Ligand (LGND) to Spin Out Pelican Subsidiary, Updates '23 View

Ligand Pharmaceuticals LGND announced that it has signed an agreement to merge its subsidiary Pelican Technology Holdings, Inc., with Primordial Genetics to create a new stand-alone private company focused on synthetic biology.

Following the completion of the merger, the new company will be called ‘Primrose Bio’.

Per the terms of this transaction, Ligand will own 49.9% of the newly merged entity and will also retain all the existing commercial royalties related to Pelican (or Pfenex) Expression technology.

Ligand has also signed a purchase and sale agreement with Primrose Bio to contribute $15 million alongside the merger agreement. In return, Ligand will receive a portion of the economic rights to two contracts previously entered into by Primordial Genetics and an economic interest in potential future revenues generated from PeliCRM197, an ideal carrier protein used in conjugate vaccines.

Per Ligand, the transaction is likely to help accelerate the company’s profitability and enable it to add multiple new royalty "shots-on-goal” while lowering its infrastructure costs.

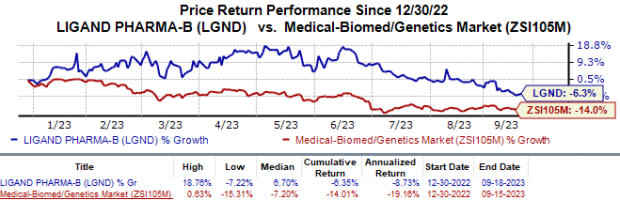

In the year so far, Ligand’s shares have lost 6.4% compared with the industry’s 14.0% decline.

Image Source: Zacks Investment Research

Alongside the above transactions, Ligand also revised its financial guidance for 2023. The company updated its total revenue guidance of $124-$126 million, a decline in the upper limit of the previously provided guidance of $124-$128 million. Royalty revenue expectations have been updated to $82-$84 million, up from the previous guidance of $78-$82 million. The company now expects Captisol sales to generate $25 million (previously: $24 million), while contract revenue is expected to be $17 million (previously: $22 million).

Due to the divestiture, Ligand now expects an increase in its adjusted diluted EPS to $5.10-$5.25, which was previously expected in the range of $4.85-$5.00.

The above guidance excludes Captisol sales related to COVID-19 and its impact on gross profit. Management will update investors as and when orders for COVID-19-related products are received.

Ligand acquired the Pelican technology following the acquisition of Pfenex in 2020. Since the closure of the acquisition, the company has five approved medicines that utilize the Pelican technology, including rights to Jazz Pharmaceuticals’ JAZZ Rylaze and Merck’s MRK Vaxneuvance and V116 vaccines, among others.

The FDA approves Jazz’s Rylaze to treat acute lymphoblastic leukemia (ALL) and lymphoblastic lymphoma (LBL) indications in patients aged one month and older. Sales from the JAZZ-marketed drug have been rising consistently in recent quarters due to strong demand. In July, Jazz Pharmaceuticals received a positive recommendation from the EMA’s CHMP on the regulatory filing for Rylaze in ALL and LBL indications.

Merck’s Vaxneuvance is a 15-valent pneumococcal conjugate vaccine approved by the FDA for use in individuals six weeks and older. The Merck vaccine is also approved for similar use in the European Union.

In July, Merck reported positive topline results from two late-stage studies evaluating V116, an investigational 21-valent pneumococcal conjugate vaccine, in vaccine-naïve and previously vaccinated individuals. Both studies, which Merck conducted, achieved their key immunogenicity and safety endpoints.

Ligand Pharmaceuticals Incorporated Price

Ligand Pharmaceuticals Incorporated price | Ligand Pharmaceuticals Incorporated Quote

Zacks Rank

Ligand currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Jazz Pharmaceuticals PLC (JAZZ) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance