Top headlines: Bank of Canada to start cutting rates in July, former deputy governor says

Today’s headlines

Little relief in sight for rental market as vacancy rate hits historic low

Canada’s economy grows more than expected, easing pressure on Bank of Canada

Top story

Rate cuts to start in July, former Bank of Canada official says

An ex-member of the Bank of Canada’s governing body says he believes the central bank will start cutting interest rates in about six months if inflation pressures ease as expected.

Policymakers will wait until they see underlying price pressures cool, even if the economy has entered a period of excess supply, former deputy governor Paul Beaudry said.

“I wouldn’t see the potential of rate cuts until probably the July decision,” Beaudry said in an interview with Avery Shenfeld, the chief economist at Canadian Imperial Bank of Commerce. The bank is scheduled to release a decision on July 24.

Last week, policymakers led by governor Tiff Macklem kept the benchmark overnight rate at five per cent, but said their focus has turned to how long they’ll need to keep borrowing costs need this high. Markets and economists see the Bank of Canada starting rate cuts at the June 5 meeting.

Bloomberg

4:40 p.m.

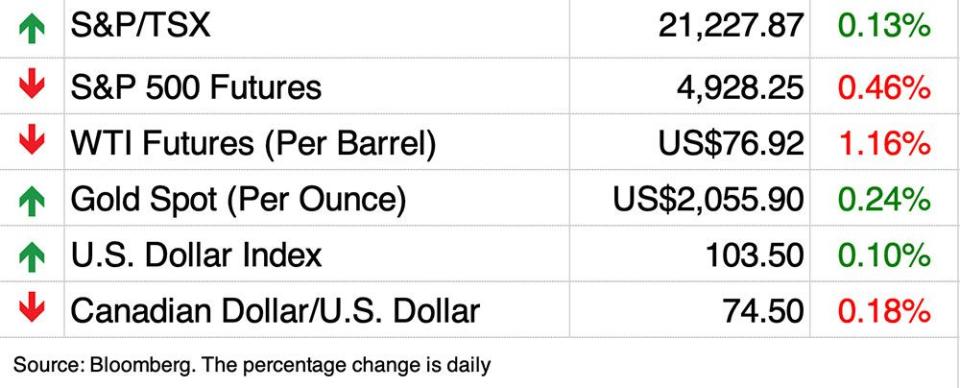

Market close: TSX down more than 200 points, U.S. stock markets also fall

Canada’s main stock index fell more than 200 points on broad-based weakness, while U.S. markets also fell, led by losses in the tech sector.

The S&P/TSX composite index was down 205.99 points at 21,021.88.

In New York, the Dow Jones industrial average was down 317.01 points at 38,150.30. The S&P 500 index was down 79.32 points at 4,845.65, while the Nasdaq composite was down 345.88 points at 15,164.01.

The Canadian dollar traded for 74.41 cents U.S., according to XE.com, compared with 74.53 cents U.S. on Tuesday.

The March crude contract was down US$1.97 at US$75.85 per barrel and the March natural gas contract was up two cents at US$2.10 per mmBTU.

The April gold contract was up US$16.50 at US$2,067.40 an ounce and the March copper contract was up half a penny at US$3.91 a pound.

The Canadian Press

11:58 a.m.

Canada posts lowest rental vacancy rate on record

The Canada Mortgage and Housing Corp. says rent prices in Canada soared last year as supply struggled to keep up with demand, leading to the lowest national vacancy rate on record since it began tracking that data in 1988.

The federal housing agency says the vacancy rate for purpose-built rental apartments sat at 1.5 per cent in October 2023 when the CMHC conducted the annual survey, down from 1.9 per cent a year earlier, which had been the lowest national vacancy rate in over two decades.

The average rent for a two-bedroom purpose-built apartment, which the CMHC uses as its representative sample, grew eight per cent to $1,359 in 2023, which it notes was well above historical averages.

Meanwhile, the average rent for a two-bedroom rental condo was $2,049 as the secondary rental market also tightened, with the vacancy rate for such units falling from 1.6 to 0.9 per cent annually.

The CMHC says that although rental supply rose in most Canadian cities last year, it was not enough to keep pace with increased demand pressures caused by population and employment growth.

It says higher mortgage rates and persistently high home prices also continued to make it harder for renters to transition to home ownership.

— The Canadian Press

Read more: Little relief in sight for rental market as vacancy rate hits historic low

2:00 p.m.

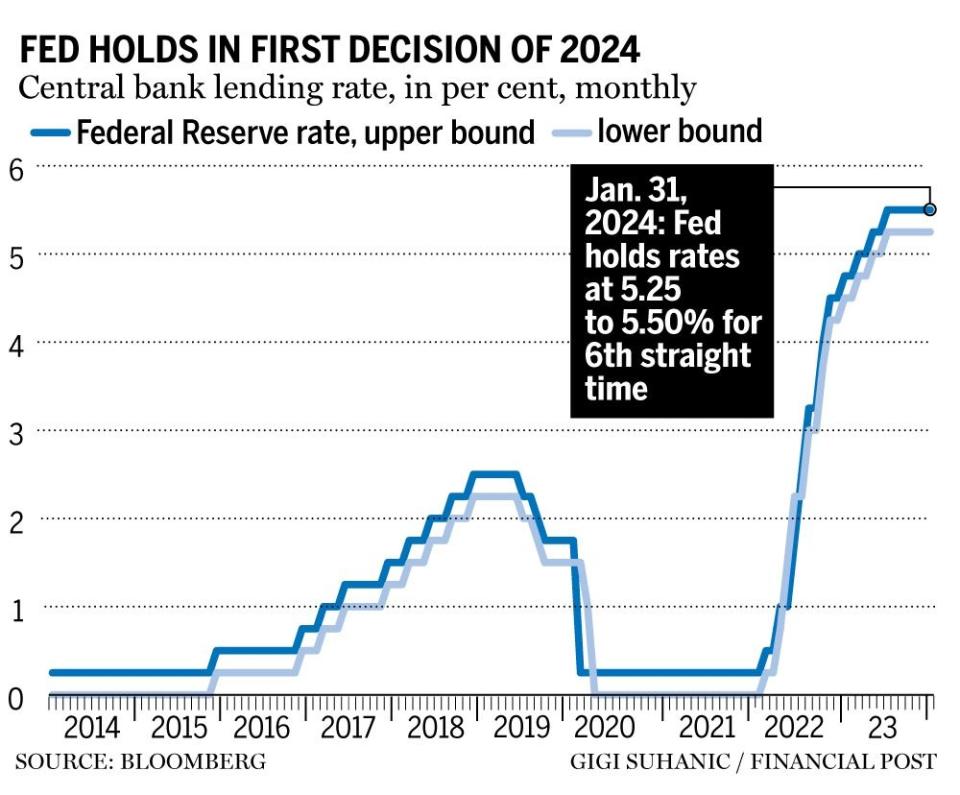

Federal Reserve holds interest steady again

WASHINGTON — The Federal Reserve indicated today that it’s nearing a long-awaited shift toward cutting interest rates, a sign that officials are confident that they are close to fully taming inflation.

The Fed kept its key rate unchanged at about 5.4 per cent, a 22-year high. But in a statement, it signalled a shift by dropping previous wording that had said it was still considering further hikes.

Still, the central bank cautioned that it “does not expect it will be appropriate” to cut rates “until it has gained greater confidence that inflation is moving sustainably” to its 2 per cent target. That suggests that a reduction is unlikely at its next meeting in March.

— The Associated Press

12:54 p.m.

Desjardins to cut 30% of service centres, ATMs by 2027

The Desjardins Group says it will cut its service centres and ATMs by 30 per cent before 2027.

Spokesman Jean-Benoit Turcotti says the boards overseeing the 200-plus credit unions that comprise the organization made the decision after analyzing how frequently the outlets were used.

Desjardins says it will be up to those boards to decide which centres and ATMs in Quebec and Ontario will shut down, as they are in the best position to assess their communities’ needs.

Turcotti says the figures, first reported by Le Soleil, could change depending on how many people use in-person services compared to digital platforms.

Desjardins says that by the end of last year its 669 service counters accounted for just one per cent of transaction volume, while its 1,559 ATMs accounted for three per cent.

In October, the Montreal-based financial services conglomerate said it would lay off nearly 400 people, or about 0.6 per cent of its workforce, due to what it described as the “current economic context.”

The Canadian Press

Noon

Wall Street waits on Fed, TSX down on tech, energy losses

Canada’s main stock index was down in late-morning trading, weighed down by losses in the technology and energy stocks, while U.S. stock markets were mixed ahead of the United States Federal Reserve’s interest rate decision later today.

The S&P/TSX composite index was down 0.28 per cent at 21,167.20.

In New York, the Dow Jones industrial average was up 0.04 per cent at 38,481.30. The S&P 500 index was down 0.83 per cent at 4,884.24, while the Nasdaq composite was down 1.63 per cent at 15,299.12.

The Canadian dollar traded for 74.65 cents US compared with 74.53 cents US on Tuesday.

The March crude contract was down 2.67 per cent at US$75.74 per barrel and the March natural gas contract was up six cents at US$2.14 per mmBTU.

The April gold contract was up 0.9 per cent at US$2,069.00 an ounce and the March copper contract was up a penny at US$3.92 a pound.

— The Canadian Press

10:45 a.m.

Markets open: AI disappointment hits Nasdaq, S&P 500, TSX up

A slide in some of the world’s largest technology companies dragged down Wall Street stocks, with traders also weighing the Treasury refunding plans and labour-market data ahead of the United States Federal Reserve decision.

Just hours away from the Fed announcement, the market scrambled to digest news that the Treasury is boosting its quarterly debt sales — while suggesting that no more increases are likely until next year. Some traders saw that latter portion as a relief that could help support demand for bonds. Indeed, yields retreated — also after data showed U.S. labour costs cooled and companies added fewer jobs than forecast. Yet this time around, the move in bonds did little to help the rate-sensitive tech space.

The most-influential group in the S&P 500 got hit on Wednesday after some of its biggest names failed to live up to high expectations around artificial intelligence. Microsoft Corp., Alphabet Inc.’s Google and Advanced Micro Devices Inc. — among the companies that have led the market rally from the bottom — disappointed investors betting that an AI bonanza would quickly fuel results.

The S&P 500 was down 0.90 per cent, while the Dow Jones industrial average was up 0.06 per cent. The tech-heavy Nasdaq composite fell 1.62 per cent.

In Canada, the S&P/TSX composite index was up 0.07 per cent on gains in the materials, industrials and utilities sectors.

9:45 a.m.

Canada’s fertility rate falls to an all-time low

Statistics Canada says the country’s fertility rate reached an all-time low of 1.33 children per woman in 2022.

The federal agency says that’s part of a downward trend that began in 2009.

The COVID-19 pandemic appeared to have temporarily disrupted the trend when the fertility rate rose in both 2020 and 2021.

According to the report, other countries had a similar experience during those years.

The decline in the fertility rate between 2021 and 2022 is the largest observed since the baby bust in the early 1970s.

StatCan says it puts Canada in the middle of the pack of 10 high-income countries, which includes those in the G7.

— The Canadian Press

8:40 a.m.

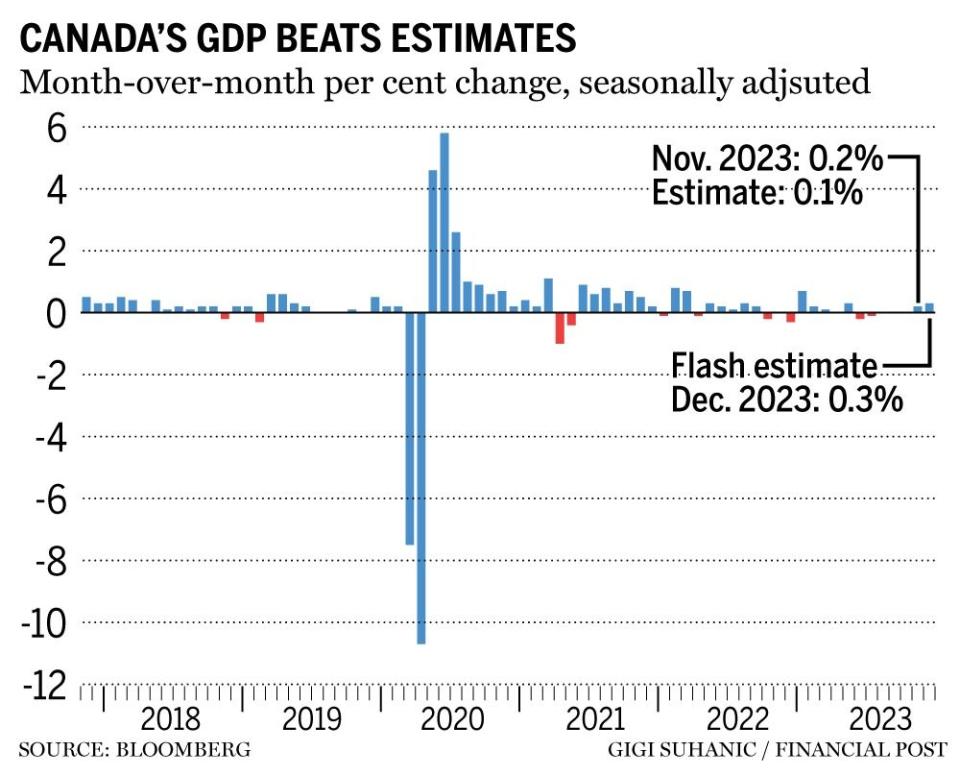

Canada’s GDP beats expectations

Canada’s economy grew more than expected in November, after flatlining for three months in row, data showed today.

Real gross domestic product grew 0.2 per cent in November, more than the 0.1 per cent growth expected by economists.

Statistics Canada said most of the gains came from goods-producing industries, which saw their highest growth rate since January 2023.

Overall, 13 of 20 industrial sectors increased in November, it said.

A preliminary estimate suggests GDP increased 0.3 per cent in the fourth quarter after posting a decline in the third quarter. That would bring economic growth in 2023 to 1.5 per cent, StatCan said.

— Denise Paglinawan, Financial Post

7:30 a.m.

Elon Musk’s record $55 billion Tesla pay package voided by judge

In throwing out Elon Musk’s US$55 billion Tesla pay deal, a Delaware judge began her legal opinion with a simple question: “Was the richest person in the world overpaid?”

After about a year’s consideration and 200 pages of legal reasoning, her answer was clear: Yes. Yes he was.

Chancery Court Chief Judge Kathaleen St. J. McCormick on Tuesday agreed with a Tesla investor who claimed the 2018 pay package failed to clearly show what was required of Musk to earn the money and that the board was rife with conflicts of interest when it approved the deal to retain him as chief executive officer.

The ruling threatens to drop Musk to the third-richest person in the world, after spending the past couple of years as No. 1. The judge’s decision also comes just days after Musk told analysts he wants to expand his stake in the electric carmaker to avoid being ousted, to maintain control of the company and expand further into artificial intelligence.

Shortly after the ruling the billionaire took to social media to vent his feelings.

Musk also asked X devotees to vote on whether he should shift Tesla’s incorporation papers to Texas, where he moved the company’s business operations in 2021. The state has just set up a business court in hopes of competing with its East Coast rival. Minutes into the survey, 90 per cent of the 67,000 votes cast were in favour of the Texas move.

— Bloomberg

Stock markets before the opening bell

Stock futures are down this morning after earnings from tech giants fell short of Wall Street’s lofty expectations and as investors prepared for the first interest-rate decision of the year from the Federal Reserve.

Contracts on the Nasdaq 100 slid 1.2 per cent, while those on the S&P 500 retreated 0.5 per cent. Microsoft Corp., Alphabet Inc. and Advanced Micro Devices Inc. dropped in premarket trading after their updates failed to match the market hype around tech megacaps and artificial intelligence that has helped drive the recent record-setting rally in U.S. stocks.

Attention turns later to the Fed, with the Federal Open Market Committee poised to keep rates in a range of 5.25 per cent to 5.5 per cent, a 22-year high first reached in July.

Traders see a roughly 40 per cent chance the central bank will lower rates for the first time in March, but most Fed officials have said it’s too soon to speculate on such a pivot. While Powell may say that recent declines in inflation are encouraging, he may still show little urgency to ease, given resilience in the labor market and growth in the economy.

Stocks in China and Hong Kong extended losses after data showed another month of contraction in China’s factory activity. Mainland shares were close to wiping out all the gains spurred by hopes of stronger support measures by the authorities. A broader gauge of Asian equities edged higher.

Oil headed for its first monthly gain since September as an escalation of attacks on ships in the Red Sea spurred a diversion of tanker traffic and raised fears about a wider conflict in the Middle East.

What to watch today

Canada’s gross domestic product numbers for November are out today. Economists expect a 0.1 per cent gain, in line with Statistics Canada’s estimate, which would mark the first time real GDP ticked up in six months.

Federal Reserve’s rate decision and accompanying statement will be released at 2 p.m. in Washington, with Chair Jerome Powell holding a press conference 30 minutes later. The Fed is expected to keep the target rate at 5.25 per cent to 5.5 per cent.

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Yahoo Finance

Yahoo Finance