Loews Corp (L) Reports Strong First Quarter 2024 Earnings, Net Income Rises 22%

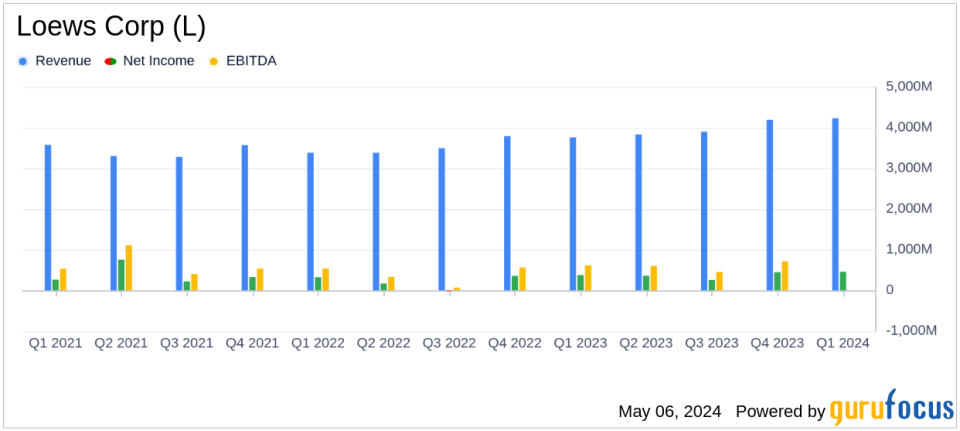

Net Income: $457M for Q1 2024, a 22% increase from $375M in Q1 2023.

Earnings Per Share: $2.05 in Q1 2024, up from $1.61 in Q1 2023.

Revenue: Total revenue reached $4.23B in Q1 2024, up 12% from $3.78B in Q1 2023.

Book Value Per Share: Increased to $83.68 as of March 31, 2024, from $81.92 at the end of 2023.

Share Repurchases: Repurchased 0.9 million shares for $67M since December 31, 2023.

Cash and Investments: Parent company held $3.2 billion as of March 31, 2024.

Debt Level: Stood at $1.8 billion as of March 31, 2024.

On May 6, 2024, Loews Corporation (NYSE: L) announced a significant increase in its first quarter earnings, with net income reaching $457 million, or $2.05 per share, up from $375 million, or $1.61 per share, in the same period last year. This 22% increase highlights a robust performance across its key subsidiaries, particularly CNA Financial Corporation and Boardwalk Pipelines. The detailed financial results can be explored in Loews Corp's recently released 8-K filing.

Loews Corp, a diversified holding company, has interests in insurance, energy, hospitality, and packaging industries. Its primary revenue generator, CNA Financial, is a leader in property and casualty insurance, while Boardwalk Pipelines focuses on the transportation and storage of natural gas and natural gas liquids.

Performance Highlights

The first quarter of 2024 was marked by strong financial achievements, with CNA Financial's net income attributable to Loews improving to $310 million from $268 million in the previous year. This was supported by higher net investment income and favorable net prior year loss reserve development, despite higher net catastrophe losses. Additionally, Boardwalk Pipelines saw a 41% increase in net income to $121 million, driven by higher revenues from re-contracting at higher rates and growth projects including the Bayou Ethane acquisition.

Loews Hotels, another subsidiary, reported a decrease in net income to $16 million from $24 million, impacted by lower occupancy rates in Orlando and higher expenses related to new openings. The parent company also enjoyed improved investment returns, contributing to a robust overall financial performance for the quarter.

Financial Metrics and Achievements

Loews Corp's book value per share, excluding Accumulated Other Comprehensive Income (AOCI), increased to $83.68 from $81.92 at the end of 2023, reflecting the strong results. The company also continued its shareholder-friendly activities, repurchasing 0.9 million shares for $67 million. As of March 31, 2024, Loews had $3.2 billion in cash and investments and $1.8 billion in debt.

Management Commentary

"Loews had an exceptional quarter driven by stellar results at CNA and Boardwalk. CNA continues to experience strong profitable growth, reporting its highest ever first quarter core income," said James S. Tisch, President and CEO of Loews Corporation.

Strategic Insights

The improved earnings reflect a strategic focus on enhancing core operations and capitalizing on favorable market conditions. The growth in net investment income and effective re-contracting strategies at Boardwalk Pipelines underscore Loews' ability to adapt to market dynamics and optimize revenue streams across its diverse portfolio.

Loews Corporation's commitment to returning value to shareholders through stock repurchases, alongside managing a balanced sheet with substantial cash reserves, positions it well for sustained growth and stability. The ongoing investments in growth projects and strategic acquisitions like Bayou Ethane further enhance its market position and future revenue prospects.

For detailed financial figures and management discussion, refer to the full earnings report and supplementary materials provided by Loews Corporation on their website.

Explore the complete 8-K earnings release (here) from Loews Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance