Lincoln Electric (LECO) Q1 Earnings Top Estimates, Rise Y/Y

Lincoln Electric Holdings, Inc. LECO reported record first-quarter 2024 adjusted earnings of $2.23 per share, beating the Zacks Consensus Estimate of $2.15. Gains from effective cost management helped offset the impact of lower revenues, resulting in a 4.7% year-over-year increase in earnings.

Including one-time items, the bottom line was $2.14 per share compared with $2.09 in the year-ago quarter.

Total revenues declined 5.6% year over year to $981 million. The top line missed the Zacks Consensus Estimate of $1.04 billion. The decline in revenues was attributed to a 6.1% decline in organic sales, which was partially offset by a 0.4% benefit from acquisitions. Foreign currency exchange had a favorable impact of 0.2%.

Lincoln Electric Holdings, Inc. Price, Consensus and EPS Surprise

Lincoln Electric Holdings, Inc. price-consensus-eps-surprise-chart | Lincoln Electric Holdings, Inc. Quote

Costs and Margins

The cost of goods sold declined 10.4% year over year to $613 million. The gross profit increased 3.7% year over year to $368 million. The gross margin was 37.5% compared with the year-ago quarter’s 34.2%, reflecting a 330-basis point expansion.

Selling, general and administrative expenses increased 4.5% year over year to $199 million. Operating profit inched up 0.4% year over year to $165 million. The operating margin was 16.8% in the quarter under review compared with 15.8% in the year-ago quarter.

Adjusted operating profit rose 1.4% year over year to $171 million in the quarter. LECO delivered an adjusted operating margin of 17.5% for the quarter. The company had reported an operating margin of 16.3% in the year-ago quarter.

Segment Performances

Americas Welding: The segment’s total sales decreased 5.3% to $654 million from $691 million in the year-ago quarter. Adjusted operating income increased around 3% year over year to $136 million.

International Welding: This segment’s revenues dipped 6% year over year to $244 million in the reported quarter. The segment reported an adjusted operating profit of $28 million, which was down 6% compared with the year-ago quarter’s $30 million.

The Harris Products Group: The segment’s first-quarter total sales amounted to around $124 million, reflecting a year-over-year dip of 5%. Adjusted operating profit was $20 million, 4.7% higher than the year-ago quarter’s $19 million.

Cash Flow & Balance Sheet

Lincoln Electric had cash and cash equivalents of around $375 million at the end of the first quarter of 2024 compared with $394 million in 2023 end. The company generated $133 million in cash flow from operations in the first quarter of 2024, up from $124 million in the first quarter of 2023. LECO returned $152 million to shareholders via dividends and share repurchases through the quarter.

The company’s debt to invested capital was 45.9% at the end of the first quarter of 2024 compared with 45.8% at the end of 2023.

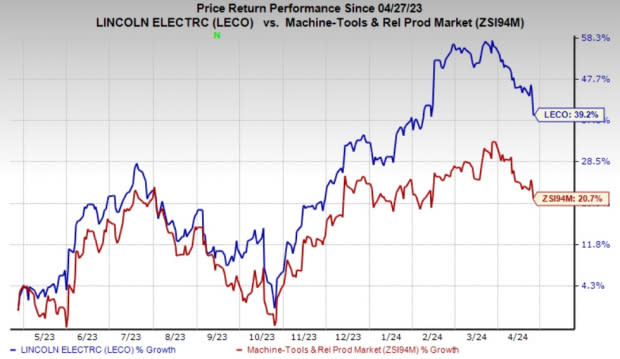

Price Performance

Lincoln Electric’s shares have gained 39.2% in the past year compared with the industry’s 20.7% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Lincoln Electric currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other top-ranked stocks from the Industrial Products sector are Applied Industrial Technologies AIT, Chart Industries, Inc. GTLS and Cadre Holdings, Inc. CDRE. AIT currently sports a Zacks Rank of 1, while GTLS and CDRE carry a Zacks Rank of 2 each.

Applied Industrial has an average trailing four-quarter earnings surprise of 13.9%. The Zacks Consensus Estimate for AIT’s 2024 earnings is pinned at $9.49 per share, which indicates year-over-year growth of 7.8%. Estimates have moved 1% north in the past 60 days. The company’s shares have gained 36% in the past year.

The Zacks Consensus Estimate for Chart Industries’ 2024 earnings is pegged at $11.98 per share. The consensus estimate for 2024 earnings has moved 6% north in the past 60 days and suggests year-over-year growth of 93.6%. The company has a trailing four-quarter average earnings surprise of 75.9%. GTLS shares have gained 19% in the past year.

The Zacks Consensus Estimate for Cadre Holdings’ 2024 earnings is pegged at $1.18 per share. The consensus estimate for 2024 earnings has moved 7% north in the past 60 days and suggests year-over-year growth of 16.7%. The company has a trailing four-quarter average earnings surprise of 33%. CDRE shares have gained 59% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln Electric Holdings, Inc. (LECO) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Chart Industries, Inc. (GTLS) : Free Stock Analysis Report

Cadre Holdings, Inc. (CDRE) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance