Top headlines: Oil and gas emissions cap coming Thursday with 2026 start date

Today’s top headlines

Wealthsimple aims to quadruple Assets to $74 Billion in five years

Surge in lithium stocks raise hope rout in EV metal almost done

4:55 p.m.

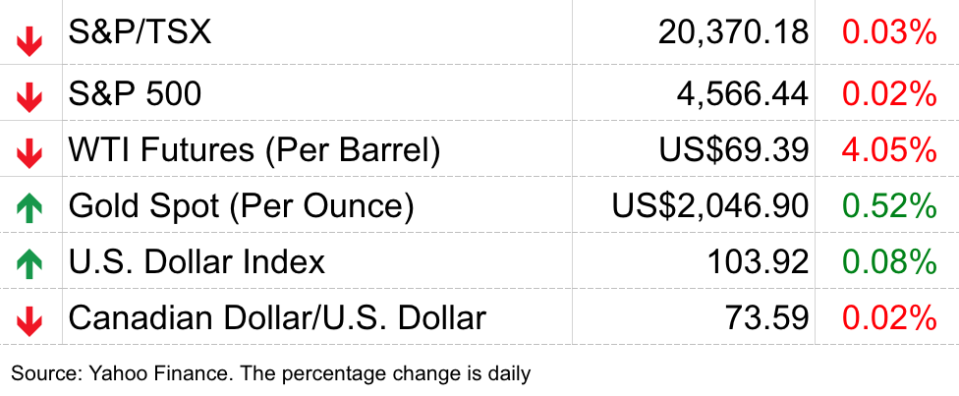

Market close: TSX down more than 100 points on energy losses

Canada’s main stock index was down more than 100 points, dragged lower by losses in energy as oil sank below US$70 a barrel, while U.S. markets were also down.

The S&P/TSX composite index closed down 101.72 points at 20,274.21.

In New York, the Dow Jones industrial average was down 70.13 points at 36,054.43. The S&P 500 index was down 17.84 points at 4,549.34, while the Nasdaq composite was down 83.20 points at 14,146.71.

The Canadian dollar traded for 73.67 cents U.S. compared with 73.64 cents U.S. on Tuesday.

The January crude oil contract was down US$2.94 at US$69.38 per barrel and the January natural gas contract was down 14 cents at US$2.57 per mmBTU.

The February gold contract was up US$11.60 at US$2,047.90 an ounce and the March copper contract was down five cents at US$3.73 a pound.

The Canadian Press

1:50 p.m.

Oil and gas emissions cap coming Thursday with 2026 start date, source says

Canada is poised to outline a federal emissions cap on the oil and gas sector using a cap-and-trade system that would begin as early as 2026, says a federal government source.

The source, who spoke on the condition of anonymity to discuss matters not yet made public, tells The Canadian Press that a framework for the cap will be published Thursday.

The target will not be as strict as the emissions cap estimated last year in the government’s emissions reduction plan.

That plan suggested the oil and gas industry needs to cut emissions to 110 million tonnes by 2030 from more than 200 million tonnes in 2019.

Oilsands companies say it would take them at least another five years beyond 2030 to get close to that.

Draft regulations are now expected by mid-next year and the final regulations in early 2025, with some flexibility to allow companies to meet their targets using offset credits or paying into a decarbonization fund. Find out more.

The Canadian Press

1:22 p.m.

Canada cuts red tape for offshore wind projects along Atlantic coast

Canada is dismantling regulatory hurdles for offshore wind projects along its Atlantic coast, aiming to transform one of the world’s longest and gustiest shorelines into a renewable energy leader despite the industry’s current slump.

Prime Minister Justin Trudeau’s government agreed Wednesday to hand over control of land tenure and regulation for projects within Newfoundland and Labrador’s inland bays and beyond its shores to the provincial government. The move will create stability for investors and streamline permitting processes that can be plagued by “way too much duplication” between levels of government, Labour Minister Seamus O’Regan said in an interview.

O’Regan, who represents a Newfoundland district in Parliament and is a former natural resources minister, said the current moment — and potential for wind energy to deliver generational benefits to Atlantic Canadians — is akin to the first major discovery of oil off the province’s coast several decades ago.

“We’ve got lots of wind and we’ve got a workforce that really knows how to work in the energy industry,” he said. “We’ve got huge assets.”

Yet Canada lacks a single offshore turbine. The nation is not only starting from behind, but also as the offshore wind industry grapples with rising costs, supply chain kinks and higher interest rates. The neighbouring United States has seen multiple offshore wind projects derailed, endangering President Joe Biden’s ambitious target of having 30 gigawatts of offshore wind capacity by 2030.

O’Regan is unfazed. “It’s a medium-long term play,” he said, comparing the slump in wind energy to fluctuations in oil prices that Canadians are used to. “There’ll be hiccups because of commodities.”

Allowing Newfoundland to take the lead on regulating projects is possible because of the Atlantic Accord, an agreement signed in 1985 between Canada and the province on managing offshore oil. The federal government introduced amendments to the accord in May to allow the province’s offshore oil regulator to also oversee wind energy.

Bloomberg

12:22 p.m.

Midday markets: TSX down in late-morning trading as oil drops below US$70 a barrel

Canada’s main stock index was down in late-morning trading as losses in the energy sector helped offset strength in the base metal, telecommunication and utility stocks as the price of oil fell below US$70 a barrel.

The S&P/TSX composite index was down 8.57 points at 20,367.36.

In New York, the Dow Jones industrial average was up 3.08 points at 36,127.64. The S&P 500 index was down 3.05 points at 4,564.13, while the Nasdaq composite was down 13.93 points at 14,215.99.

The Canadian dollar traded for 73.65 cents U.S. compared with 73.64 cents U.S. on Tuesday.

The January crude oil contract was down US$2.59 at US$69.73 per barrel and the January natural gas contract was down nine cents at US$2.62 per mmBTU.

The February gold contract was up US$12.00 at US$2,048.30 an ounce and the March copper contract was down less than a penny at US$3.78 a pound.

The Canadian Press

9:22 a.m.

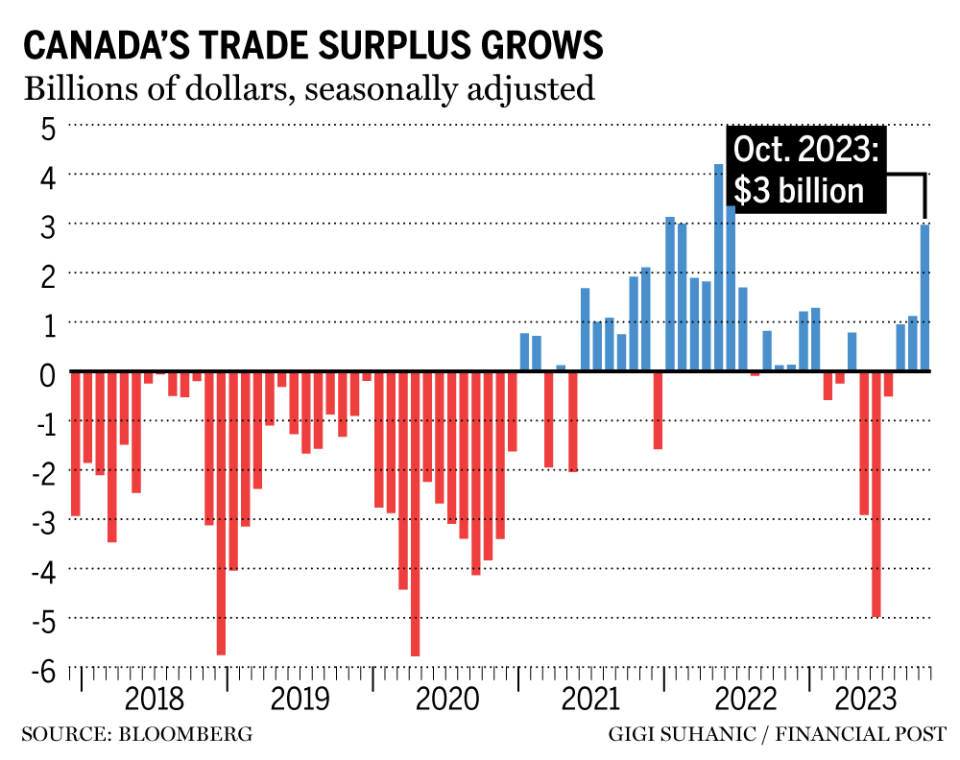

Statistics Canada reports $3B merchandise trade surplus for October

Statistics Canada says the country’s merchandise trade surplus grew to $3.0 billion in October as imports fell and exports edged higher.

The agency says the result compared with a revised surplus of $1.1 billion in September.

The October figures showed imports fell 2.8 per cent for the month to $63.0 billion for the month as imports of metal and non-metallic mineral products dropped 14.7 per cent and motor vehicles and parts moved down 5.8 per cent.

On the flip side, exports of goods rose 0.1 per cent in October to $66.0 billion.

The move came as exports of aircraft and other transportation equipment and parts gained 15.0 per cent, offset by a 1.2 per cent drop in exports of energy products and a 3.5 per cent decline in basic and industrial chemical, plastic and rubber products.

In volume terms, imports in October fell 3.2 per cent, while export volumes edged down 0.1 per cent.

The Canadian Press

7:30 a.m.

Trans Mountain pipeline faces more delays after regulator denies variance

Trans Mountain Corp suffered another blow when Canada’s energy regulator denied a request for a variance on a section of the pipeline in B.C., a development that the company said could delay construction of the ongoing expansion project and push back the pipeline’s start date.

Trans Mountain had applied for the variance after running into what it said were construction challenges related to hard rock between Chilliwack and Hope, B.C. The denial could mean the company is unable to complete the project in time for an anticipated first-quarter 2024 start date.

The development is only the latest in a string of construction-related hurdles that have plagued the Trans Mountain expansion project.

The pipeline is Canada’s only oil pipeline to the west coast. Its expansion will boost the its capacity to 890,000 barrels per day from 300,000 bpd currently and improve access to export markets for Canadian oil companies.

But the project’s costs have spiralled through the course of construction from an original estimate of $5.4 billion to the most recent estimate of $30.9 billion.

The Canadian Press

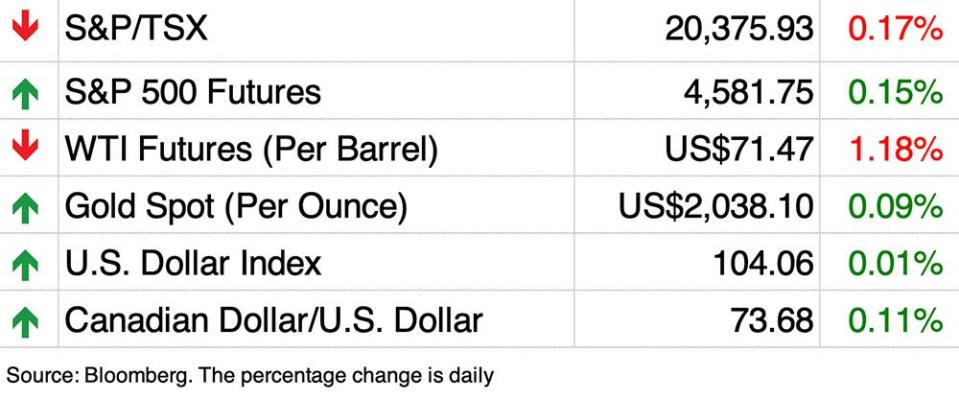

Stock markets before the opening bell

Stocks are ticking higher this morning as hopes that central bankers are ready for a global pivot to rate cuts gather steam again.

This latest rally was fuelled by weaker job-market data in the United States and comments from European central bankers that inflation was showing a “remarkable” slowdown.

What to watch today

The big event today is the Bank of Canada’s last decision on interest rates for the year. Governor Tiff Macklem and his team was widely expected to keep the benchmark overnight rate unchanged at 5 per cent when they announce the decision at 10 a.m., the third consecutive pause. But the statement could be key as Bank attempts to balance a weakening economy with the need to keep inflation in check.

Canada gets trade data today, which is expected to reflect the drop in oil prices and a pullback in exports of metal and mineral products.

Also to watch, Natural Resources Minister Jonathan Wilkinson and Newfoundland and Labrador Premier Andrew Furey will make an announcement regarding offshore wind power in Newfoundland and Labrador.

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Yahoo Finance

Yahoo Finance