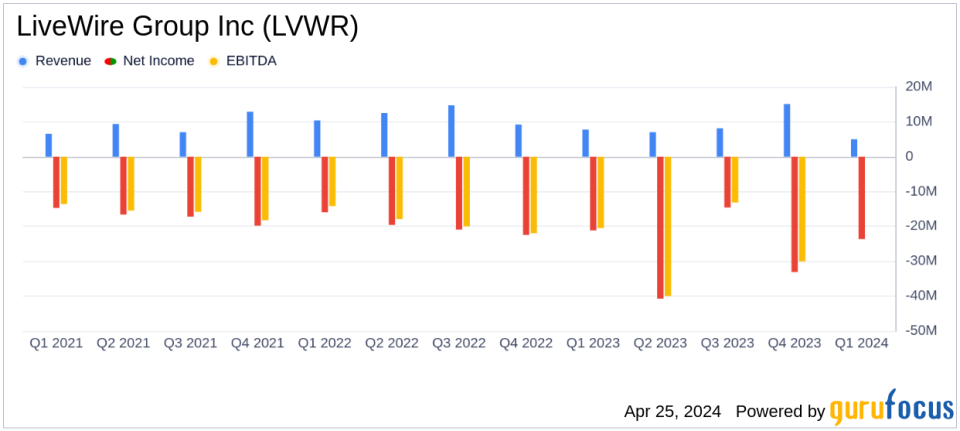

LiveWire Group Inc (LVWR) Q1 2024 Earnings: Challenges Persist as Losses Widen

Revenue: Reported at $5.0 million, a decrease of 36% year-over-year, falling short of estimates of $13.51 million.

Net Loss: Increased to $23.6 million from $21.1 million in the previous year, exceeding the estimated net loss of $28.25 million.

Earnings Per Share (EPS): Recorded a loss of $0.12 per share, slightly better than the estimated loss of $0.14 per share.

Operating Loss: Expanded to $30.4 million, compared to $24.9 million last year, reflecting increased investment in new models and cost reduction initiatives.

Unit Sales: Electric motorcycle sales increased by 86% with 117 units sold, despite a decrease in segment revenue.

STACYC Segment: Revenue fell by 41% to $3.7 million, with operating loss significantly increasing to $1.4 million from $0.1 million.

Financial Outlook: Revised operating loss guidance for 2024 to $105 million to $115 million, improving from previous estimates of $115 million to $125 million.

On April 25, 2024, LiveWire Group Inc (NYSE:LVWR) disclosed its first-quarter financial results through an 8-K filing, revealing a challenging period despite achieving the status of the #1 on-road electric motorcycle retailer in the US. The company, known for its electric vehicles and related products, reported a net loss of $23.6 million, a deterioration from the $21.1 million loss recorded in the same quarter the previous year.

Financial Performance Overview

LiveWire's revenue for the quarter stood at $5.0 million, a significant drop of 36% from $7.8 million in Q1 2023. This decline occurred despite an 86% increase in unit sales of electric motorcycles, highlighting the challenges of a shifting product mix and strategic adjustments in retail partnerships. The operating loss widened to $30.4 million from $24.9 million year-over-year, primarily due to investments in new models and initiatives aimed at reducing electric vehicle (EV) costs.

The Electric Motorcycles segment, which includes sales of electric motorcycles and related products, saw a revenue decrease to $1.2 million from $1.5 million, alongside an increased operating loss. The STACYC segment, focusing on electric balance bikes for kids, also experienced a revenue fall to $3.7 million from $6.3 million, with its operating loss expanding dramatically.

Strategic Moves and Market Position

CEO Karim Donnez highlighted the successful launch of the S2 Mulholland and the company's consolidation efforts at Harley-Davidsons historic headquarters, aimed at achieving greater operational efficiency and cost management. These strategic moves are part of LiveWire's broader plan to strengthen its market leadership in the electric motorcycle sector.

Outlook and Future Projections

For the full year 2024, LiveWire expects to sell between 1,000 to 1,500 electric motorcycles. The company has also revised its operating loss guidance to $105 to $115 million, an improvement from the previously projected range of $115 to $125 million. This revision reflects the ongoing efforts to streamline operations and manage costs more effectively.

Analysis of Financial Health

The balance sheet shows a decrease in cash and cash equivalents from $167.9 million at the end of 2023 to $141.0 million as of March 31, 2024. This reduction is primarily due to cash used in operations and investments in capital expenditures. The company's efforts to manage its financial position amidst expanding losses will be crucial for its sustainability and growth in the competitive EV market.

Overall, while LiveWire demonstrates a robust strategic direction and market positioning, the financial results indicate ongoing challenges that need to be addressed to achieve profitability and long-term success in the evolving electric vehicle industry.

Explore the complete 8-K earnings release (here) from LiveWire Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance