Life After Gross: BOND Adjusts Portfolio

Recently, the big news surrounding the PIMCO Total Return ETF (BOND) has been investors selling positions in the actively managed ETF in the wake of Bill Gross’ departure from PIMCO, the bond managed he co-founded.

That and news revealed last week that the Securities and Exchange Commission is investigating the issuer r egarding pricing issues at BOND that potentially could have inflated returns advertised to prospective investor. However, it must be noted that it is not yet clear whether improprieties are at the center of the SEC probe.

Important to investors that are sticking with BOND is what the new ETF’s new managers — Scott Mather, Mark Kiesel and Mihir Worah – have in store for the second-largest U.S. actively managed ETF. New adjustments for BOND include trimming its exposure to Canadin bonds. BOND “slashed its holdings of Canadian debt to 2.1 percent from 9.2 percent in the five days ending yesterday,” according to Bloomberg.

Ten-year Canadian bonds yield about 2.1%, roughly 30 basis points below the comparable 10-year U.S. Treasuries. BOND allocates 23% of its weight to ex-U.S. developed markets, according to PIMCO data. That is the third-largest position after a 36% weight to U.S. corporate debt and a 27% allocation to mortgage-backed securities.

Interestingly, BOND’s managers have modestly boosted the fund’s exposure to Mexico. Mexican assets in the ETF increased to 1.1 percent yesterday from 0.9 percent on Sept. 25, Bloomberg reported. Gross had previously been bullish on Mexico, citing an attractive overall balance sheet for Latin America’s second-largest economy. [Bullish on Mexican Bonds]

It would not be surprising to BOND increase its exposure to Latin American debt. Earlier this year, Kiesel’s team said it views valuations on Brazilian debt as attractive for investors with long-term time horizons. [PIMCO Sees Value in Brazilian Debt]

BOND currently has a 3% emerging markets weight compared to a 2% allocation found in the benchmark bond index.

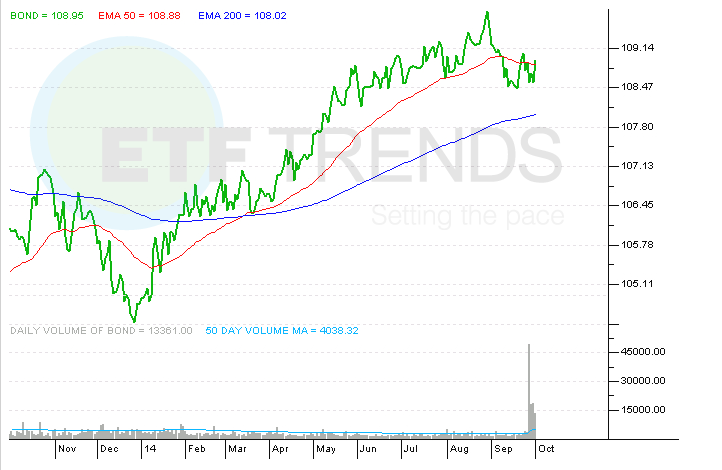

PIMCO Total Return ETF

ETF Trends editorial team contributed to this post.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.

Yahoo Finance

Yahoo Finance