I’m a Retirement Planning Expert: These 4 States Top Florida and Arizona

Once they hit retirement age, many people automatically think of heading to the bright and sunny states of Florida or Arizona.

With their warm weather, golf courses and retirement communities, these states seem like obvious choices. However, retirement planning experts say other states may be even better for retirement living.

Check Out: 4 States Retirees Are Moving to in 2024 That Aren’t Arizona or Florida

Read Next: The Surprising Way You Can Get Guaranteed Retirement Income for Life

In recent years, there has been a shift away from the traditional retirement magnet states like Florida and Arizona. Rising housing costs, taxes, and crowds have made some retirees reconsider whether these are really the best places to settle down. Instead, they are looking for alternatives that offer a high quality of life, low cost of living and tax advantages.

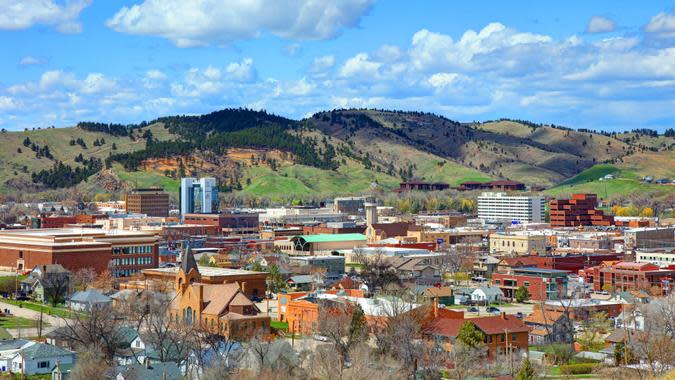

Colorado

While Colorado may not immediately come to mind as a retirement destination, it offers compelling benefits, according to some experts. The state provides access to the Rocky Mountains and an active, outdoor lifestyle. The cost of living is quite reasonable in certain areas.

“Colorado is a great state for retirees, in my opinion,” said Seamus Nally, CEO of TurboTenant. “I’m partial to it because I live here of course, but the truth is that it is a great option for retirees looking for a competitive cost of living. Cities like Denver or Colorado Springs are more expensive, but there are other options like Canon City, where the cost of living is below the national average. The median home price is around $346,000. For outdoorsy retirees, there really is no better place to be.”

Learn More: The Cheapest Places to Retire Across the US That Look Expensive

For You: 5 Subtly Genius Things All Wealthy People Do With Their Money

For comparison, the median home price in Florida is around $388,000, while Arizona’s is nearly $422,000, according to Zillow.com.

With stunning mountain towns like Vail and Aspen, there is certainly luxury living available for those who can afford it. Yet many of Colorado’s smaller towns and communities offer retirees a peaceful lifestyle and comfortable cost of living. Active adults will find hiking, biking, fishing and skiing options abound. With the right home base, Colorado provides the ideal blend of natural beauty and amenities for many retirees.

Earning passive income doesn't need to be difficult. You can start this week.

Tennessee

Tennessee has emerged as a top retirement destination in recent years thanks to its natural beauty, range of living options, and tax perks. This state offers an excellent balance of urban and rural amenities along with a low cost of living.

According to Zillow, the median home price in Tennessee is around $306,000, and according to Payscale.com, the cost of living in Memphis is 13% lower than the national average.

Trending Now: Trump Wants To Eliminate Income Taxes: How Would That Impact You If You Are Retired?

Major metro areas like Nashville and Memphis offer amenities, healthcare facilities and cultural attractions. At the same time, small towns in eastern Tennessee provide a more peaceful setting with a charming, down-home vibe. The Great Smoky Mountains provide ample opportunities for outdoor recreation and natural beauty.

North Carolina

North Carolina is quickly emerging as a leading retirement destination thanks to its mild climate, natural beauty, and vibrant cities. The state offers miles of scenic coastline, the Blue Ridge Mountains, and a reasonable cost of living.

According to Payscale, the median home price in North Carolina is $175,000. Better yet, the cost of living is nearly 10% lower than the national average.

“North Carolina offers the stunning natural beauty of the Blue Ridge Mountains as well as over 300 miles of pristine Atlantic coastline,” said Alex Adekola, CEO and founder of Ready Adjuster. “Major metro areas provide amenities like world-class healthcare through Duke University and cultural attractions that rival larger states.

Smaller towns let you escape the hustle and bustle. With options ranging from quiet Appalachian hamlets to vibrant cities, North Carolina has a retirement spot to fit every lifestyle,” said Adekola. “Low taxes and affordable housing coupled with natural wonders and an appealing climate make North Carolina a retirement sweet spot. It delivers a high quality of life for substantially less than popular alternatives out west and down south.”

With such abundant natural beauty and lots of amenities, it’s no wonder North Carolina’s becoming a go-to retirement destination. The temperate climate means plenty of comfortable days to be out and about. With everything from major metros to charming small towns, North Carolina offers retirement living options to suit every lifestyle and budget.

South Dakota

While not on most retirees’ radars, South Dakota offers financial benefits that make it worth a close look. The state doesn’t tax income, Social Security benefits or pension income. For retirees focused on maximizing their savings, South Dakota offers unparalleled advantages.

According to Zillow, the median home price in South Dakota is around $290,000, and, according to Payscale, the cost of living in Sioux Falls is 8% lower than the national average.

Major population centers are few, but vibrant towns like Sioux Falls offer sufficient amenities along with a more relaxed pace of life. Custer State Park offers beautiful wildlife viewing opportunities. Retirees who enjoy the outdoors will find biking, fishing, and hiking options abound.

More From GOBankingRates

2 Regions in the US Where the Housing Market Is Starting To Shift

If You Shop Online, Make Sure You Do This -- It Could Put an Extra $200 in Your Wallet

This article originally appeared on GOBankingRates.com: I’m a Retirement Planning Expert: These 4 States Top Florida and Arizona

Yahoo Finance

Yahoo Finance