A Look Back at Leisure Facilities Stocks' Q1 Earnings: Bowlero (NYSE:BOWL) Vs The Rest Of The Pack

Looking back on leisure facilities stocks' Q1 earnings, we examine this quarter's best and worst performers, including Bowlero (NYSE:BOWL) and its peers.

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 13 leisure facilities stocks we track reported a weaker Q1; on average, revenues beat analyst consensus estimates by 1.6%. while next quarter's revenue guidance was 5.2% below consensus. Stocks, especially growth stocks where cash flows further in the future are more important to the story, had a good end of 2023. But the beginning of 2024 has seen more volatile stock performance due to mixed inflation data, but leisure facilities stocks have shown resilience, with share prices up 7.9% on average since the previous earnings results.

Bowlero (NYSE:BOWL)

Operating over 300 locations globally, Bowlero (NYSE:BOWL) is a contemporary bowling company merging classic lanes with entertainment and deluxe food offerings.

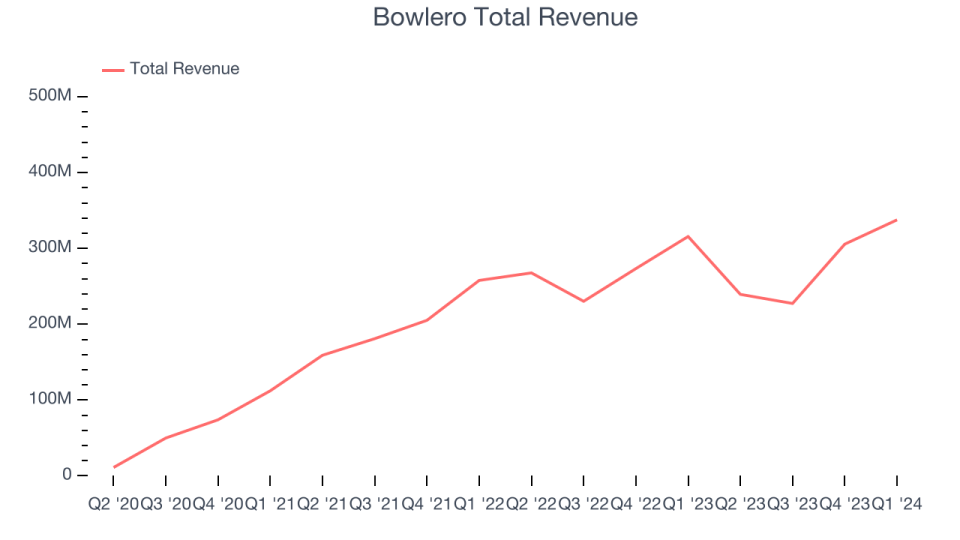

Bowlero reported revenues of $337.7 million, up 7% year on year, falling short of analysts' expectations by 1.1%. It was a weak quarter for the company: Its adjusted EBITDA and EPS both missed Wall Street's estimates.

“Third quarter fiscal year 2024 started slowly due to weather. Post the first three weeks of January, we found a stable footing and increased investments to drive traffic. After the first three weeks of the quarter, we achieved a positive same-store-comp and double-digit total growth. Lucky Strike Miami opened in the quarter with exciting results, and we expect to have four more new builds opening in the next nine months with two in the Denver area and two in California. Summer Season Pass returned this year, and we expect that our continued investments in traffic will drive results throughout the spring and fall,” said Thomas Shannon, Founder and Chief Executive Officer of Bowlero.

The stock is up 13.2% since the results and currently trades at $14.13.

Read our full report on Bowlero here, it's free.

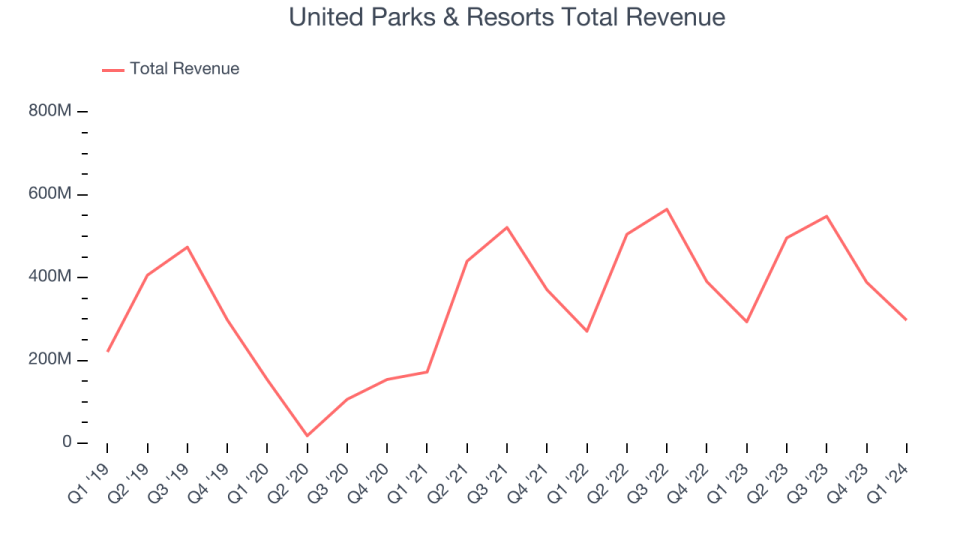

Best Q1: United Parks & Resorts (NYSE:PRKS)

Parent company of SeaWorld and home of the world-famous Shamu, United Parks & Resorts (NYSE:PRKS) is a theme park chain featuring marine life, live entertainment, roller coasters, and waterparks.

United Parks & Resorts reported revenues of $297.4 million, up 1.4% year on year, outperforming analysts' expectations by 4.5%. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates and a narrow beat of analysts' visitors estimates.

The stock is up 7.9% since the results and currently trades at $52.99.

Is now the time to buy United Parks & Resorts? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Dave & Buster's (NASDAQ:PLAY)

Founded by a former game parlor and bar operator, Dave & Buster’s (NASDAQ:PLAY) operates a chain of arcades providing immersive entertainment experiences.

Dave & Buster's reported revenues of $588.1 million, down 1.5% year on year, falling short of analysts' expectations by 4.5%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

Dave & Buster's had the weakest performance against analyst estimates in the group. The stock is down 24.2% since the results and currently trades at $38.18.

Read our full analysis of Dave & Buster's results here.

European Wax Center (NASDAQ:EWCZ)

Founded by two siblings, European Wax Center (NASDAQ:EWCZ) is a beauty and waxing salon chain specializing in professional wax services and skincare products.

European Wax Center reported revenues of $51.87 million, up 4% year on year, falling short of analysts' expectations by 0.3%. It was a weaker quarter for the company, with and full-year revenue guidance missing analysts' expectations.

The stock is down 8.4% since the results and currently trades at $9.97.

Read our full, actionable report on European Wax Center here, it's free.

Xponential Fitness (NYSE:XPOF)

Owner of CycleBar, Rumble, and Club Pilates, Xponential Fitness (NYSE:XPOF) is a boutique fitness brand offering diverse and specialized exercise experiences.

Xponential Fitness reported revenues of $79.52 million, up 12.5% year on year, in line with analysts' expectations. It was a weaker quarter for the company, with a miss of analysts' earnings estimates.

The stock is up 17.2% since the results and currently trades at $15.75.

Read our full, actionable report on Xponential Fitness here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance