LyondellBasell (LYB) Earnings and Sales Beat Estimates in Q1

LyondellBasell Industries N.V. LYB recorded a first-quarter 2024 profit of $473 million or $1.44 per share compared with the year-ago quarter's $474 million or $1.44 per share.

LYB posted adjusted earnings of $1.53 per share, down 38.8% from the year-ago quarter figure of $2.50. It beat the Zacks Consensus Estimate of $1.42.

The company’s net sales in the first quarter were $9,925 million, which beat the Zacks Consensus Estimate of $9,462.1 million. Net sales decreased around 3.14% from $10,247 million in the prior-year quarter.

Lower natural gas-based feedstock and energy costs in North America supported olefins and polyolefins margins, and regional demand for polyethylene increased. The company's North American volume was limited by downtime in olefins, polyolefins, propylene oxide, oxyfuels and acetyls.

LyondellBasell Industries N.V. Price, Consensus and EPS Surprise

LyondellBasell Industries N.V. price-consensus-eps-surprise-chart | LyondellBasell Industries N.V. Quote

Segment Highlights

In the Olefins & Polyolefins — Americas division, revenues increased roughly 2.2% year over year to $2,871 million in the first quarter of 2024. The figure was higher than the Zacks Consensus Estimate of $2,730.1 million. Olefins margins grew due to lower energy and feedstock costs and higher propylene co-product prices.

The Olefins & Polyolefins — Europe, Asia, the international segment recorded revenues of $2,745 million, down from the prior-year quarter level of $2,892 million. The figure was above the Zacks Consensus Estimate of $2,526.8 million. Olefins results improved year over year, owing to greater margins and volumes.

The Advanced Polymer Solutions segment posted revenues of $965 million, down from $997 million in the prior-year quarter. The figure was above the Zacks Consensus Estimate of $957 million.

Revenues in the Intermediates and Derivatives segment decreased around 3.6% on a year-over-year basis to $2,586 million. The figure was lower than the Zacks Consensus Estimate of $2,702.1 million. Propylene Oxide & Derivatives results declined year over year due to weaker demand, which affected margins.

The Refining segment reported revenues of $2,090 million in the quarter, down around 4.6% from the year-ago quarter. The figure was higher than the Zacks Consensus Estimate of $1,678.7 million.

The Technology segment’s revenues were $192 million in the reported quarter, up around 38% year over year. The figure was higher than the Zacks Consensus Estimate of $154.7 million. Licensing revenues grew from a year ago due to contract revenue milestones, increased catalyst volumes and margins.

Financials

The company is committed to its balanced and disciplined capital allocation approach. In the first quarter, LYB used $114 million of cash in operating activities, spent $483 million on capital expenditures and returned $408 million to stockholders through dividends.

Outlook

For the second quarter, the company anticipates seasonal demand to increase across most businesses. LYB's North American and Middle Eastern production will continue to benefit from low natural gas and NGL costs compared to higher oil-based costs in other regions.

As the summer driving season begins, oxyfuel and refining margins are likely to rise due to increased gasoline crack spreads and reduced butane costs. In the second quarter, LYB anticipates meeting market demand with average operating rates of 85% for global olefins and polyolefins assets and 80% for Intermediates & Derivatives assets. The company continues to follow targeted stimulus activities and remains watchful for improved demand in China.

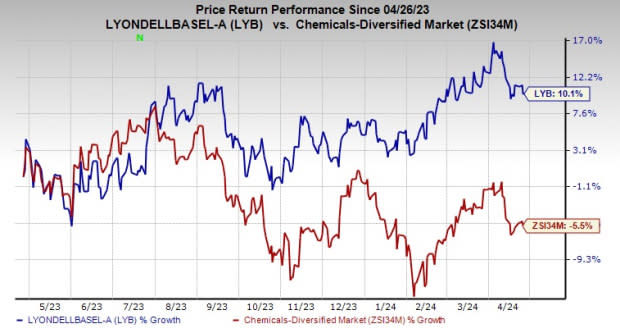

Price Performance

Shares of LyondellBasell have gained 10.1% in the past year against a 5.5% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank

LyondellBasell currently carries a Zacks Rank #4 (Sell).

Upcoming Releases

Scotts Miracle-Gro Company SMG is slated to report fiscal second-quarter results on May 1, before market open. The Zacks Consensus Estimate for fiscal second-quarter earnings is pegged at $3.33 per share. SMG beat the Zacks Consensus Estimate in three of the last four quarters, with the average earnings surprise being 3.4%. The company’s shares have gained roughly 5% in the past year. SMG carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ero Copper Corp. ERO is slated to report first-quarter results on May 7, after market close. The Zacks Consensus Estimate for ERO’s first-quarter earnings is pegged at 5 cents The company’s shares have gained around 1% in the past year. ERO currently carries a Zacks Rank #1.

Innospec Inc. IOSP is slated to report first-quarter results on May 9, after market close. The consensus estimate for Innospec’s earnings is pegged at $1.64 per share. IOSP, carrying a Zacks Rank #2, beat the consensus estimate in each of the last four quarters, with the average earnings surprise being 10.5%. The company’s shares have gained around 20% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Scotts Miracle-Gro Company (SMG) : Free Stock Analysis Report

LyondellBasell Industries N.V. (LYB) : Free Stock Analysis Report

Innospec Inc. (IOSP) : Free Stock Analysis Report

Ero Copper Corp. (ERO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance