lululemon (LULU) Driving Brand Awareness, Customer Engagement

lululemon athletica inc. LULU has emerged as a formidable player, showcasing growth across channels, regions and product categories. This underscores the company's ability to attract and retain customers both in-store and online. The top and bottom lines have been witnessing positive trends from ongoing business momentum and innovative products.

LULU has always been dedicated to provide a seamless and convenient shopping experience through its omni channel retail model. Strengthening omni-channel capabilities like curbside pickups, same-day deliveries and BOPUS enhance customer convenience and keep the company competitive in today's market.

By investing in e-commerce infrastructure, the company is likely to enhance its digital presence. It has been investing in developing sites, building transactional omni functionality and increasing fulfillment capabilities. Digital revenues accounted for 52% of its net revenues. E-commerce traffic also improved 20% in the fourth quarter of 2023.

Digging Further

LULU has been on a successful growth trajectory with Power of Three x2 growth plan. As a part of the plan, it aims to double its net revenues by 2026, reaching an impressive $12.5 billion. The plan focuses on three key growth drivers including product innovation, guest experience and market expansion.

Lululemon's expansion into international markets, particularly in Mainland China and other regions, presents a significant growth opportunity. With robust growth rates in these markets, it is poised to capitalize on the increasing global demand for athleisure apparel.

The company’s commitment to product innovation sets it apart in the competitive athleisure market. Its compelling pipeline of innovative products, including footwear and fabric innovations, ensures that it stays ahead of evolving consumer preferences and maintains its competitive edge.

Lululemon's strategic initiatives to increase brand awareness, such as community-based events and brand campaigns, are crucial for attracting new customers and strengthening brand loyalty. These efforts help solidify its position as a top-of-mind brand in the athleisure space.

Management expects revenues for the first quarter of 2024 to be between $2.175 billion and $2.2 billion, suggesting growth of 9-10% compared with the prior-year quarter. It projects revenues for the full year to be between $10.7 billion and $10.8 billion, suggesting growth of 11-12% relative to 2023.

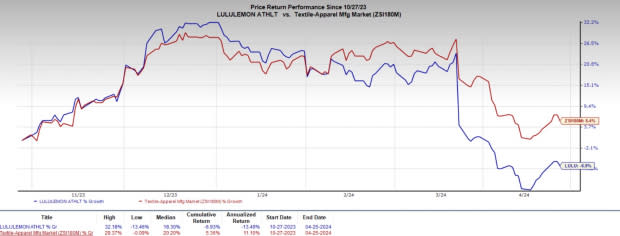

Image Source: Zacks Investment Research

Stock Performance

Despite robust revenue growth and strategic initiatives, there are factors suggesting potential challenges. Shares of LULU have decreased 6.9% in the past six months against the industry’s growth of 5.4%.

Lululemon expects operating margin for the first quarter of 2024 to decline 130-140 basis points from a year ago due to SG&A investments. This is driven by increased investments to grow brand awareness and acquire new customers, as well as higher depreciation resulting from technology investments made in 2022 and 2023.

From a valuation perspective, this Zacks Rank #3 (Hold) company looks stretched. In terms of the price-to-earnings (P/E) ratio, Lululemon is currently trading at a premium to its industry as well as the S&P 500.

The stock has a forward 12-month P/E ratio of 24.76. This compares to the forward 12-month P/E ratio of 12.07 and 20.48 for the industry and the S&P 500, respectively. This elevated valuation raises questions about whether investors are overly optimistic about its future growth prospects or if there are underlying risks not fully priced into the stock.

Final Thoughts

With its strong revenue growth, international expansion and commitment to innovation, Lululemon has positioned itself for continued success. However, investors should be mindful of potential risks, such as the challenging U.S. consumer environment and increased expenses, that could impact LULU's performance in the future.

3 Stocks to Consider

We have highlighted three better-ranked stocks in the broader sector, namely Duluth Holdings Inc. DLTH, Electronic Arts Inc. EA and Gildan Activewear Inc. GIL.

Duluth Holdings sells casual wear, workwear, outdoor apparel and accessories for men and women under the Duluth Trading brand. It currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for DLTH current financial-year sales and earnings suggests growth of 0.8% and 75.0%, respectively, from the year-ago reported figures.

Electronic Arts develops, markets, publishes and distributes games, content and services for game consoles, PCs, mobile phones and tablets worldwide. It has a Zacks Rank #2. EA has a trailing four-quarter earnings surprise of 16.1%, on average.

The Zacks Consensus Estimate for Electronic Arts current financial-year sales and earnings suggests growth of 2.9% and 29.3%, respectively, from the year-ago reported numbers.

Gildan Activewear, a distributor and manufacturer of activewear products currently carries a Zacks Rank #2. GIL has a trailing four-quarter negative earnings surprise of 0.7%, on average.

The Zacks Consensus Estimate for Gildan Activewear current fiscal-year sales and earnings suggests growth of 2% and 14.4%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

Electronic Arts Inc. (EA) : Free Stock Analysis Report

Gildan Activewear, Inc. (GIL) : Free Stock Analysis Report

Duluth Holdings Inc. (DLTH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance