Is LBT Innovations (ASX:LBT) Weighed On By Its Debt Load?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies LBT Innovations Limited (ASX:LBT) makes use of debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for LBT Innovations

What Is LBT Innovations's Net Debt?

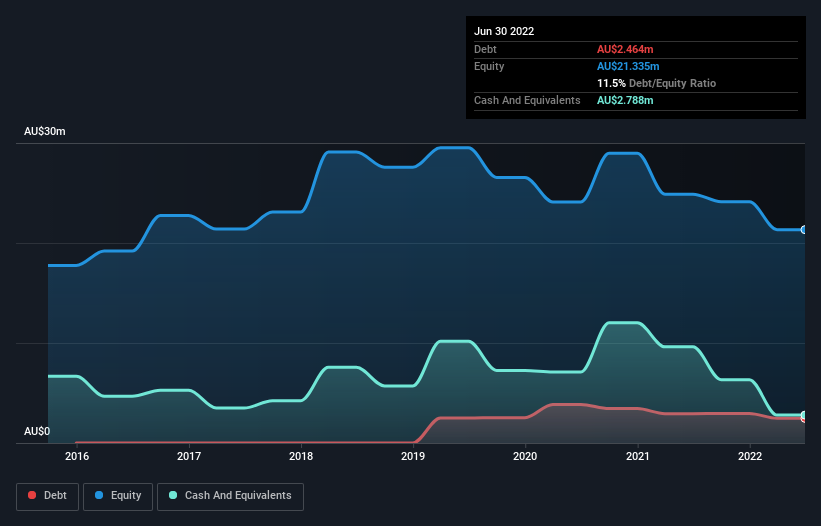

As you can see below, LBT Innovations had AU$2.46m of debt at June 2022, down from AU$2.94m a year prior. However, it does have AU$2.79m in cash offsetting this, leading to net cash of AU$324.0k.

How Healthy Is LBT Innovations' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that LBT Innovations had liabilities of AU$2.86m due within 12 months and liabilities of AU$7.33m due beyond that. Offsetting this, it had AU$2.79m in cash and AU$3.21m in receivables that were due within 12 months. So it has liabilities totalling AU$4.19m more than its cash and near-term receivables, combined.

Of course, LBT Innovations has a market capitalization of AU$24.4m, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, LBT Innovations also has more cash than debt, so we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since LBT Innovations will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year LBT Innovations wasn't profitable at an EBIT level, but managed to grow its revenue by 89%, to AU$2.1m. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is LBT Innovations?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year LBT Innovations had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through AU$5.6m of cash and made a loss of AU$6.6m. However, it has net cash of AU$324.0k, so it has a bit of time before it will need more capital. With very solid revenue growth in the last year, LBT Innovations may be on a path to profitability. By investing before those profits, shareholders take on more risk in the hope of bigger rewards. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. To that end, you should learn about the 5 warning signs we've spotted with LBT Innovations (including 2 which are concerning) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance