company did pencil in a strong 12.8% bottom-line beat in its latest quarter, perhaps indicating that the tide could be turning.

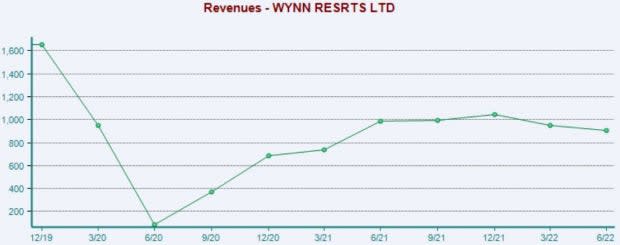

Revenue results have also been primarily disheartening, with Wynn Resorts exceeding top-line estimates in just three of its last ten prints.

Still, the company’s revenue appears to have recovered from the initial pandemic shock, as we can see in the chart below illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, WYNN shares carry a 1.9X forward price-to-sales ratio, nicely below its five-year median of 2.3X but representing a 12% premium relative to its Zacks Consumer Discretionary Sector.

Wynn Resorts carries a Style Score of a D for Value.

Image Source: Zacks Investment Research

Las Vegas Sands

Las Vegas Sands is a leading international developer of multi-use integrated resorts primarily operating in the U.S. and Asia. The company's Macau business comprises the following resorts: Sands Macau, Venetian Macau, Four Seasons Macau, and Parisian Macau.

Las Vegas Sands shares were hot yesterday, closing up more than 11%.

The pandemic restrictions have hit LVS hard; the company has missed the Zacks Consensus EPS Estimate in seven of its last ten quarters.

Top-line results paint the same story, with Las Vegas Sands exceeding revenue estimates in just three of its last ten prints.

However, similar to WYNN, it appears that the company’s revenue has recovered nicely from its 2020 lows, as we can see in the chart below.

Image Source: Zacks Investment Research

Still, LVS carries stretched valuation levels, further bolstered by its Style Score of an F for Value.

The company’s 6.9X forward price-to-sales ratio is undoubtedly on the steep side, well above its five-year median of 4.4X and representing a rich 314% premium relative to its Zacks Sector.

Image Source: Zacks Investment Research

MGM Resorts International

MGM Resorts International is a holding company that owns and operates casino resorts through wholly owned subsidiaries. MGM’s China operations consist of the MGM Macau resort and casino.

MGM shares came out of the gate hot, touching a price of roughly $31.50 before tumbling and closing the day down a marginal 0.2%.

MGM has a much stronger earnings track record, exceeding the Zacks Consensus EPS Estimate in eight of its last ten quarters. Still, the gaming titan posted a wide 87% bottom-line miss in its latest report.

Top-line results have been impressive; MGM has chained together seven consecutive revenue beats. In addition, MGM has a notably stronger revenue trend than WYNN and LVS, as we can see below.

Image Source: Zacks Investment Research

Further, the company sports a Style Score of an A, indicating that shares could be considered undervalued.

MGM’s 0.9X forward price-to-sales ratio is nowhere near its 1.4X five-year median and reflects an attractive 36% discount relative to its Zacks Sector.

Image Source: Zacks Investment Research

Bottom Line

A curb on travel-related restrictions has put the gambling capital of the world, Macau, in the spotlight.

After years of depressed foot traffic stemming from pandemic restrictions, consumers look to get back into the casinos, undoubtedly a positive for any company with exposure to the city.

All three stocks above – Las Vegas Sands LVS, Wynn Resorts WYNN, and MGM Resorts International MGM – have operations in Macau.

In addition, all three carry a Zacks Rank #3 (Hold).

All three would provide exposure for investors looking to tap into the cash that’ll soon be flowing in Macau.

However, investors should approach the situation carefully.

Many unknowns could occur in the coming months, especially with the lingering pandemic.

A great approach would be waiting until positive earnings estimate revisions start rolling in.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Las Vegas Sands Corp. (LVS) : Free Stock Analysis Report

Wynn Resorts, Limited (WYNN) : Free Stock Analysis Report

MGM Resorts International (MGM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance