I’m an Economist: Here Is What I Would Predict for Inflation If Kamala Harris Were To Replace Biden

After the first presidential debate for this election year, there have been concerns whether President Joe Biden is fit to run for office against former President Donald Trump. Many in the Democratic Party have wondered if it’s time for Biden to drop out of the race. This comes on the heels of Biden stumbling over his words numerous times during the debate — seemingly not being able to connect certain thoughts. The big question is who would replace him?

Explore More: Trump Wants To Eliminate Income Taxes: 3 Items That Will Instantly Get More Expensive

Find Out: 5 Subtly Genius Things All Wealthy People Do With Their Money

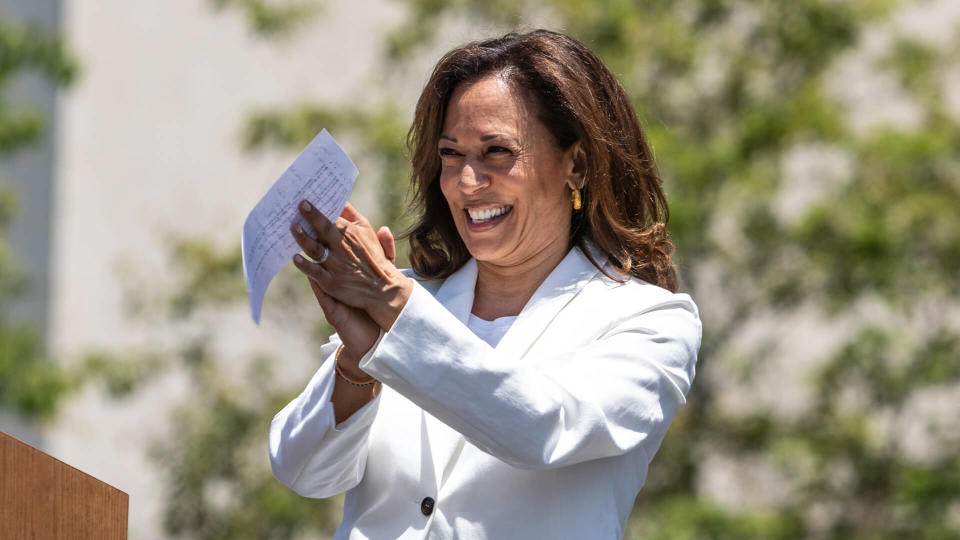

One potential nominee to take up the mantle and head the Democratic Party’s ticket is current Vice President Kamala Harris. While Biden maintains that he’s not stepping down from the campaign, economists and others have started to speculate what a Harris-fronted run for office could do to the global markets, pricing and other aspects of the economy.

GOBankingRates asked a few of these economists to weigh in with predictions for inflation if Harris replaces Biden. Here’s what they foresaw as some possibilities.

Also here’s an experts take on inflation if Biden wins again.

Wealthy people know the best money secrets. Learn how to copy them.

Initial Market Reaction

“Political uncertainty often makes markets volatile,” said Chuck Warren, political economist and host of “Political Podcast.”

Warren said if this should occur, where Biden does step down and Harris takes the reins, “there will be an initial period of market turbulence.

“There may be some doubts from investors about her policy priorities that result in stock prices wavering or even possibly a temporary burst of inflation anticipation,” Warren said.

Trending Now: I’m an Economist: Here Are My Predictions for Inflation If Biden Wins Again

Policy Continuity vs. Change

Warren said a focus on continuity with Biden’s economic policies by Harris would have little immediate impact on inflation.

“Conversely, new fiscal or monetary policies introduced by her administrations which are more progressive or expansive may cause upward pressure on inflation through government spending or regulatory changes,” he said.

“Trade policy is not usually associated with inflation, but since an august group of economists criticized Trump’s proposal to raise tariffs as inflationary, it deserves some mention in this context,” said Milton Ezrati, chief economist at Vested.

“Harris has shown no interest in trade policy,” he said. “Biden kept the original Trump tariffs on Chinese imports in place and has added to them recently for EVs, batteries and the like. Unless there is a side of Harris that she has kept carefully hidden, it is doubtful that she would deviate from the path set by Biden and so in this respect, have no special impact one way or the other.”

Federal Reserve’s Role

“The Federal Reserve’s actions will be crucial in managing inflation expectations,” Warren said. “Should interest rates and monetary policy remain as they are at present, it can go some way towards alleviating what might otherwise become significant inflationary pressures.”

“Harris’ economic policies have the potential to impact FDS decisions even though they function autonomously,” said Alan Andrews, commercial finance specialist at KIS Finance.

“Inflation can increase if she is inclined to maintain low interest rates in order to promote economic expansion,” Andrews said. “However, if Harris is more circumspect and advocates for steps to rein in inflation, the Fed may adjust its policy accordingly.”

Nevertheless, Warren thought this might disrupt a previous approach the Fed had taken on and hence affect the rate of inflation due to politics.

Economic Confidence

“Inflation dynamics are largely influenced by consumer and business confidence,” Warren said. “If the Harris administration can effect a smooth transition and communicate its intentions transparently, it could maintain or bolster confidence thereby stabilizing inflation.”

“Inflation would probably get worse,” said Joseph Camberato, CEO at National Business Capital, citing how Harris is part of the current administration that, in Camberato’s opinion, hasn’t done enough to tackle inflation.

“Plus, there hasn’t been much visibility on what the current VP thinks or plans to do about these issues,” he said. “It’s hard to know how she would approach handling everything going on in our country and the world that influences inflation.”

Conversely, Warren said “…the changeover is seen as disorganized or polarized, this could result in decreased expenditure and investment that would at first lower inflation but damage economic development in the long term.”

Long-Term Structural Changes

“Harris has advocated for addressing long-term economic challenges such as income inequality, healthcare and climate changes,” Warren said.

Depending on how these policies are financed and implemented, there could be inflating or deflationary forces if her administration focuses on these areas with substantial investments. There is also a lot to do with timing and what happens if Harris not only becomes the candidate, but President as well.

If Harris Takes Control for the Balance of the Term

“With the election pending, especially given today’s polls, few economic players would look to a longer-term Harris influence, leaving little reason to look for an impact on either policy expectations or direct inflation expectations,” Ezrati said.

The exception might be a White House influence on Fed policy.

“She, as is the case with all presidents, [would have] little direct impact on Fed policy making. History shows, however, that the person in the White House can lean on the Fed chair and Jay Powell has not shown himself especially resistant to such pressure,” he said.

“If, in anticipation of the election, she could get Powell to relax his anti-inflation stance, inflation expectations would rise and the positioning for those heightened expectations could cause an immediate acceleration in the pace of consumer price increases,” Ezrati said. “Even if Powell resisted the pressure, a public display of such White House pressure could raise inflation expectations.”

If Harris Takes the White House for a Term of Her Own

Ezrati said Harris has shown considerable enthusiasm for free spending by the federal government.

“Recently at a recent White House interview she proudly proclaimed, ‘We are dropping trillions of dollars on the streets of America,'” he said. “Whether this is a good thing or a bad thing, that attitude in power would create widespread worries about future debt and hence future upward inflationary pressure and on the Fed to help finance the spending, with future upward inflationary pressures.

“Even if the situation in Congress raised doubts about her ability to implement such policies, just the tendency in the White House would raise inflation expectations and an actual acceleration in inflation as people positioned themselves for those expectations,” Ezrati said.

“Inflation is not just mere monetary expansion; it is a multifaceted phenomenon driven by several factors including political stability and policy direction, Warren said. “A probable transition from Biden to Harris might occasion short-run volatility but will certainly not have massive impacts on future trends of inflation if managed properly. The key will be clear communications backed up with steady hands on economic policy.”

Warren said “…while the initial period following such a significant political change could see some inflationary pressure due to uncertainty, the long-term effects would largely depend on the policies enacted by Harris and the overall economic environment.”

This article originally appeared on GOBankingRates.com: I’m an Economist: Here Is What I Would Predict for Inflation If Kamala Harris Were To Replace Biden

Yahoo Finance

Yahoo Finance