Recap: Meta reports strong Q3 earnings beat, Mark Zuckerberg talks AI, Threads, and hiring faster next year

Meta Platforms reported third-quarter earnings that beat analysts' revenue and profit estimates.

In the earnings call, Mark Zuckerberg discussed AI, how Threads is doing, and plans to hire faster in 2024.

Meta's CFO said the company is seeing "softer" ad spend in the fourth quarter coinciding with the Israel-Hamas war.

Meta Platforms reported third-quarter earnings after the closing bell Wednesday that beat analysts' revenue and profit estimates.

The beat was driven by a continued rebound in Meta's advertising business following a sharp slowdown throughout 2022. Meta's guidance on its 2023 and 2024 expenses also hit the sweet spot for investors, as it signaled that it can balance its "year of efficiency" cost cutting efforts while it continues to invest in the metaverse and artificial intelligence.

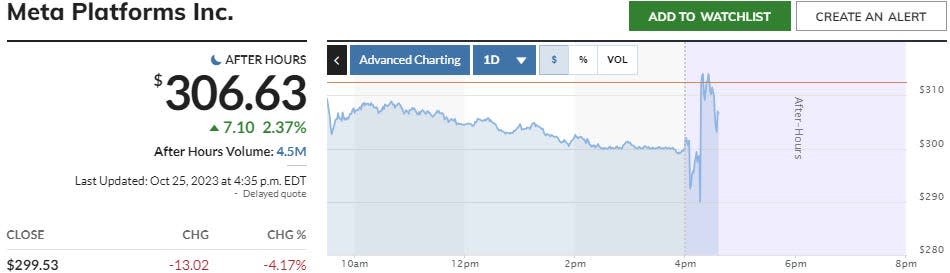

Shares initially jumped in after-hours trading, but dipped into the red as the earnings call progressed. Meta's stock was trading down more than 3% following the end of the call. Meta CFO Susan Li said the company has seen "softer" ad spend so far in the fourth quarter coinciding with the Israel-Hamas war. Li warned that 2024 will be volatile in terms of the broader economy, and the company is exposed to that as an advertising giant.

Zuckerberg closes out the call saying AI will 'transform' how people use Meta's apps.

The executive says that, over time, Meta will be able to use artificial intelligence to create content for people on its family of apps based on their interests.

Meta's stock dips into red in after-hours trading near the end of the call.

The stock was trading down nearly 1% going into the last analyst question after initially popping on Meta's earnings results.

Meta CFO says Meta is seeing more volatility early in Q4, including softer ad spend.

Susan Li says the company is seeing less ad spending in part due to the Israel-Hamas war. The executive says the company saw a similar impact from the war in Ukraine.

Snap issued a similar warning in its earnings on Tuesday.

Zuckerberg pitches his open-source strategy for AI models.

The Meta CEO says that when his engineers create open AI models that are used by other engineers, it works as free advertising for bringing in top talent in the field.

Meta CFO lays out 4 hiring priorities for 2024.

Next year, the company will be hiring most in AI, monetization, metaverse and reality labs, and regulatory compliance needs.

Much of the hiring budgeted for in 2023 will happen in 2024, Susan Li says.

Zuckerberg is still happy with Threads.

"From what we can tell, people love it so far," Zuckerberg says.

The Meta CEO says the app has just under 100 million monthly active users and he hopes to create an app that would encompass one billion users.

Threads was launched earlier this year and has become an alternative to X, formerly known as Twitter.

Zuckerberg says Meta is deprioritizing some non-AI projects to focus on the big prize.

The CEO said AI will be one of the company's biggest investment areas. Meta is racing to compete in the AI arms race with Google and Microsoft.

Meta might be hiring faster next year to work through a sizable 'hiring backlog,' Zuckerberg says.

The company executed a series of layoffs this year, eliminating tens of thousands of roles.

Mark Zuckerberg's Year of Efficiency 'is morphing into the Years of Efficiency,' ISI Evercore analyst Mark Mahaney says.

The company has made a series of cutbacks, including layoffs and cutbacks on office space and perks, since Zuckerberg announced the "year of efficiency" earlier this year.

In an overall positive third quarter earnings report, Meta notes it is currently in a fight with the Federal Trade Commission.

The FTC "is seeking to substantially modify our existing consent order and impose additional restrictions on our ability to operate," Meta says.

The company in 2020 entered into a consent decree with the FTC and agreed to pay a $5 billion civil penalty related to charges first made in 2012 over user privacy and data. Earlier this year, the FTC said it wanted Meta to expand its privacy protections for underage users of its virtual reality products, while limiting the company's use of facial recognition technology.

"We are contesting this matter, but if we are unsuccessful it would have an adverse impact on our business," Meta says Wednesday.

Mark Zuckerberg will speak for the first time since 33 states sued the company.

A bipartisan group of US state attorneys general announced on Tuesday that they are suing Meta, alleging Facebook and Instagram are harming young people's mental health by designing intentionally addictive features on the platforms.

At the time, a Meta spokesperson said the company has introduced dozens of tools to help support teens.

"We're disappointed that instead of working productively with companies across the industry to create clear, age-appropriate standards for the many apps teens use, the attorneys general have chosen this path," the company said.

Zuckerberg could be asked about the lawsuit during the earnings call.

Meta 'may be starting to come out of the woods,' Investing.com's Jesse Cohen says.

"All in all, it was a blowout quarter with Meta reporting its most profitable quarter in years," Cohen says in a note following the earnings release. "Investors have been encouraged by aggressive cost-cutting initiatives implemented by CEO Mark Zuckerberg in recent months."

Meta stock pops 4% after earnings beat.

Meta stock popped about 4% after it reported better than expected third-quarter earnings results. The gain essentially wiped out the stock's loss of about 4% during Wednesday's regular trading session. That rise has since been whittled down to about 2% as investors await the earnings conference call.

Meta reports profit and revenue that beat estimates.

3rd quarter results

Revenue: $34.15 billion, vs $33.52 billion estimate

Earnings per share: $4.39, vs $3.70 estimate

Facebook daily active users: 2.09 billion, vs 2.07 billion estimate

Facebook monthly active users: 3.05 billion, vs 3.05 billion estimate

Family of apps revenue: $33.94 billion, vs $33.08 billion estimate

4th quarter guidance

Revenue: $36.5 billion to $40 billion, vs estimate of $38.76 billion

Full-year 2023 guidance

Total expenses: $87 billion to $89 billion, vs $89.76 billion estimate

Full-year 2024 guidance

Total expenses: $94 billion to $99 billion

Estimate Source: Bloomberg

Goldman Sachs says Meta stock is a buy before earnings

Meta offers a positive risk/reward profile heading into earnings, and its "revenue growth remains on a re-acceleration trajectory," according to a recent note from Goldman Sachs.

"The stock is inexpensive on forward price-to-earnings multiples and management has reset the cost base to align with a mixture of compounded earnings growth while also maintaining a robust investment cadence in long-term initiatives such as AI and the metaverse," it said.

The bank rates Meta at "Buy" with a $384 price target, representing potential upside of 22%.

Meta stock slides 4% heading into earnings.

Meta stock is down about 4% heading into its third-quarter earnings report this afternoon.

The decline is nearly double the Nasdaq 100's decline of about 2.2% and is in-line with the 4% decline seen in the communications sector, of which Meta and Alphabet are the biggest components.

Alphabet's 10% decline today after its earnings results has dragged down the entire sector. But Deepwater Asset Management managing partner Gene Munster said Alphabet's solid advertising results are a "slight positive" for Meta heading into its earnings report.

Despite today's decline, Meta stock is still up 151% year-to-date and is up 243% from its 52-week low, making it one of the best-performing mega-cap stocks since the bear market bottom in October 2022.

All eyes on Meta's 2024 expense guidance as Wall Street sees $100 billion.

Analysts at Bank of America said in a recent note that Meta's 2024 forecast for its expenses will be closely watched by investors.

The bank expects the social media company to guide expenses at $100 billion, which is in line with JPMorgan's 2024 estimate of $96 billion-$102 billion.

Additionally, Bank of America said that solid fourth-quarter guidance and positive management commentary on Reels could drive further upside to Meta's stock.

"Our checks suggest Meta is benefitting from improving digital ad market, ramping Reels monetization and improving AI driven ad measurement," analysts said. "Reels and AI should fuel third-quarter growth."

JPMorgan says advertising trends have been improving.

Solid advertising revenues should enable Meta to beat analysts' revenue and profit estimates, according to a recent note from JPMorgan.

The bank expects third-quarter revenue to jump 22% year over year to $33.8 billion, and for the company to forecast 2024 total expenses at $96 billion-$102 billion.

"We like Meta and believe valuation remains compelling... For Q3 specifically, ad checks have been positive, both from a macro perspective and in terms of Meta-specific initiatives like Advantage+, Reels, and Click-to-Message ads," JPMorgan said.

JPMorgan rates Meta at "Overweight" with a $324 price target, representing potential upside of 7% from current levels.

Meta has to delicately balance its 'year of efficiency' with investments in AI.

Meta's disastrous 2022, in which its stock price plunged more than 70%, led CEO Mark Zuckerberg to announce a "year of efficiency," in which the company would significantly cut back on costs.

But with the arrival of generative artificial intelligence, Meta has to increase its investments in order to remain competitive.

According to Morningstar, management has to delicately balance its cost cutting plans with the need to invest heavily in AI.

"We'd like the firm to discuss its latest plans for the metaverse, and whether it will relaunch with its aggressive investments on that front. We think artificial intelligence is an important component of the metaverse," Morningstar said in a recent note.

UBS says Reels on Instagram is outperforming TikTok.

According to a recent note from UBS, channel checks by the bank indicate that "Reels is outperforming TikTok with lower CPMs and much improved engagement."

That's great news for Meta, given that TikTok has been viewed as one of the company's top risks in the competition for more eyeballs.

The bank said the apps' share of downloads have been rising for Instagram and Facebook, to 18% and 19% respectively, while TikTok has seen its download share fall to 22% from above 25% last year.

In Meta's post-earnings conference call, UBS also wants the social media giant to offer more details about its initiatives in artificial intelligence, including how and when it plans to make money off of the new technology.

"We think the GenAI consumer app bull case is still under-appreciated and not priced into shares. We think more disclosure on GenAI product uptake and eventual monetization could bolster confidence in the durability of top line growth, driving multiple expansion," UBS said.

Meta's consensus third-quarter revenue estimate is $33.52 billion.

3rd quarter

Revenue estimate $33.52 billion (Bloomberg Consensus)

Advertising rev. estimate $32.94 billion

Family of Apps revenue estimate $33.08 billion

Reality Labs revenue estimate $313.4 million

Other revenue estimate $211.7 million

Facebook daily active users estimate 2.07 billion

Facebook monthly active users estimate 3.05 billion

Ad impressions estimate +29.6%

Average price per ad estimate -8.94%

Family of Apps operating income estimate $15.23 billion

Reality Labs operating loss estimate $3.94 billion

Average Family service users per day estimate 3.09 billion

Average Family service users per month estimate 3.88 billion

EPS estimate $3.60

Operating margin estimate 33.9%

Full-year 2023

Total expenses estimate $89.76 billion

Capital expenditure estimate $29.31 billion

Source: Bloomberg

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance