Top headlines: Saskatchewan to stop collecting carbon tax on electric heat

Today’s headlines

CIBC beats expectations as bad loan provisions come in lower than forecast

TD cuts thousands of jobs, takes restructuring charge as earnings miss

4:40 p.m.

Market close: TSX gains more than 100 points as U.S. stock markets mixed

Canada’s main stock index gained more than 100 points, led by strength in financial, industrial and telecom stocks, while U.S. markets were mixed, led by a gain of almost 1.5 per cent on the Dow Jones.

The S&P/TSX composite index closed up 120.09 points at 20,236.29.

In New York, the Dow Jones industrial average was up 520.47 points at 35,950.89. The S&P 500 index was up 17.22 points at 4,567.80, while the Nasdaq composite was down 32.27 points at 14,226.22.

The Canadian dollar traded for 73.63 cents U.S. compared with 73.58 cents U.S. on Wednesday.

The January crude oil contract was down US$1.90 at US$75.96 per barrel and the January natural gas contract was down a less than penny at US$2.80 per mmBTU.

The February gold contract was down US$9.90 at US$2,057.20 an ounce and the March copper contract was up three cents at US$3.85 a pound.

The Canadian Press

3:25 p.m.

Netflix urges CRTC to recognize its existing contributions to Canadian broadcasting

Streaming giant Netflix Inc. says the Canadian Radio-television and Telecommunications Commission should recognize the role it already plays in helping fund Canada’s broadcasting industry and reject calls to mandate an additional payment from the company.

But if the federal regulator does move ahead with requiring foreign streamers to contribute money to the Canadian content system, it says that burden should be no more than two per cent of annual revenues, in line with other jurisdictions.

Netflix appeared Thursday at a hearing that is part of the CRTC’s public consultations in response to the Online Streaming Act, which received royal assent in April.

The legislation, formerly known as Bill C-11, is meant to update federal law to require digital platforms to contribute to and promote Canadian content.

Stephane Cardin, director of public policy for Netflix in Canada, told the commission the platform already makes direct investments in Canadian content through its funding of local productions, and an additional levy could “result in displacement of certain investments.”

He urged the CRTC to maintain flexibility as it crafts rules for digital companies to support Canadian broadcasting, rather than obliging them to subsidize certain funds available for local players.

The Canadian Press

1:40 p.m.

Ottawa buying Boeing surveillance planes to replace aging Auroras

The federal government is buying at least 14 Boeing Co. surveillance planes from the United States to replace the aging CP-140 Aurora fleet.

The deal costs more than $10 billion in total, including US$5.9 billion for the jets themselves, and the planes are expected to be delivered in 2026 and 2027.

Defence Minister Bill Blair, Procurement Minister Jean-Yves Duclos and Industry Minister Francois-Philippe Champagne held a press conference this afternoon to make the announcement.

Officials say Boeing’s reconnaissance plane is the only available aircraft that will meet Royal Canadian Air Force needs before the Auroras reach their retirement age in 2030.

Officials said in a media briefing today that the fleet will give Canada new capabilities in the Arctic to hunt submarines, and that allies including Norway are already flying the planes in the far North.

The officials from the Defence Department, Air Force and Procurement Department were providing the information on the condition they not be named.

The decision to go with a sole-source contract has closed the door on Quebec-based jet maker Bombardier Inc., which had been pushing for an open bid.

The Canadian Press

12:37 p.m.

Midday markets: Stocks looking for ‘next leg up’ to close out year

Stocks are drifting in afternoon trading on Wall Street Thursday but remain on track for their best monthly gain in more than a year.

The S&P 500 fell 0.2 per cent at 4,540.93, but remains up more than eight per cent in November. The Dow Jones Industrial Average rose 230 points, or 0.7 per cent, to 35,662 as of 12:30 p.m. Eastern. The Nasdaq fell 0.8 per cent.

The market has been marching steadily higher in recent weeks as investors hope the United States Federal Reserve is finally done raising interest rates, which fight inflation by slowing the economy. Those hopes got more support with a report that the Fed’s preferred measure of inflation cooled last month.

November’s rally has also been driven largely by the technology sector, where several companies with high values tend to disproportionately impact the market. Microsoft Corp. is up 11.5 per cent and Nvidia Corp. rose 15 per cent for the month. Also, Treasury yields have generally been falling and easing pressure on stocks. High yields tend to make expensive stocks look less attractive to investors.

“The rally has been dramatic in its move,” said Quincy Krosby, chief global strategist for LPL Financial.

The recent softness has essentially been the market’s way of dealing with an overbought scenario, she said, but it hardly suggests a deep sell-off ahead.

“What you want to see is that next leg up as we close the year,” she said. “November is a strong month for the market, but so is December.”

Canada’s main stock index edged higher in early-afternoon trading as strength in the telecommunications and financial sectors was offset by weakness in technology stocks, while U.S. stock markets were mixed.

The S&P/TSX composite index was up 0.03 per cent at 20,123.68.

The Canadian Press, The Associated Press

11:51 a.m.

Moe says Saskatchewan to stop collecting carbon levy for electric heat

Saskatchewan Premier Scott Moe says the province is to stop collecting the carbon levy on electric heat starting Jan. 1.

He says many people in northern Saskatchewan use electricity to heat their homes, and that they should be exempt from paying the price.

The premier says the province is to examine who uses electricity to heat their homes, and then will figure out how to take the carbon price off their bills.

In late October, Moe announced the province won’t remit the carbon charge on natural gas after Ottawa exempted home heating oil.

Moe says the federal government’s exemption is unfair, as it mainly helps those in Atlantic Canada.

The province has introduced legislation to shield executives at SaskEnergy, its natural gas utility, from being fined or facing jail time should the company not remit the charge.

The Canadian Press

11:15 a.m.

BRP profit falls by half as consumers melt away

BRP Inc. saw its third-quarter profits tumble by half from a year earlier, as the recreational vehicle maker felt the squeeze of sluggish consumer spending.

The financial drop marked a sharp U-turn from the previous quarter, when earnings jumped 42 per cent year-over-year and optimism rode high atop near-record sales for the period.

“Consumer confidence declined since July,” chief executive Jose Boisjoli told analysts on a conference call Thursday, citing weaker demand for the Ski-Doo maker’s products.

Read the full story here.

The Canadian Press

10:05 a.m.

Markets open: Signs of buyer exhaustion emerge

“This month’s blistering rally in stocks struggled to gain traction on Thursday, with traders giving a lukewarm response to data that bolstered bets the United States Federal Reserve is done with its hiking cycle.

Signs of buyer exhaustion emerged after a rally that put the S&P 500 less than five per cent away from its all-time high, with equities little changed.

Treasuries reversed course at the end of the month, with yields rising on speculation the market has moved too far, too fast in projecting Fed rate cuts. Oil climbed as OPEC+ agreed on extra supply cuts of one million barrels a day.

Inflation-adjusted personal spending rose 0.2 per cent last month after a downwardly revised 0.3 per cent advance in September. The core personal consumption expenditures price index, which strips out the volatile food and energy components, rose 0.2 per cent.

From a year ago, the Fed’s preferred gauge of underlying inflation advanced 3.5 per cent.

“This is likely to cement expectations that the monetary policy inflection point is close, and the Fed will make at least one rate cut in the first six months of 2024,” said Sonu Varghese, global macro strategist at Carson Group. “Fed officials have already acknowledged that inflation is easing, and that can happen in the face of a strong economy and low unemployment, essentially laying the groundwork for rate cuts.”

On Wall Street, the S&P 500 was up 0.12 per cent at 4,556.12. The Dow Jones Industrial Average was up 0.73 per cent at 35,869.70 while the Nasdaq composite was down 0.28 per cent at 14,218.63.

In Toronto, the S&P/TSX composite index was up 0.15 per cent at 20,152.50.

Bloomberg

8:30 a.m.

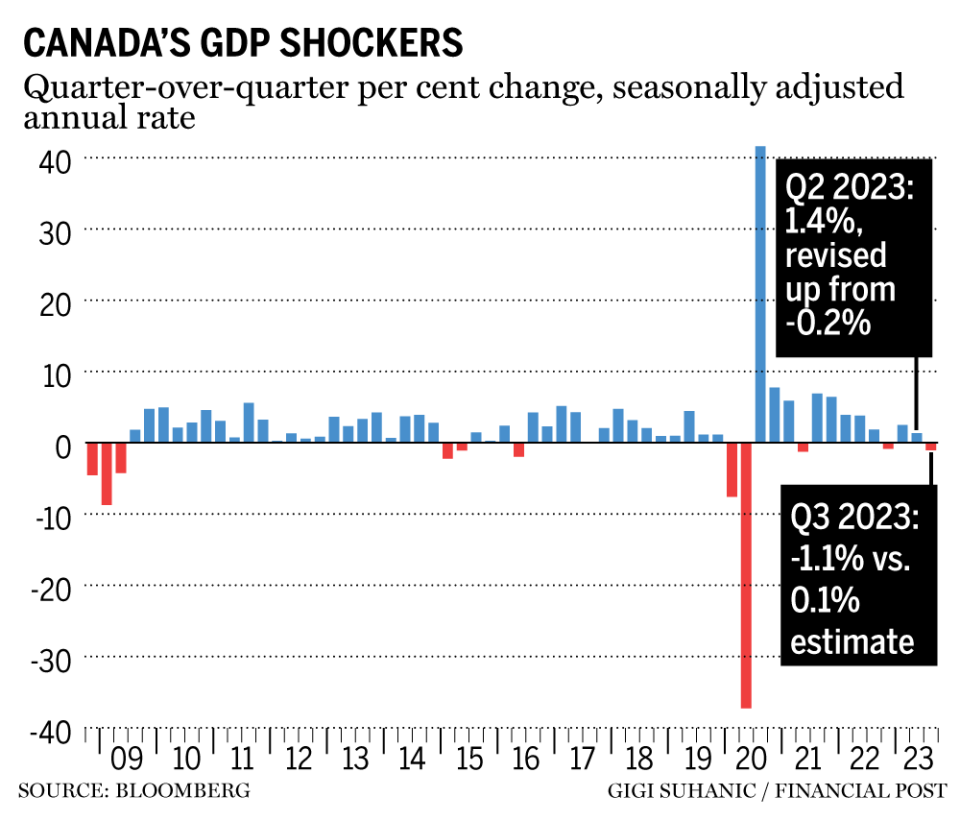

Canadian GDP falls 1.1% in Q3

Canada’s economy shrank in the third quarter by 1.1 per cent on an annualized basis, Statistics Canada said Thursday.

A decrease in international exports and slower inventory accumulation by businesses were partially offset by increases in government spending and housing investment.

It also revised up its reading for real gross domestic product in the second quarter, noting the economy did not shrink, but rather grew by 1.4 per cent on an annualized basis.

Today’s report shows consumer spending continued to be flat for a second consecutive quarter. Meanwhile, business capital investment fell by two per cent.

Bank of Canada interest rate hikes have been putting downward pressure on consumer and business spending as they both face higher borrowing costs.

The Canadian Press

7:30 a.m.

RBC, CIBC, TD raise quarterly dividends amid mixed earnings reports

Both Royal Bank of Canada and the Canadian Imperial Bank of Commerce raised their dividends after reporting a rise in profit, while Toronto-Dominion Bank also raised its divided, though profit fell.

RBC said it had fourth-quarter profit of $4.13 billion, up from $3.88 billion a year earlier. The bank will now pay a quarterly dividend of $1.38 per share, up three cents from $1.35.

Meanwhile, CIBC said it earned $1.48 billion or $1.53 per diluted share for the quarter ended Oct. 31 compared with a profit of nearly $1.19 billion or $1.26 per diluted share a year earlier. It raised its dividend to 90 cents per share, up from 87 cents per share.

TD said it earned $2.89 billion or $1.49 per diluted share for the quarter ended Oct. 31, down from a profit of $6.67 billion or $3.62 per diluted share a year earlier. It raised its dividend to $1.02 per share, up from 96 cents.

The Canadian Press

Read the full stories: RBC beats expectations; CIBC beats expectations; TD cuts thousands of jobs as earnings miss

Stock markets before the opening bell

World shares were mostly higher Thursday ahead of an update on United States consumer inflation and a meeting of oil producers in Vienna.

U.S. futures rose and oil prices also advanced.

Germany’s DAX edged 0.1 per cent higher to 16,189.89 and the CAC 40 in Paris also gained 0.1 per cent to 7,277.03. Britain’s FTSE 100 picked up 0.3 per cent to 7,448.08. The future for the S&P 500 rose 0.1 per cent and that for the Dow Jones industrial average was up 0.4 per cent.

The S&P/TSX composite index closed up 79.43 points at 20,116.20 on Wednesday.

The Associated Press

What to watch today

Statistics Canada will release gross domestic product numbers for the third quarter this morning. We’ll also get the September survey of employment, payroll and hours. In the United States, expect the release of initial jobless claims for the week of Nov. 25, personal income and consumption data for October, the Chicago PMI for November and pending home sales for October.

More big bank earnings are on tap today, too, with reports from Royal Bank of Canada, Toronto-Dominion Bank and Canadian Imperial Bank of Commerce.

Labour Minister Seamus O’Regan takes part in a conversation with Empire Club of Canada chair Sal Rabbani. The discussion will be focused on an economic update on the state of labour relations in Canada, and how business, labour and government can work together to address structural changes in the labour market and grow the economy amidst inflation, energy transition, automation and other challenges.

Nate Horner, Alberta’s minister of finance, will provide an update on the province’s finances and economy.

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance