Louisiana-Pacific (LPX) Q4 Earnings Lag, SmartSide Revenues Up

Louisiana-Pacific Corporation’s LPX shares gained nearly 4% on Feb 11, despite reporting lower-than-expected results in fourth-quarter 2019. Better-than-expected SmartSide Strand revenue growth and its long-term adjusted EBITDA projection might have boosted investors’ sentiments. Also, the company’s announcement of a 7% increase in quarterly cash dividend to 14.5 cents per share and authorization of a new $200-million share repurchase program are expected to have added to the positives.

The company reported adjusted earnings of 5 cents per share, which lagged the Zacks Consensus Estimate of 10 cents by 50% and declined a whopping 73.4% from the year-ago period. The downside can be attributed to lower sales, and higher costs and expenses.

Net sales totaled $537 million, missing the consensus estimate of $552 million by 2.7% and declining from the year-ago figure of $589 million by 8.8%. Lower Oriented Strand Board (“OSB”) prices and reduced commodity OSB shipments across all North America segments (down 29%) negatively impacted its performance. However, these headwinds were partially offset by SmartSide Strand revenue growth of 11%.

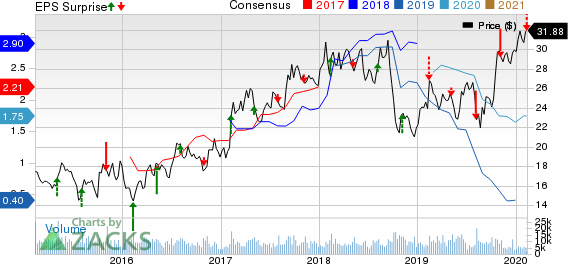

Louisiana-Pacific Corporation Price, Consensus and EPS Surprise

Louisiana-Pacific Corporation price-consensus-eps-surprise-chart | Louisiana-Pacific Corporation Quote

Segmental Analysis

Siding: The segment’s sales of $230 million during the quarter were up 8% from the prior-year figure of $213 million. Adjusted EBITDA also increased 23.5% from the prior-year quarter to $42 million. The upside was backed by strong SmartSide Strand.

OSB: Sales in the segment declined 32.5% year over year to $172 million. The company’s adjusted EBITDA also deteriorated significantly to $6 million from $34 million reported a year ago. Increase in the Structural Solutions mix was more than offset by lower OSB pricing and shipments.

Engineered Wood Products or EWP: Segment’s sales grew 16.3% year over year to $93 million. The upside was backed by the temporary shutdown of its North Carolina facility in 2018 owing to damage caused by hurricane. Adjusted EBITDA also increased year over year to $3 million, primarily due to an increase in joint venture earnings and operational efficiency.

South America: Sales of $38 million decreased 2.6% year over year due to pricing pressure from increased competition in export markets in South America and Asia, partially offset by higher Chilean shipments. Adjusted EBITDA of $8 million was on par with the year-ago quarter.

Operating Highlights

Gross margin declined nearly 300 basis points (bps) year over year to 13%. Selling, general and administrative expenses — as a percentage of revenues — increased 110 bps.

Adjusted EBITDA from continuing operations was $49 million in the quarter, down 25% from the prior-year figure of $65 million. Adjusted EBITDA margin also contracted nearly 200 bps to 9.1%.

Financials

As of Dec 31, 2019, Louisiana-Pacific had cash and cash equivalents of $181 million compared with $878 million at the end of 2018. Long-term debt (excluding current portion) of $348 million slightly increased from the 2018-end level of $347 million.

At the end of 2019, net cash provided by operations was $159 million compared with $511 million in the comparable year-ago period.

2019 Highlights

In 2019, Louisiana-Pacific reported adjusted earnings of 37 cents per share, missing the consensus mark of 42 cents and declining 86.5% from the 2018 level of $2.75. Net sales of $2.31 billion also declined 18.3% year over year and slightly missed analysts’ expectation of $2.33 billion. Adjusted EBITDA also declined 68.3% from a year ago.

2020 View & Strategic Update

Based on current plans and expectations, Louisiana-Pacific expects capital expenditure in the range of $130-$140 million. SmartSide Strand revenue growth is targeted within 10-12% for 2020.

Notably, the company remains optimistic to fulfill its long-term adjusted EBITDA growth (through 2021) expectation of $165 million and expects EBITDA margins to be at least 20% in the Siding segment.

Zacks Rank & Peer Release

Louisiana-Pacific, which shares space with Norbord Inc. OSB and Universal Forest Products Inc. UFPI in the Zacks Building Products - Wood industry, currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Weyerhaeuser Company WY reported mixed fourth-quarter 2019 results, with earnings missing the Zacks Consensus Estimate by 57.1%, while net sales beating the same by 1.6%. However, the top and bottom lines declined 5.4% and 70%, respectively, year over year. Its two major segments reported significantly lower net sales on a year-over-year basis.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Weyerhaeuser Company (WY) : Free Stock Analysis Report

Louisiana-Pacific Corporation (LPX) : Free Stock Analysis Report

Universal Forest Products, Inc. (UFPI) : Free Stock Analysis Report

Norbord Inc. (OSB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance