Top headlines: Saskatchewan invokes autonomy act over clean energy rules

Top headlines

Quebec is pushing away international students, just when labour market needs them most

Scotiabank misses expectations as provisions for credit losses climb

4:43 p.m.

Berkshire Hathaway’s Charlie Munger dies at age 99

Charles Munger, the alter ego, sidekick and foil to Warren Buffett for almost 60 years as they transformed Berkshire Hathaway Inc. from a failing textile maker into an empire, has died. He was 99.

He died on Tuesday at a California hospital, the company said in a statement. He was a longtime resident of Los Angeles. “Berkshire Hathaway could not have been built to its present status without Charlie’s inspiration, wisdom and participation,” Buffett said in the statement.

Read the full story here.

Bloomberg

4:40 p.m.

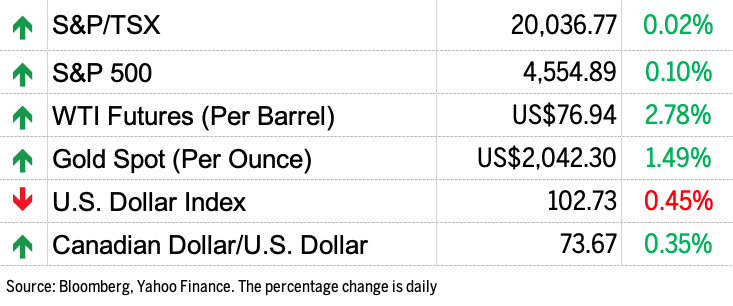

Market close: Energy stocks help TSX eke out gain as U.S. markets rise

Canada’s main stock index eked out a gain as strength in energy and base metals helped offset softness across the rest of the market, while U.S. markets also rose.

The S&P/TSX composite index closed up 0.02 per cent at 20,036.77.

In New York, the Dow Jones industrial average was up 0.24 per cent at 35,416.98. The S&P 500 index was up 0.10 per cent at 4,554.89, while the Nasdaq composite was up 0.29 per cent at 14,281.76.

The Canadian dollar traded for 73.67 cents U.S. compared with 73.34 cents U.S. on Monday.

The January crude oil contract was up 2.78 per cent at US$76.94 per barrel and the January natural gas contract was down 11 cents at US$2.84 per mmBTU.

The February gold contract was up 1.49 per cent at US$2,042.30 an ounce and the March copper contract was up four cents at US$3.84 a pound.

The Canadian Press

2:37 p.m.

Saskatchewan uses autonomy legislation for first time to review Ottawa’s clean electricity rules

The Saskatchewan government is using its autonomy legislation for the first time to review the federal government’s proposed clean-electricity regulations.

Justice Minister Bronwyn Eyre says she’s implementing the Saskatchewan First Act to establish a tribunal to study the economic effects of the rules.

The regulations would require provinces to work toward an emissions-free electricity grid by 2035.

Eyre says the tribunal’s members are to submit a report outlining the costs.

She adds the report could also be used as evidence in court, should the province file an injunction application in the future.

On Monday, Alberta used its sovereignty act for the first time tabling a motion to empower Alberta officials and regulators to not co-operate with the federal rules.

The Canadian Press

1:22 p.m.

Conservative motion seeks support to order senators to pass carbon pricing bill

Conservative Leader Pierre Poilievre wants MPs to order the “unelected” Senate to pass a Tory bill that would take the carbon price off natural gas and propane used on farms.

Poilievre introduced a motion in the House of Commons this morning looking to send a message to senators to pass Bill C-234.

The House already passed the private member’s bill, and all but three Liberal MPs voted against it.

It would remove carbon pricing from natural gas and propane used to heat farm buildings and grain dryers for eight years.

It has been the subject of heated debate in the Senate, with one senator saying that online attacks from people who want the bill passed recently led to a threat that forced her to leave her home on the advice of police.

Environment Minister Steven Guilbeault says the Conservatives didn’t think the Senate “was so unelected” when they tried to have the Senate block Liberal bills.

The Canadian Press

12:09 p.m.

Midday markets: Stocks rise in Toronto and on Wall Street

Strength in energy stocks helped lift Canada’s main stock index higher in early-afternoon trading, while U.S. stock markets also rose following a strong report on consumer confidence and a boost to hopes that the United States Federal Reserve is finished with its aggressive interest rate hikes.

In Toronto, the S&P/TSX composite index was up 0.20 per cent at 20,072.59.

In New York, the S&P 500 index was up 0.33 per cent at 4,565.78. The Dow Jones industrial average was up 0.44 per cent at 35,487.26. while the Nasdaq composite was up 0.33 per cent at 14,288.36.

The Canadian dollar traded for 73.71 cents U.S. compared with 73.34 cents U.S. on Monday.

The January crude oil contract was up 2.67 per cent at US$76.86 per barrel.

The February gold contract was up 1.44 per cent at US$2,041.50 an ounce.

The Canadian Press, The Associated Press

10:31 a.m.

Markets open: Stocks fluctuate on busy day for ‘Fedspeak’

Stocks struggled for direction, with traders awaiting remarks from a slew of United States Federal Reserve speakers while wading through the latest readings on the economy.

“It’s a busy day for Fedspeak,” said Will Compernolle, macro strategist at FHN Financial. “Fed communication since the November decision hasn’t come close to suggesting a hike at the upcoming meeting. As such, the real focus will be on how much Fed officials push back on markets’ growing confidence that the Fed has reached its terminal rate and that rate cuts are in the pipeline as early as the first half of next year.”

Just a few days ahead of start of the so-called blackout period in which central bank officials don’t talk publicly, traders will be focused on a raft of speakers Tuesday. Fed governor Christopher Waller said he’s encouraged by a recent slowing of economic activity, which may indicate the central bank’s policy is tight enough to contain inflation that still remains too high.

On Wall Street, the S&P 500 was down 0.06 per cent 4,547.51. The Dow Jones Industrial Average was up 0.09 per cent at 35,364.99 while the Nasdaq composite was down 0.18 per cent 14,217,16.

In Toronto, the S&P/TSX composite index was down 0.23 per cent at 19,987.17.

Bloomberg

10:28 a.m.

Porter, Air Transat launch joint venture to gird against domestic competition

Porter Airlines and Air Transat are announcing a joint venture as the two carriers look to expand their range of destinations and tap into each other’s markets.

For Toronto-based Porter, the deal will open the gate to Europe and sunny southern getaways currently being served by Air Transat.

Meanwhile, the Montreal-based airline, which largely operates tour package trips, can benefit from access to Porter’s rapidly growing network in Canada and the United States.

The joint venture allows the airlines to co-ordinate pricing and schedules along with revenue sharing, and builds on a year-old code-share agreement, which enables carriers to sell one another’s flights as if they were their own.

It also comes as competition on major domestic routes and sun destination flights ramps up, even amid uncertain travel demand.

Porter Airlines plans to grow its fleet to 79 by 2025 from 46 currently, while Canadian budget carriers continue to expand their fleets.

The Canadian Press

9:36 a.m.

Canada Goose buys European knitwear supplier Paola Confectii

Canada Goose Holdings Inc. says it has acquired a long-standing knitwear supplier and its European manufacturing facility.

Financial terms of the deal for the operating assets of Paola Confectii Manufacturing were not immediately available.

Canada Goose, best known for its luxury down-filled parkas, says Paola Confectii is based in Romania and has been a knitwear manufacturing partner since Canada Goose launched in 2017.

The company says the deal builds on its existing network of seven facilities across Canada and marks its first in Europe.

Canada Goose chairman and chief executive Dani Reiss says the deal demonstrates the confidence the company has in its emerging categories and its plans to develop them into even more meaningful contributors to its business.

It says Paola Confectii will continue to be led by general manager Giannino Lessi and technical director Paola Zaffalon as a stand-alone entity.

The Canadian Press

8:30 a.m.

Panama’s Supreme Court rules First Quantum copper contract unconstitutional

Panama’s Supreme Court ruled that First Quantum Minerals Ltd.’s mining contract is unconstitutional, ratcheting up uncertainty over the future of one of the world’s biggest copper mines.

The vote against the full contract was unanimous, the court’s president Maria Eugenia Lopez said in a press conference on Tuesday morning. The ruling must now be published in the country’s official government newspaper, she said.

The Supreme Court ruling adds to the growing question marks surrounding First Quantum’s Cobre Panama mine. Mass protests erupted last month after Panama’s congress approved a new mining contract with the Canadian company, which has since been forced to suspend production because it can’t access the supplies it needs.

First Quantum declined to comment on the ruling.

Read the full story here.

Bloomberg

7:30 a.m.

Scotiabank misses estimates on higher-than-expected provisions

Bank of Nova Scotia missed fiscal fourth-quarter profit estimates as the company set aside more money than expected for potentially souring loans.

Provisions for credit losses totalled $1.26 billion, more than the $870 million analysts had expected. The Canadian lender earned $1.26 a share on an adjusted basis, it said in a statement Tuesday, short of the $1.67 average estimate of analysts in a Bloomberg survey.

The Toronto-based bank was hit by higher-than-forecast provisions for loan losses in both its Canadian and Latin American operations, which have been plagued by economic turmoil, and also reported lower capital-markets earnings as trading slowed in the quarter.

Christine Dobby, Bloomberg

More: Scotiabank misses expectations as provisions for credit losses climb

7 a.m.

Alberta invokes Sovereignty Act to defy clean electricity regulations

Alberta Premier Danielle Smith invoked a measure to defy federal regulations that aim for a net zero electrical grid by 2035, setting up a confrontation between the province and Prime Minister Justin Trudeau’s government.

The resolution proposed under the Alberta Sovereignty Within a United Canada Act orders provincial government agencies to not enforce or aid in enforcing Canada’s clean electricity regulations, arguing that power generation is the jurisdiction of the provinces under the constitution, not the federal government’s.

The move is likely to set up a major court battle and standoff between Trudeau and Smith, a conservative premier who has vowed to thwart federal regulations that would undermine the province’s energy sector.

Smith’s government said in a statement that Alberta, which relies on natural gas for the bulk of its power generation, is able to achieve a net-zero power grid by 2050 but the 2035 target would be “unaffordable, unreliable and unconstitutional” and puts people at risk of “freezing in the dark” when temperatures drop as low as minus-23F.

Bloomberg

More: Alberta to defy Ottawa’s clean power rules

Before the opening bell: Stocks retreat

European stocks fell for a second day and United States futures pointed to a weaker open on Wall Street amid signs the November rally in equities is overstretched.

The Stoxx 600 declined 0.6 per cent, while contracts on the S&P 500 slipped.

The U.S. dollar edged lower, on track for its steepest monthly drop in a year. Treasuries steadied after gains in the previous session.

In Canada, the S&P/TSX composite index ended Monday down 70.45 points at 20,032.66, led by declines in energy and base metal stocks.

Bloomberg, The Canadian Press

What to watch today

Big bank earnings season kicks off this morning with the Bank of Nova Scotia. Alimentation Couche-Tard Inc. will also report earnings today.

National Citizens Inquiry will reconvene for a virtual hearing to release the final report from the commissioners resulting from the investigation into Canada’s response to COVID-19.

Alberta Premier Danielle Smith will announce two initiatives in emissions reduction. The premier will be joined by Energy and Minerals Minister Brian Jean and Environment and Protected Areas Minister Rebecca Schulz to outline a new initiative to accelerate carbon capture in the province and to mark a major emissions-reduction milestone.

Katrine Conroy, British Columbia’s minister of finance, will provide an update about the fiscal and economic landscape with the release of the province’s second quarterly report.

Ron Morrow, executive director of supervision at the Bank of Canada, will speak before the Central 1 Credit Union’s Momentum 2023 Summit in Vancouver.

Need a refresher on yesterday’s top headlines? Get caught up here.

Additional reporting by The Canadian Press, Associated Press and Bloomberg

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance