Lightspeed Stock and Others That Just Hit 52-Week Lows

Written by Karen Thomas, MSc, CFA at The Motley Fool Canada

It was not too long ago that I struggled to find TSX stocks trading at 52-week lows. The market bubble kept me on the sidelines, just accumulating cash. Today, the stock market selloff has flipped the script. I know that we’re all feeling uneasy. I mean, stocks like Lightspeed Commerce (TSX:LSDP)(NYSE:LSPD) are down as much as 77% in the last few months. We may also be downright scared, as we wonder what will happen to our savings. Well, I’m here to remind you that stock market selloffs often drive significant outperformance.

We just have to be brave enough to step in when everyone else is running away. As Warren Buffett famously said, “be fearful when others are greedy and greedy when others are fearful.” There’s a lot of value emerging here. So, grab your pencil and paper and start thinking about what to buy and at what price. In this article, I would like to review three stocks that are trading at 52-week lows. This will hopefully give you some ideas of stocks to add to your buy list as this selloff continues.

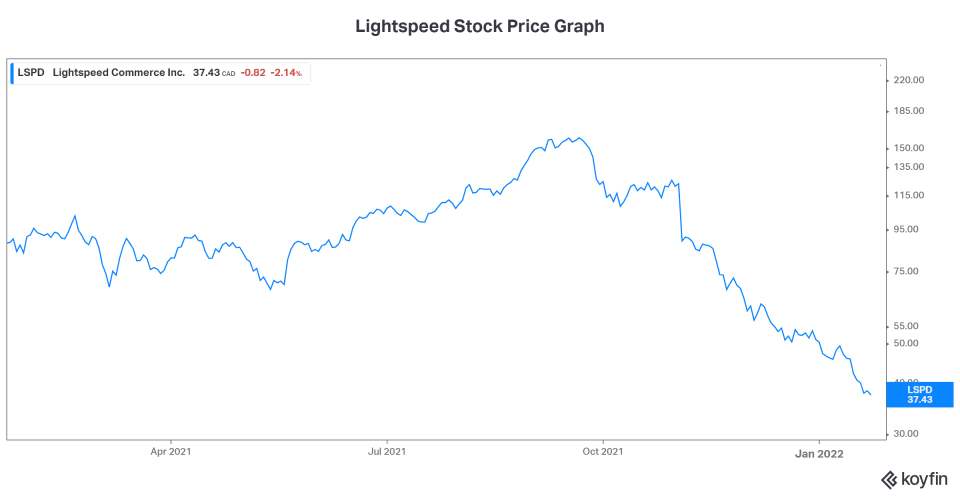

Lightspeed stock: Value uncovered

Lightspeed stock has been walloped in the last few months. In fact, it’s trading at a mere fraction of what is was trading at just in autumn last year. It’s down a frightful 77% in the last four months alone. This is a prime example of how important and telling Warren Buffett’s quote is. Motley Fool investors, if you invest with Warren Buffett’s quote in mind, you will save yourself a lot of loss and stress.

So, today, Lightspeed stock is valued much more attractively than just four months ago. Yet the company is still healthily growing its revenue. Furthermore, its balance sheet remains strong, and it continues to be in a long-term growth business. Today, Lightspeed has grown into an all-in-one solution, helping clients to sell across channels. It is what is known as an omni-channel, e-commerce solution.

The build-out of e-commerce has been happening at lightning speed. Today, it’s obvious that e-commerce is here to stay. But is it the right time to buy?

Ballard Power Systems stock: Like Lightspeed, it’s been hit hard

Ballard Power Systems (TSX:BLDP)(NASDAQ:BLDP) is another high flying stock that has been pummeled. Like Lightspeed stock, this one is also down 77%, but this is relative to one year ago. So, what should we do about Ballard? Well, I still like the stock. I recognize that the market environment is more risk averse right now, favouring more established companies. Yet Ballard is still a stock that I like.

The fuel cell industry is growing rapidly, and Ballard has a prime position. The time to buy a stock like this is when everyone is fearful — i.e., now. With Ballard Power stock, we must be prepared for a volatile ride. However, buying at 52-week lows is a great start. If the fuel cell industry continues to surge, Ballard stock will likely be a star performer.

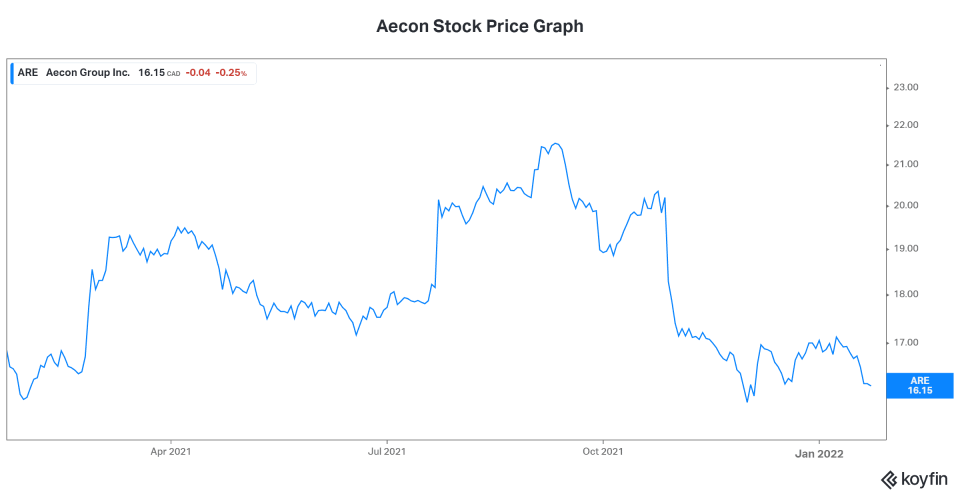

Aecon Group stock

The problem with Lightspeed stock and Ballard Power stock is that these companies have no earnings. So, it makes the decision to buy in a little more risky. It’s simply more difficult to value such companies. Let’s move on to the last stock on the list. Aecon Group (TSX:ARE) has tumbled 26% from its September highs. It’s now also trading at 52-week lows.

But Aecon has earnings and cash flows to talk about. It trades at below 20 times earnings, which are expected to rebound. Longer term, infrastructure spending in North America is on a healthy trend upward. Aecon stock will benefit from this.

Motley Fool: The bottom line

In this stock market selloff, many deals can be had. In fact, the three stocks at 52-week lows listed in this article are certainly showing some real value here. What comes next, though, will depend as much on market sentiment as on fundamentals. For now, market sentiment stinks. I would wait a little before buying money-losing stocks like Lightspeed and Ballard. But if we plug our nose and jump into Aecon at its lows, I think it has great upside potential.

The post Lightspeed Stock and Others That Just Hit 52-Week Lows appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Ballard Power Systems Inc. (usa)?

Before you consider Ballard Power Systems Inc. (usa), we think you’ll want to hear this.

Our S&P/TSX market doubling Stock Advisor Canada team just released their top 10 starter stocks for 2022 that we believe could be a springboard for any portfolio.

Want to see if Ballard Power Systems Inc. (usa) made our list? Get started with Stock Advisor Canada today to receive all 10 of our starter stocks, a fully stocked treasure trove of industry reports, two brand-new stock recommendations every month, and much more.

Click Here to Learn More About Stock Advisor Canada Today * Returns as of 1/18/22

More reading

Fool contributor Karen Thomas owns shares of Ballard Power and Aecon Group. The Motley Fool recommends Lightspeed Commerce.

2022

Yahoo Finance

Yahoo Finance