Leon's CEO Michael Walsh on retail, real estate and running a Canadian icon

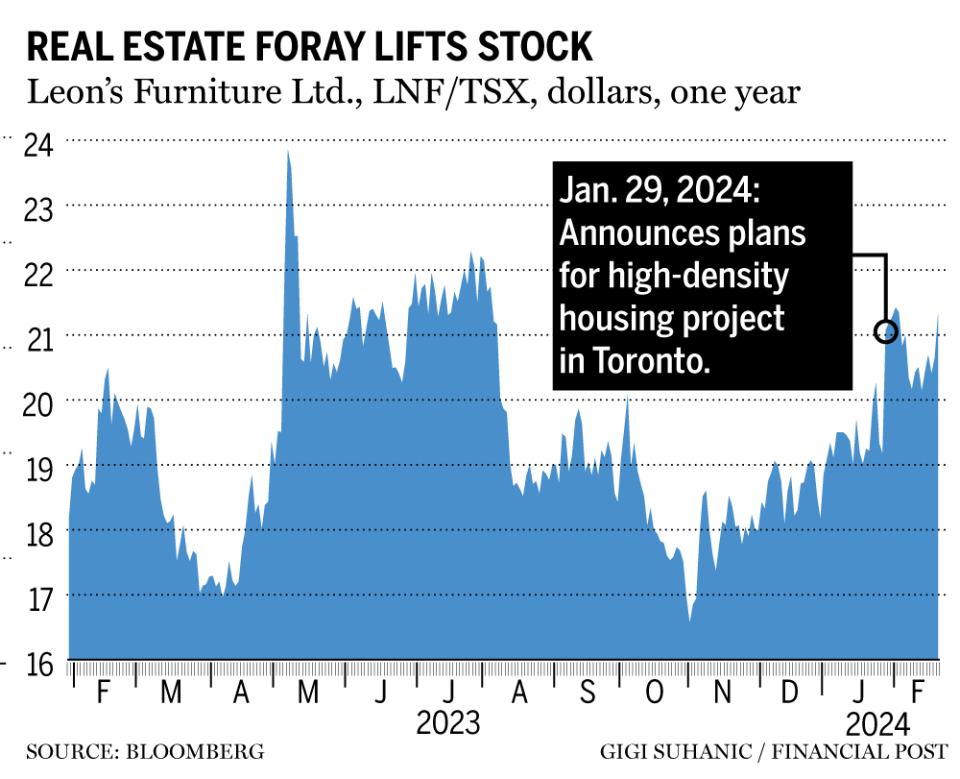

Leon’s Furniture Ltd. revealed in January that it intends to develop a master-planned community that would include 4,000 residential units on a large tract of land it owns near its corporate head office in Toronto. It may seem like a stretch for a furniture retailer to get into the housing game, but Leon’s chief executive, Michael Walsh, doesn’t see it that way. Unlocking the value in the publicly traded company’s vast real estate portfolio — it has 303 stores across the country under banners that include Leon’s, The Brick, Brick Outlet and The Brick Mattress Store, many on land that it owns — is one of the chief executive’s key priorities. The Financial Post’s Denise Paglinawan spoke to Walsh recently about the company’s plans. The following interview has been edited and condensed.

Financial Post: Where are you now in the development process for the residential community?

Michael Walsh: The first approval happened in July 2022 when Toronto City Council adopted a recommendation to convert our land from a general employment area to a regeneration area. With that recommendation, it went to the minister of housing at the provincial level and in December of 2023, what’s called Official Plan Amendment 591 was approved without modification. The conversion from employment area to regeneration area allows us to build office, retail, industrial and housing.

FP: How will that be broken down in the mixed-use project?

MW: The key to all this is optimizing and intensifying the land. There’s two phases to it. Phase 1, we can do fairly quickly, we just have to go back with a submission to the city and that would be for a new head office and a new retail flagship store. The second phase of that is developing the master plan and then working with the city on a secondary plan to get that approved. We’re hoping that we can get that completed in 2025.

FP: Why did you make the jump into developing the land yourself?

MW: The real reason is we own 429 acres across the country. We currently develop our own lands with distribution centres and a lot of Leon’s properties are owned by the company. You won’t see me in a dump truck, but what we’ll do is we’ll partner with a top-tier developer, and figure out joint ventures and other business relationships where they’ll develop the land and we’ll continue to maintain some ownership in it.

FP: You’ve mentioned that you already own a bunch of land throughout the country. Can you give an estimate of the value of your land holdings?

MW: I probably can in May. We announced a while back that we’re going to create a REIT, given the properties that we hold, which would be a separate company with a separate CEO and a separate board of trustees. That’s already been announced (in May last year). As part of that, 35 to 50 per cent of our properties will be sent into the REIT. So we have to do valuations on all of our lands, which we’re currently starting.

FP: Do you think the company’s stock price adequately reflects that value?

MW: No, I think our stock price is low. We still remain focused on retail because that’s the engine behind this company and a big focus of ours between our retail and our services. But unlocking the value of our real estate is massive. Our land and buildings are on our balance sheet for $236 million and all of its unencumbered. That definitely is not the valuation of 429 acres, with 40 acres being in North York (part of Toronto), then we have another 32 acres of land where our Burlington (east of Toronto) store is and we have parcels within other stores and locations.

FP: What made you think of developing residential?

MW: With this particular site, we believe that we can build 4.6 million square feet of gross floor area. So how you maximize that is through residential, highrise, low-rise, rental units and town homes. So each property is different, but when you want to optimize and intensify land, it’s a mix of a whole bunch of different things.

FP: You became CEO of Leon’s in July 2021. What’s it like to take the helm of a 100-year-old family business?

MW: I’m the first non-Leon CEO and I feel very humbled by it. You have a retail organization that’s been through every market condition known to retail and we have successfully navigated through it. I spent a long time at another retailer, which was another great company. But coming here, everybody thinks of Leon’s as just a furniture store and we’re not. We have a real estate portfolio that’s quite large, we have a suite of products and services that live within the ecosystem, from an insurance company to a warranty company to a service company. It’s great being part of a Canadian icon.

Leon's Furniture plans to unlock 'massive' real estate in Toronto

Trudeau offers $2 billion in financing for homebuilding plan

FP: What can the company do to get better recognition for that diverse portfolio?

MW: We’ve started doing that. The REIT will be a publicly traded company. We need people to understand Leon’s Furniture Limited and all the components from financial services to appliance to the other retailers. There seems to be great interest out there. They’re blown away at how much more Leon’s is than a furniture company. And by the time you get to the end of it, they’re like, “Oh, and your shares are trading where they are? You have a story to tell. You’ve got to start telling it.”

• Email: dpaglinawan@postmedia.com

Yahoo Finance

Yahoo Finance