I’m Buying These 3 Resilient Stocks During a Bear Market

Written by Karen Thomas, MSc, CFA at The Motley Fool Canada

Resiliency is the capacity to recover quickly from difficulties — difficulties like a bear market, for instance. For a stock to have resiliency, it must have stood the test of time. It must also have been a consistent shareholder value creator. During a bear market, there’s nothing more valuable than a resilient stock. It can see us through difficult times and ensure that we come out on top.

Without further ado, here are three top resilient stocks that are great buys during a bear market.

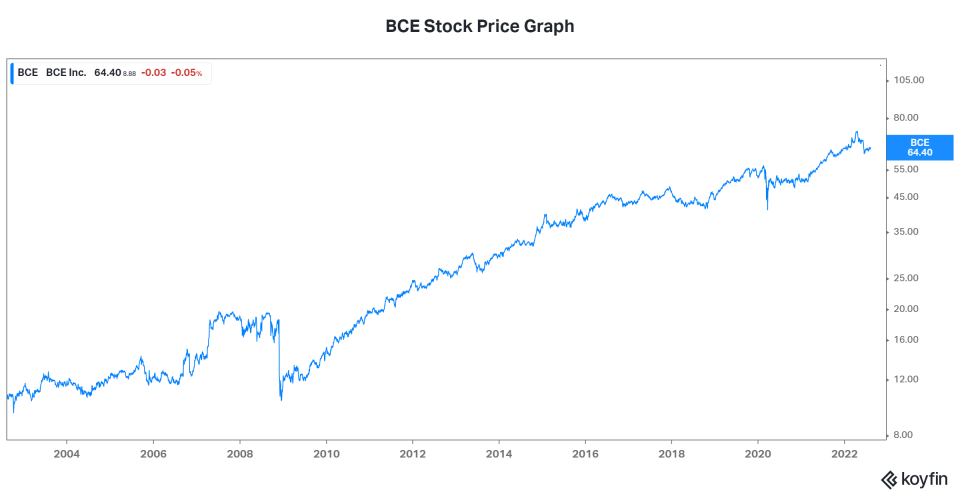

BCE stock: This telecommunications giant can see us through a bear market

As it has been for many bear markets before, BCE (TSX:BCE)(NYSE:BCE) is an anchor. It protects shareholder money and offers a safe place to hide. This is because the telecommunications business is an essential business that’s highly defensive. Therefore, it’s not sensitive to economic downturns. Essentially, this means that its revenue, earnings, and cash flow are predictable and stable.

BCE is also highly resilient because it’s a leader in its industry. With an unmatched, extensive Canadian network, BCE has built itself a moat. Barriers to entry are high. So, it seems that this moat is virtually untouchable.

All of this has resulted in strong, consistent cash flows and a top-notch balance sheet for BCE. Over the last five years, free cash flow has grown almost 10% to more than $8 billion in 2021. Last quarter, operating cash flow rose 4% to 2.6 billion and free cash flow rose 7% to $1.3 billion. And these strong numbers are matched by BCE’s dividend payouts. In fact, 2021 was the 14th consecutive year of a 5% or higher dividend increase at BCE. Its current dividend yield is 5.7%.

Simply put, BCE has staying power — resilience.

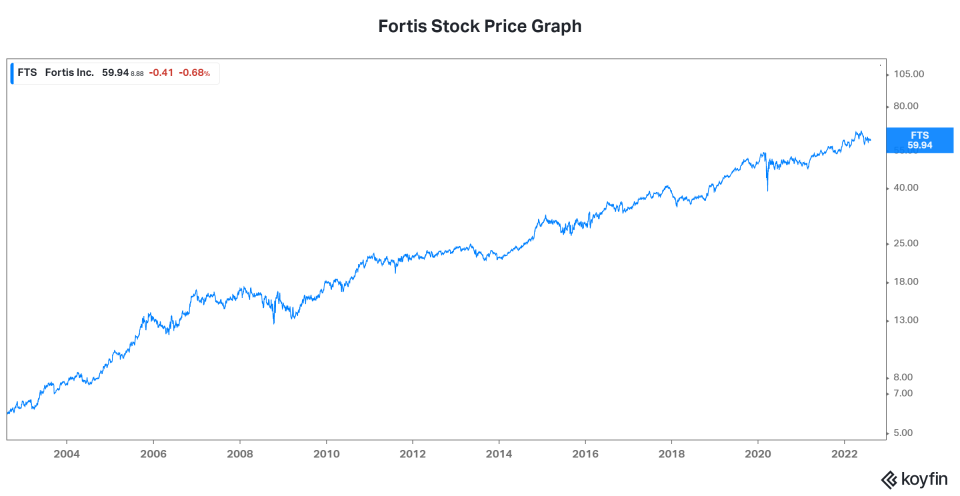

Fortis: A bear market’s best friend

Fortis (TSX:FTS)(NYSE:FTS) is a regulated gas and electric utility company. It’s also another high quality, defensive stock that’s ideal to own during a bear market. This is because this defensive business breeds safety and predictability.

These qualities are reflected in Fortis’s dividend, which has consistently grown for 48 years. Fortis stock’s dividend income has not only combatted inflation, but it’s also provided more than acceptable returns on investment. It currently has a very generous dividend yield of 3.6%.

Fortis has been creating shareholder value throughout different economic cycles and over many years. It’s seen its stock price rise dramatically over the long run as a result.

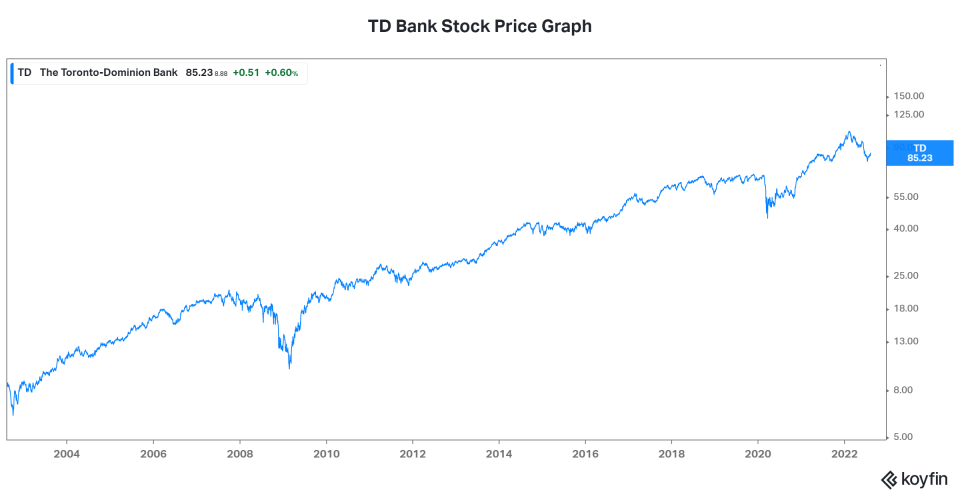

TD Bank exemplifies the resiliency of the Canadian banking system

What is there to say about Toronto-Dominion Bank (TSX:TD)(NYSE:TD)? This bank has not only survived many crises and bear markets, but it has also thrived. In fact, it has provided shareholders with growing dividends and returns over time.

Canadian banks have been anchors to Canadian investors for many decades. They’re built on a framework of conservatism. The government demands this and, through different regulations, has kept our banking system one of the best in the world.

TD Bank has thrived under these conditions. In the process, it has been a beacon of resilience for investors. We need only to look at TD Bank stock’s long-term price chart to see evidence of this.

Motley Fool: The bottom line

So, in closing, the three stocks listed in the article are top stocks to own in a bear market. BCE, Fortis, and TD Bank stock have all shown their resiliency in the last many decades. This reassures me that they’re stocks worth owning when the going gets tough. They’re safe places to park money and they also offer steady long-term growth.

The post I’m Buying These 3 Resilient Stocks During a Bear Market appeared first on The Motley Fool Canada.

Should You Invest $1,000 In BCE?

Before you consider BCE, you'll want to hear this.

Our market-beating analyst team just revealed what they believe are the 5 best stocks for investors to buy in August 2022 ... and BCE wasn't on the list.

The online investing service they've run for nearly a decade, Motley Fool Stock Advisor Canada, is beating the TSX by 27 percentage points. And right now, they think there are 5 stocks that are better buys.

See the 5 Stocks * Returns as of 8/8/22

More reading

Fool contributor Karen Thomas owns shares of BCE and Toronto-Dominion Bank. The Motley Fool recommends FORTIS INC.

2022

Yahoo Finance

Yahoo Finance