Logitech (LOGI) Introduces Litra Glow Premium Streaming Light

Logitech International SA LOGI recently announced the launch of a premium streaming light with TrueSoft technology — Litra Glow — under its Logitech For Creators brand. The company stated that the Litra Glow video and streaming light has been professionally designed to counter the problems of harsh shadows and eye fatigue caused due to long hours of streaming under artificial lighting.

With Logitech’s TrueSoft technology, which utilizes a balanced and full-spectrum light source with cinematic color accuracy, the Litra Glow light-emitting diode (“LED”) light delivers a soft, glare-free light to the streamers and content creators.

Litra Glow is certified for all-day streaming safety and can be controlled by Logitech’s G HUB software platform. The light can also be adjusted for brightness and colour temperatures from its backside settings. It includes a monitor mount with adjustable height, tilt and rotation that helps find ideal light placement on a desktop monitor.

Logitech’s Litra Glow has been made available at $59.99 in Canada, the United States, Australia and some of the European countries from January 2022.

Logitech has been benefiting from elevated demand for its products in the Gaming, Creativity & Productivity, and Video Collaboration units. Its continued focus on bolstering cloud-based video conferencing services is aiding it to robustly expand the clientele base.

The growing adoption of new mobile platforms in both mature and emerging markets is fueling the demand for the company’s peripherals and accessories. Logitech’s expanding partner base that includes Google, Microsoft and Zoom Video is key to its top-line performance. Buyouts like Streamlabs — a leading tool provider for professional streamers, and ASTRO Gaming — a popular console gaming headset maker are major positives.

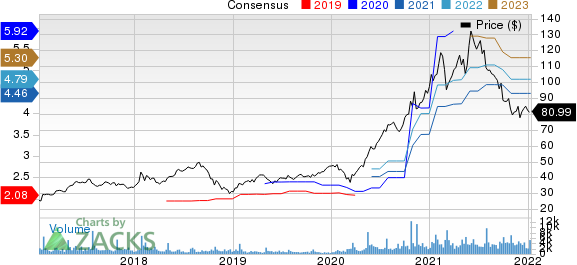

Logitech International S.A. Price and Consensus

Logitech International S.A. price-consensus-chart | Logitech International S.A. Quote

Zacks Rank & Stocks to Consider

Logitech currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader computer and technology sector include the largest global Customer Relationship Management vendor Salesforce CRM and Hewlett Packard HPE, both flaunting a Zacks Rank #1 (Strong Buy), and Advanced Micro Devices AMD carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Salesforce’s fourth-quarter fiscal 2022 earnings has been revised downward by 7.6% to 73 cents per share over the past 60 days. For fiscal 2022, earnings estimates have moved upward by 0.43% to $4.68 per share in the last 60 days.

Salesforce’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 44.2%. CRM stock has appreciated 9% in the past year.

The Zacks Consensus Estimate for HPE’s first-quarter fiscal 2022 earnings has been revised downward by 6.1% to 46 cents per share over the past 60 days. For fiscal 2022, earnings estimates have moved north by 1.5% to $2.03 per share in the past 90 days.

HPE’s earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 14.4%. Shares of HPE have rallied 40.9% in the past year.

The Zacks Consensus Estimate for Advanced Micro Devices’ fourth-quarter 2021 earnings has been revised upward by 7 cents to 75 cents per share over the past 90 days. For 2021, earnings estimates have moved north by 0.38% to $2.65 per share in the last 30 days.

Advanced Micro Devices’ earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 14%. Shares of AMD have rallied 49.7% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

salesforce.com, inc. (CRM) : Free Stock Analysis Report

Logitech International S.A. (LOGI) : Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance