Lincoln Educational Services (NASDAQ:LINC) Is Looking To Continue Growing Its Returns On Capital

What trends should we look for it we want to identify stocks that can multiply in value over the long term? One common approach is to try and find a company with returns on capital employed (ROCE) that are increasing, in conjunction with a growing amount of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So on that note, Lincoln Educational Services (NASDAQ:LINC) looks quite promising in regards to its trends of return on capital.

Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Lincoln Educational Services, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.073 = US$17m ÷ (US$292m - US$55m) (Based on the trailing twelve months to December 2022).

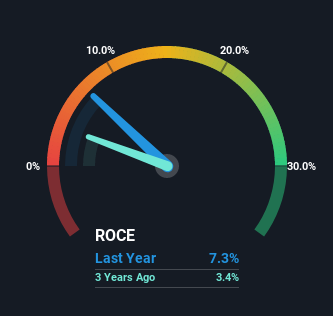

So, Lincoln Educational Services has an ROCE of 7.3%. On its own that's a low return on capital but it's in line with the industry's average returns of 6.8%.

Check out our latest analysis for Lincoln Educational Services

Above you can see how the current ROCE for Lincoln Educational Services compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free report for Lincoln Educational Services.

The Trend Of ROCE

The fact that Lincoln Educational Services is now generating some pre-tax profits from its prior investments is very encouraging. Shareholders would no doubt be pleased with this because the business was loss-making five years ago but is is now generating 7.3% on its capital. And unsurprisingly, like most companies trying to break into the black, Lincoln Educational Services is utilizing 120% more capital than it was five years ago. This can tell us that the company has plenty of reinvestment opportunities that are able to generate higher returns.

On a related note, the company's ratio of current liabilities to total assets has decreased to 19%, which basically reduces it's funding from the likes of short-term creditors or suppliers. So this improvement in ROCE has come from the business' underlying economics, which is great to see.

In Conclusion...

Overall, Lincoln Educational Services gets a big tick from us thanks in most part to the fact that it is now profitable and is reinvesting in its business. And with the stock having performed exceptionally well over the last five years, these patterns are being accounted for by investors. In light of that, we think it's worth looking further into this stock because if Lincoln Educational Services can keep these trends up, it could have a bright future ahead.

Since virtually every company faces some risks, it's worth knowing what they are, and we've spotted 4 warning signs for Lincoln Educational Services (of which 1 can't be ignored!) that you should know about.

While Lincoln Educational Services isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance