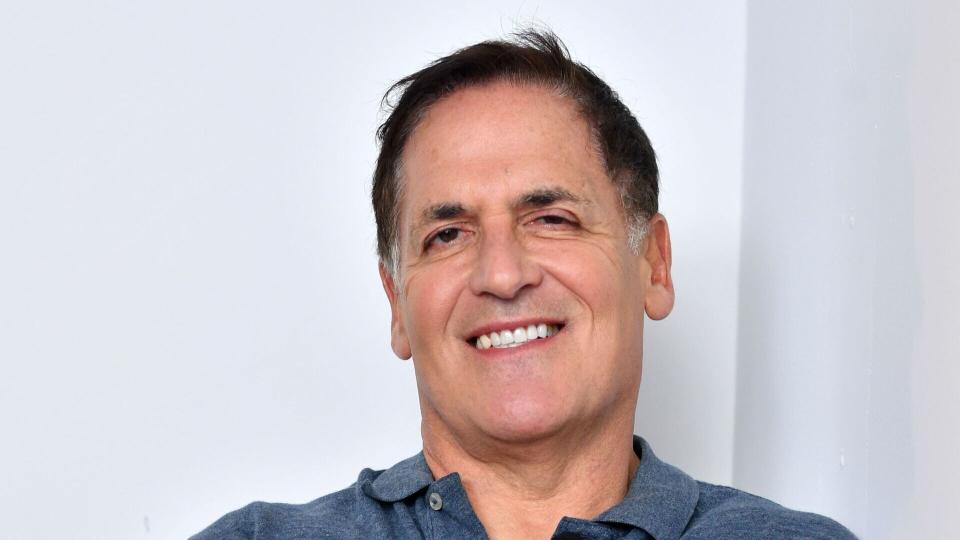

I’m a Financial Advisor: This Money Advice From Mark Cuban Could Help You Make Thousands

With a plethora of financial advice at our disposal — thanks to social media and TikTok reels — it can be hard to discern what will legitimately make us wealthy.

Read More: I Followed Mark Cuban’s Genius Advice and Am on Track To Become a Millionaire

Learn More: 5 Subtly Genius Things All Wealthy People Do With Their Money

There’s a lot of erroneous information floating around; but, according to experts, following billionaire entrepreneur Mark Cuban is actually spot on.

GOBankingRates spoke with Brandon Galici, certified financial planner and founder of Galici Financial, and Justin Godur, finance advisor and founder of Capital Max, to discuss how Cuban’s money advice can help you make thousands.

Wealthy people know the best money secrets. Learn how to copy them.

Live Like a Student

This advice is crucial, especially for young professionals, Galici said.

“It’s tempting to inflate your lifestyle when you land your first ‘adult’ job, but being intentional with your purchases can set the foundation for long-term wealth,” he said.

While he doesn’t advocate eating ramen noodles every night, he said spending less than you earn is a fundamental habit for building wealth. “It helps you avoid high-interest credit card debt and frees up money for investing.”

Galici also noted that getting a handle on your cash flow early on is one of the most impactful steps you can take toward financial success.

Check Out: Mark Cuban’s Best Advice on How To Become Rich

Save Six Months’ Worth of Income

This advice is about more than just being prepared for emergencies, Galici said, it’s about creating financial flexibility and opportunity.

“Having this cushion not only protects you from unexpected expenses without resorting to high-interest credit cards,” he said, “but it also provides you with the freedom to pursue opportunities.”

Whether it’s bridging the gap between jobs or giving you a runway to pursue your side business, he said these savings are crucial.

“With high-yield savings accounts currently offering 4% to 5% interest,” he said, “it’s an excellent place to park your emergency cash while still earning a decent return.”

Eliminate Personal Debt

According to Godur, one particular piece of advice from Cuban that stands out for him is the billionaire’s emphasis on eliminating personal debt before seeking investment opportunities.

“Cuban suggests, ‘The best investment you can make is paying off your credit cards,'” Godur said. “Paying off a 19% credit card is a heck of a lot better than trying to make 19% in the stock market.”

Godur noted that this approach is crucial because it guarantees a return equivalent to your interest rate, which is often significantly higher than achievable through average market activities.

He explained, “I advocate for this strategy because it not only solidifies your financial foundation but also frees up future income for investments, thus accelerating the wealth accumulation process.”

By eliminating high-interest liabilities first, you not only save on interest payments but also enhance your credit score, improving eligibility for more favorable investment loans or opportunities.

Godur said, “This methodical approach to personal finance maximizes potential returns by prioritizing financial stability and smart allocation of resources.”

Invest In S&P 500 Funds

Galici explained that Cuban’s advice about investing in a low-cost, diversified portfolio is a powerful way to build wealth over the long term.

“S&P 500 index funds offer broad market exposure at minimal cost,” he said. “This approach aligns with the principle of not trying to beat the market, but rather benefiting from overall market growth.”

It’s a strategy that has proven effective for many investors over time.

Place up to 10% in High-Risk Investments

“I appreciate Cuban’s balanced approach here,” Galici noted. “While high-risk investments can potentially offer higher returns, they also come with the possibility of significant losses.”

He explained that limiting this to 10% (or less) of your portfolio ensures that you’re not taking on too much risk.

“It’s important to understand your risk tolerance before venturing into these types of investments.”

This strategy allows for potential upside while protecting the majority of your wealth.

Read Books

Books and courses are excellent ways to level up your skills and potentially increase your earning power.

“People often focus solely on cutting expenses when trying to build wealth, but increasing income can be equally, if not more, impactful,” Galici said. “If you’ve already got control of your cash flow, this increase in income can accelerate your wealth-building journey significantly.”

Build a Strong Network Through Kindness

“While this might not seem directly related to finance, I love this advice,” Galici said.

He noted that genuinely caring about others and seeking to help can lead to unexpected opportunities and success.

“Building a strong network and reputation through kindness and helpfulness can open doors and create possibilities you might never have anticipated.”

Prioritize Long-Term Security Over Short-Term Gains

According to Godur, incorporating Cuban’s advice into your financial strategy isn’t just about investment returns.

“It’s about cultivating a disciplined financial mindset that prioritizes long-term security over short-term gains,” he said. “This philosophy forms the cornerstone of my advisory practice, where I assist clients in achieving financial independence through prudent and strategic financial planning.”

More From GOBankingRates

This article originally appeared on GOBankingRates.com: I’m a Financial Advisor: This Money Advice From Mark Cuban Could Help You Make Thousands

Yahoo Finance

Yahoo Finance