A Look Back at Leisure Facilities Stocks' Q1 Earnings: European Wax Center (NASDAQ:EWCZ) Vs The Rest Of The Pack

As the Q1 earnings season wraps, let's dig into this quarter's best and worst performers in the leisure facilities industry, including European Wax Center (NASDAQ:EWCZ) and its peers.

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 13 leisure facilities stocks we track reported a weaker Q1; on average, revenues beat analyst consensus estimates by 1.6%. while next quarter's revenue guidance was 5.2% below consensus. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, but leisure facilities stocks have performed well, with the share prices up 10.1% on average since the previous earnings results.

European Wax Center (NASDAQ:EWCZ)

Founded by two siblings, European Wax Center (NASDAQ:EWCZ) is a beauty and waxing salon chain specializing in professional wax services and skincare products.

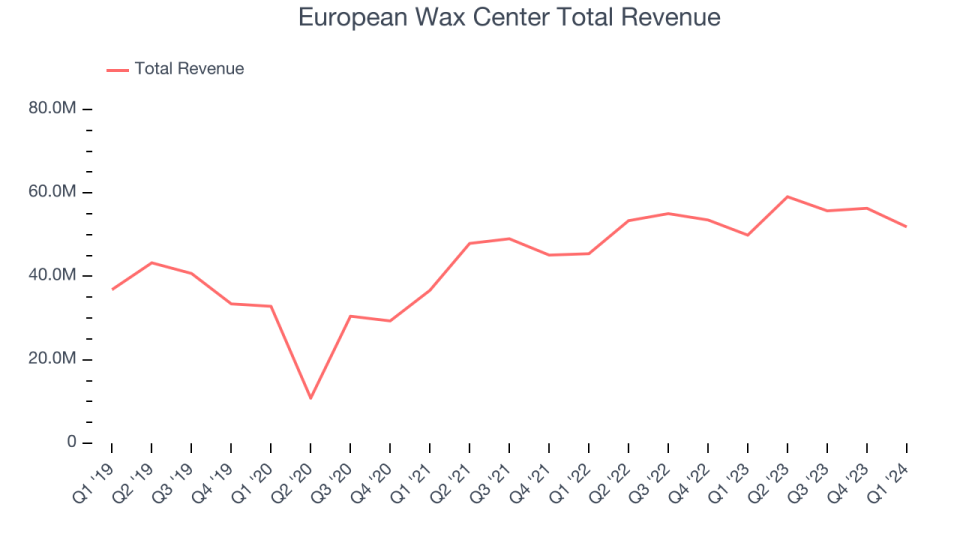

European Wax Center reported revenues of $51.87 million, up 4% year on year, falling short of analysts' expectations by 0.3%. It was a weaker quarter for the company, with and full-year revenue guidance missing analysts' expectations.

David Willis, Chief Executive Officer of European Wax Center, Inc. stated, “We began 2024 with stable frequency and spend among our existing guests which led to positive system-wide sales and revenue growth in the first quarter and underpins our predictable, recurring business model. Further, continued franchisee demand drove new center growth in-line with our expectations. We’re pleased that our development pipeline remains robust and supported by our well-capitalized and committed franchisees.”

The stock is down 10.5% since the results and currently trades at $9.75.

Read our full report on European Wax Center here, it's free.

Best Q1: United Parks & Resorts (NYSE:PRKS)

Parent company of SeaWorld and home of the world-famous Shamu, United Parks & Resorts (NYSE:PRKS) is a theme park chain featuring marine life, live entertainment, roller coasters, and waterparks.

United Parks & Resorts reported revenues of $297.4 million, up 1.4% year on year, outperforming analysts' expectations by 4.5%. It was a very strong quarter for the company, with an impressive beat of analysts' earnings estimates and a narrow beat of analysts' visitors estimates.

The stock is up 11.6% since the results and currently trades at $54.84.

Is now the time to buy United Parks & Resorts? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Dave & Buster's (NASDAQ:PLAY)

Founded by a former game parlor and bar operator, Dave & Buster’s (NASDAQ:PLAY) operates a chain of arcades providing immersive entertainment experiences.

Dave & Buster's reported revenues of $588.1 million, down 1.5% year on year, falling short of analysts' expectations by 4.5%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

Dave & Buster's had the weakest performance against analyst estimates in the group. The stock is down 23% since the results and currently trades at $38.78.

Read our full analysis of Dave & Buster's results here.

Topgolf Callaway (NYSE:MODG)

Formed between the merger of Callaway and Topgolf, Topgolf Callaway (NYSE:MODG) sells golf equipment and operates technology-driven golf entertainment venues.

Topgolf Callaway reported revenues of $1.14 billion, down 2% year on year, falling short of analysts' expectations by 1.1%. It was an ok quarter for the company, with an impressive beat of analysts' earnings estimates but full-year revenue guidance missing analysts' expectations.

Topgolf Callaway had the weakest full-year guidance update among its peers. The stock is down 8.3% since the results and currently trades at $14.98.

Read our full, actionable report on Topgolf Callaway here, it's free.

Six Flags (NYSE:SIX)

Sporting the fastest rollercoaster in the United States, Six Flags (NYSE:SIX) is a regional theme park operator offering thrilling rides, entertainment, and family-friendly attractions.

Six Flags reported revenues of $133.3 million, down 6.3% year on year, falling short of analysts' expectations by 2.5%. It was a weak quarter for the company, with a miss of analysts' earnings estimates.

Six Flags had the slowest revenue growth among its peers. The stock is up 30.3% since the results and currently trades at $32.66.

Read our full, actionable report on Six Flags here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance