Lowe's (LOW) Q1 Earnings Top Estimates, Comps Decline 4.1% Y/Y

Lowe’s Companies, Inc. LOW came up with first-quarter fiscal 2024 results, wherein the top and bottom lines beat the respective Zacks Consensus Estimate. However, the company experienced a year-over-year decline in both metrics. The reduction in Do-It-Yourself (DIY) big-ticket discretionary spending did hurt the company’s performance to an extent. However, favorable comparable sales in Pro and online helped mitigate the impact.

This Mooresville, NC-based company implemented a new DIY loyalty program on a national scale, expanded same-day delivery options and captured market share in important categories. Additionally, the company's Total Home strategy continued to gain traction, as evidenced by growth in the Pro segment and online sales.

Q1 in Detail

The home improvement retailer posted quarterly earnings of $3.06 per share, which came ahead of the Zacks Consensus Estimate of $2.94. However, the figure marked a decline from the adjusted earnings of $3.67 per share reported in the same period last year.

While net sales of $21,364 million beat the Zacks Consensus Estimate of $21,074 million, the same fell 4.4% year over year. Comparable sales for the quarter declined 4.1%, primarily due to softness in demand from DIY customers, partly offset by strength in the Pro segment and online sales. We had expected a comparable sales decline of 6%.

The gross profit declined 5.8% year over year to $7,090 million, whereas the gross margin shrunk 50 basis points to 33.2%. We had expected a gross margin contraction of 10 basis points.

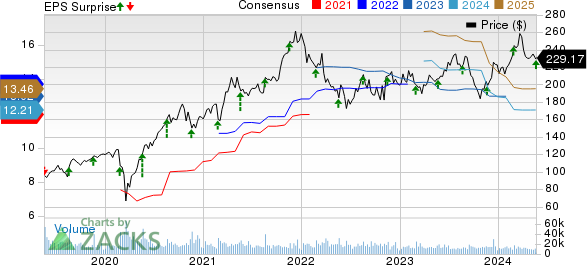

Lowe's Companies, Inc. Price, Consensus and EPS Surprise

Lowe's Companies, Inc. price-consensus-eps-surprise-chart | Lowe's Companies, Inc. Quote

Other Financial Aspects

Lowe’s ended the quarter with cash and cash equivalents of $3,237 million, long-term debt (excluding current maturities) of $34,622 million and shareholders’ deficit of $14,606 million.

For the quarter under review, Lowe’s generated cash flow from operations of $4,262 million. The company executed a buyback of around three million shares, amounting to $743 million.

FY2024 Outlook

Lowe’s reiterated its fiscal 2024 view. It continues to anticipate total sales between $84 billion and $85 billion compared to the $86.4 billion recorded in fiscal 2023. The company expects a modest decline of 2% to 3% in comparable sales for the fiscal year 2024.

Furthermore, Lowe’s continues to envision earnings per share for fiscal 2024 in the range of $12.00-$12.30. Additionally, the operating margin is projected to fall within the range of 12.6%-12.7%. Management maintained its capital expenditures plan of approximately $2 billion for fiscal 2024.

Stock Price Performance

This Zacks Rank #3 (Hold) stock has risen 15.5% in the past six months compared with the industry’s growth of 11.7%.

Don’t Miss These Solid Bets

Casey's General Stores CASY, the third largest convenience retailer and fifth largest pizza chain in the United States, currently carries a Zacks Rank #2 (Buy). CASY has a trailing four-quarter earnings surprise of 12%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Casey's current financial-year earnings suggests growth of around 10.4% from the year-ago reported numbers.

BJ's Wholesale Club BJ, which operates a membership-only warehouse club chain, currently has a Zacks Rank #2. BJ has a trailing four-quarter earnings surprise of 4.2%, on average.

The Zacks Consensus Estimate for BJ's Wholesale Club’s current financial-year sales suggests growth of 3.4% from the year-ago reported figure.

Tractor Supply Company TSCO, the largest rural lifestyle retailer in the United States, currently carries a Zacks Rank #2. TSCO has a trailing four-quarter earnings surprise of 2.7%, on average.

The Zacks Consensus Estimate for Tractor Supply Company’s current financial-year sales and earnings suggests growth of around 3% and 2.4%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lowe's Companies, Inc. (LOW) : Free Stock Analysis Report

Tractor Supply Company (TSCO) : Free Stock Analysis Report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

Casey's General Stores, Inc. (CASY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance