Such Is Life: How Melkior Resources (CVE:MKR) Shareholders Saw Their Shares Drop 60%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Taking the occasional loss comes part and parcel with investing on the stock market. Anyone who held Melkior Resources Inc. (CVE:MKR) over the last year knows what a loser feels like. The share price has slid 60% in that time. At least the damage isn't so bad if you look at the last three years, since the stock is down 14% in that time. Furthermore, it's down 33% in about a quarter. That's not much fun for holders.

View our latest analysis for Melkior Resources

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

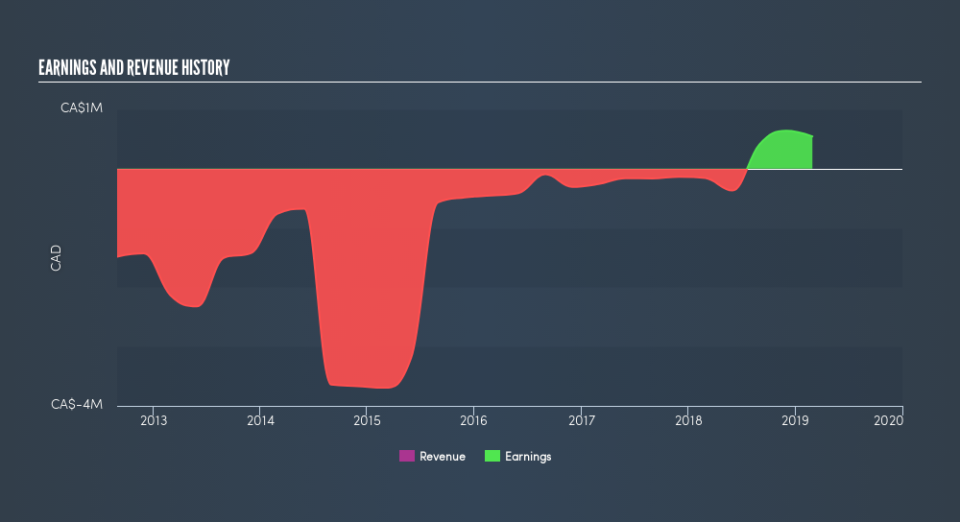

Melkior Resources managed to increase earnings per share from a loss to a profit, over the last 12 months. When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action. But we may find different metrics more enlightening.

Revenue was fairly steady year on year, which isn't usually such a bad thing. However, it is certainly possible the market was expecting an uptick in revenue, and that the share price fall reflects that disappointment.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Investors in Melkior Resources had a tough year, with a total loss of 60%, against a market gain of about 0.6%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 3.7% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Melkior Resources is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance