LyondellBasell (LYB) to Post Q1 Earnings: What's in Store?

LyondellBasell Industries N.V. LYB is scheduled to report first-quarter 2024 earnings on Apr 26, before the opening bell.

The company surpassed the Zacks Consensus Estimate in three of the last four quarters and missed once, the average earnings surprise being roughly 16.8%. It delivered a negative earnings surprise of 2.3% in the last reported quarter. Weaker demand amid economic uncertainties is likely to have hurt LYB’s first-quarter results.

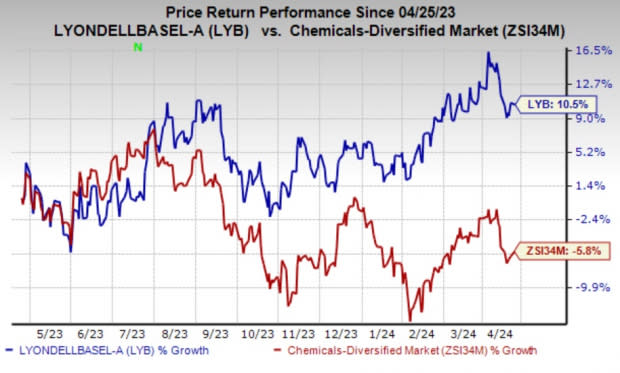

The stock has gained 10.5% in the past year against the industry’s decline of 5.8%.

Image Source: Zacks Investment Research

Let’s see how things are shaping up for this announcement.

What Do the Estimates Say?

The Zacks Consensus Estimate for the to-be-reported quarter’s revenues is currently pegged at $9,767.9 million, which suggests a fall of roughly 4.7% from the year-ago reported figure.

The consensus estimate for the Olefins and Polyolefins – Americas division’s revenues is currently pegged at $2,730.1 million, implying a fall of 2.7% year over year.

The same for the Olefins and Polyolefins – Europe, Asia & International division’s revenues is currently pegged at $2,526.8 million, indicating a fall of 12.7% from the year-ago reported figure.

The Zacks Consensus Estimate for first-quarter revenues of LYB’s Advanced Polymer Solutions segment is pinned at $957 million, suggesting a year-over-year decline of 4%.

The consensus estimate for the Intermediaries and Derivatives segment’s revenues is pegged at $2,702.1 million, which implies a 1% increase from the prior year’s levels.

The Zacks Consensus Estimate for the Refining segment's revenues is pinned at $1,678.7 million, suggesting a decline of 23.4%. The same for the Technology segment is pegged at $154.7 million, which indicates an 11.3% rise from the year-ago reported figure.

Factors to Note

LyondellBasell's first-quarter results are likely to have faced challenges due to weaker demand and lingering economic uncertainty. However, the company's North American Olefins & Polyolefins segment is expected to have benefited from low ethane costs, along with a slow pickup in demand. Oxyfuels and refining margins are expected to have followed typical winter trends. In the Americas, polyethylene prices are likely to have remained stable amid slight improvements in domestic demand and continued strength in export markets. Demand in Europe is likely to have remained weak amid low consumer confidence in the March quarter.

LYB, on its fourth-quarter call, said that demand in January was subdued in China as buyers exercised caution ahead of the Lunar New Year, with growth trends remaining uncertain. However, markets worldwide are likely to experience a seasonal boost in demand during the spring and summer. The company intends to operate its Olefins & Polyolefins assets in the Americas at approximately 80% capacity, and its Olefins & Polyolefins EAI and Intermediates & Derivatives assets at around 75% capacity.

LyondellBasell Industries N.V. Price and EPS Surprise

LyondellBasell Industries N.V. price-eps-surprise | LyondellBasell Industries N.V. Quote

Zacks Model

Our proven model does not conclusively predict an earnings beat for LyondellBasell this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. But that’s not the case here.

Earnings ESP: Earnings ESP for LyondellBasell is -3.77%. The Zacks Consensus Estimate for the first quarter is currently pegged at $1.48. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: LyondellBasell currently carries a Zacks Rank #4 (Sell).

Stocks That Warrant a Look

Here are some companies in the basic materials space you may want to consider as our model shows that they have the right combination of elements to post an earnings beat this quarter.

Innospec Inc. IOSP has an Earnings ESP of +2.44% and carries a Zacks Rank #2 at present. The company is scheduled to release earnings on May 9. You can see the complete list of today’s Zacks #1 Rank stocks here.

The consensus estimate for IOSP’s first-quarter earnings is currently pegged at $1.64.

The Scotts Miracle-Gro Company SMG has an Earnings ESP of +12.78% and carries a Zacks Rank #2 at present. The company is slated to release earnings on May 1.

The consensus mark for SMG’s fiscal second-quarter earnings is currently pegged at $3.33.

Ingevity Corporation NGVT has an Earnings ESP of +33.33% and carries a Zacks Rank #3 at present. The company is scheduled to release first-quarter earnings on May 1.

The Zacks Consensus Estimate for NGVT’s first-quarter earnings is currently pegged at 12 cents.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Scotts Miracle-Gro Company (SMG) : Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report

Ingevity Corporation (NGVT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance