This Luxury Retailer Could See Double-Digit Gains in 3-6 Weeks

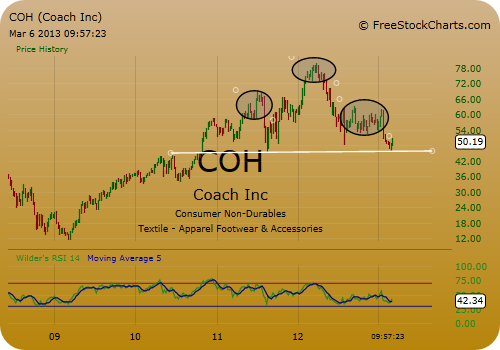

From a longer-term, multi-year perspective, Coach (COH) has traced out a massive bearish head-and-shoulders formation. But this formation will not be triggered until the stock closes below $45, about 10% below where it currently trades.

In the intermediate term, the stock has traced out what looks to be a nice rounding bottom that should allow more than 10% of additional upside from current levels.

Let's move through some charts to gain a better understanding of the bigger picture, as well as the nearer-term trade setup to the long side.

The multi-year weekly chart below shows the stock moving nicely off the 2009 lows like most other stocks. While the going was choppy (which makes for a solid swing trading stock) through much of 2011, eventually the COH resolved to the upside in the first quarter of 2012.

In the classic fashion of a stock-gone-vertical, the extraordinarily steep ascent from January through late March 2012 came to a sudden halt. Momentum traders that had chased the stock higher in the first quarter were quick to sniff out the trend reversal and jumped on the short side of the stock. And so COH erased 16 months' worth of gains in just four months.

The steep rise and fall of the stock ended up shaping a big head formation in the head-and-shoulders pattern. The neckline is easily spotted, coming in around the $45-$46 area. As I mentioned earlier, the bearish formation does not get triggered unless this neckline is broken. If that happens, the ultimate downside price target is close to the $10 mark. Let me be clear, though, I am neither counting on this price target nor interested in the short side of the stock at the moment, but I would be remiss not to at least point it out.

Closer up on the daily charts a different picture reveals itself -- one that is very juicy from a swing trading point of view.

On Feb. 26, the stock again bounced off the neckline support near $46, leaving a bullish hammer candlestick behind on the daily chart. The following day, COH gapped up at the open and closed higher for the day. For swing trading, this is a classic formation I keep my eyes peeled for as upside momentum now has more room to go.

On March 5, Coach stock managed to break past its first meaningful resistance level near $49.60, which had kept the stock under pressure since early February. From here the stock has a minor resistance level to contend with at $52.44, which is the bottom of the big down gap from Jan. 23. Above $52.44 it's clear sailing with a price target of $55, which also more or less coincides with the stock's 100-day simple moving average. With COH currently trading at about $49.80, that represents a 10% gain.

More patient traders could continue holding the stock until a potential gap fill closer to the $60 level for a 20% gain, but in my humble opinion, a 5%-10% gain on a long-side swing trade is juicy enough.

In case the stock gears into reverse again, $47.60 looks to be a solid spot to place stops. Any break below there would likely cause COH to slip further.

Recommended Trade Setup:

-- Buy COH at $50.80 or lower

-- Set stop-loss at $47.60

-- Set initial price target at $55 for a potential 8% gain in 3-6 weeks

Related Articles

Little-Known Stock Could Deliver 28% Returns at Apple's Expense

This Risk-Reducing Income Strategy Could Yield 25%-35% Annually

Major Breakout Setting This Tech Stock Up for a Double-Digit Rally

Yahoo Finance

Yahoo Finance