Will Low Oil Prices Dent Diamondback's (FANG) Q2 Earnings?

Diamondback Energy FANG is set to release second-quarter results on Jul 31. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of $4.14 per share on revenues of $2 billion.

Let’s delve into the factors that might have influenced the Permian-focused oil and gas producer’s performance in the June quarter. But it’s worth taking a look at FANG’s previous-quarter performance first.

Highlights of Q1 Earnings & Surprise History

In the last reported quarter, this Midland, TX-based upstream player missed the consensus mark due to lower overall realization, partly offset by higher-than-expected production. Diamondback had reported adjusted earnings per share of $4.10 for the first quarter, below the Zacks Consensus Estimate of $4.36. Revenues of $1.9 billion also fell marginally short of the Zacks Consensus Estimate.

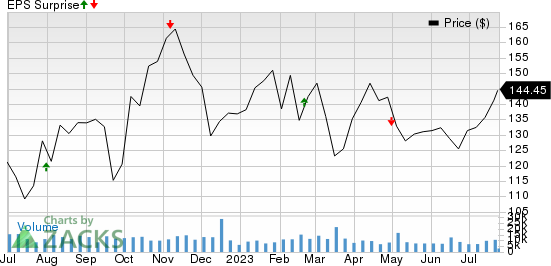

FANG beat the Zacks Consensus Estimate for earnings in two of the last four quarters and missed in the other two, resulting in an earnings surprise of 0.4%, on average. This is depicted in the graph below:

Diamondback Energy, Inc. Price and EPS Surprise

Diamondback Energy, Inc. price-eps-surprise | Diamondback Energy, Inc. Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for the second-quarter bottom line has been revised 4.1% downward in the past seven days. The estimated figure indicates a 40.7% drop year over year. The Zacks Consensus Estimate for revenues, meanwhile, suggests a 29.2% decrease from the year-ago period.

Factors to Consider

Diamondback Energy is expected to have benefited from higher production during the quarter. The company continues to churn out impressive volumes from its wide inventory of drill-ready locations in the Permian Basin — America's hottest and lowest-cost shale region. Consequently, our expectation for FANG’s average Q2 volume is pegged at 432,895 barrels of oil equivalent per day (BOE/d), 13.8% up from the year-ago quarter’s level of 380,451 BOE/d.

However, lower oil and natural gas realizations are likely to have hurt Diamondback Energy’s revenues and cash flows. Going by our model, the second-quarter average sales price for crude is expected at $66.32 per barrel, considerably lower than a year earlier when the company had fetched $108.80 per barrel. As far as natural gas price is concerned, our estimate is pegged at $1.92 per thousand cubic feet, suggesting a 68.7% year-over-year plunge.

On a further bearish note, the increase in Diamondback Energy’s costs might have dented its to-be-reported bottom line. Our estimate for lease operating cost per barrel of oil equivalent (BOE) is pegged at $4.71, indicating an increase from $4.59 reported in the year-ago quarter. Our model also predicts the company’s gathering and transportation expenses to rise 15% year over year to $2.02 per BOE.

What Does Our Model Say?

The proven Zacks model does not conclusively show that FANG is likely to beat estimates in the second quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate Estimate and the Zacks Consensus Estimate, for this company is -6.43%.

Zacks Rank: Diamondback currently carries a Zacks Rank #5 (Strong Sell).

Stocks to Consider

While an earnings beat looks uncertain for Diamondback Energy, here are some firms from the energy space that you may want to consider on the basis of our model:

TC Energy Corporation TRP has an Earnings ESP of +14.72% and a Zacks Rank #2. The firm is scheduled to release earnings on Jul 28.

You can see the complete list of today’s Zacks #1 Rank stocks here.

TC Energy beat the Zacks Consensus Estimate for earnings in three of the last four quarters and missed in the other. It has a trailing four-quarter earnings surprise of 2.1%, on average. Valued at around $40.7 billion, TRP has lost 27.9% in a year.

MPLX LP MPLX has an Earnings ESP of +1.01% and a Zacks Rank #2. The firm is scheduled to release earnings on Aug 1.

MPLX has a trailing four-quarter earnings surprise of 5.9%, on average. Over the past 60 days, the partnership saw the Zacks Consensus Estimate for 2023 move up 8.5%. Valued at around $35 billion, the company has gained 11.7% in a year.

Murphy USA MUSA has an Earnings ESP of +0.20% and a Zacks Rank #2. The firm is scheduled to release earnings on Aug 2.

Murphy USA has a trailing four-quarter earnings surprise of 15.6%, on average. Over the past 60 days, MUSA saw the Zacks Consensus Estimate for 2023 move up 1.7%. Valued at around $6.9 billion, the company has gained 17.5% in a year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Murphy USA Inc. (MUSA) : Free Stock Analysis Report

TC Energy Corporation (TRP) : Free Stock Analysis Report

MPLX LP (MPLX) : Free Stock Analysis Report

Diamondback Energy, Inc. (FANG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance