Loss-making AgileThought (NASDAQ:AGIL) has seen earnings and shareholder returns follow the same downward trajectory over past -43%

AgileThought, Inc. (NASDAQ:AGIL) shareholders should be happy to see the share price up 15% in the last week. But that doesn't change the fact that the returns over the last year have been less than pleasing. After all, the share price is down 43% in the last year, significantly under-performing the market.

While the stock has risen 15% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for AgileThought

AgileThought wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

AgileThought grew its revenue by 15% over the last year. That's definitely a respectable growth rate. Unfortunately that wasn't good enough to stop the share price dropping 43%. This implies the market was expecting better growth. But if revenue keeps growing, then at a certain point the share price would likely follow.

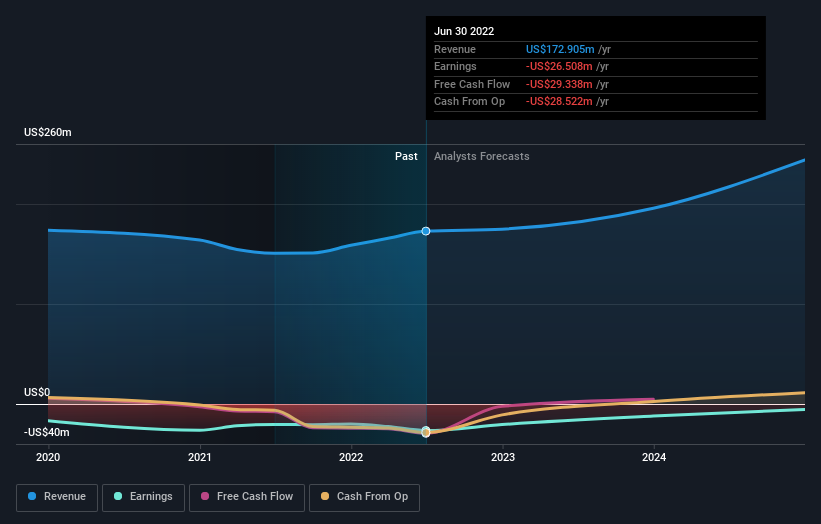

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So it makes a lot of sense to check out what analysts think AgileThought will earn in the future (free profit forecasts).

A Different Perspective

We doubt AgileThought shareholders are happy with the loss of 43% over twelve months. That falls short of the market, which lost 21%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 16% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for AgileThought that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance