Lazydays (GORV) Q1 Earnings & Revenues Fall Short of Estimates

Lazydays Holdings, Inc. GORV reported first-quarter 2024 results, wherein earnings and revenues missed the Zacks Consensus Estimate for the third straight quarter. Moreover, both the top and bottom lines decreased year over year. Following the news, the company’s shares declined 3.8% in the after-hour trading session on May 15.

John North, CEO, Lazydays, said that challenging market conditions and higher-than-anticipated losses in the first quarter resulted in a pre-tax loss in 2024. Nevertheless, GORV expects to maintain positive EBITDA and adjusted operational cash flow. Despite the ongoing economic challenges and competition within the industry, it remain confident in the earning capabilities of its stores and anticipate realizing its full potential as the industry rebounds.

Earnings & Revenues

Lazydays reported adjusted loss per share of $1.63, wider than the Zacks Consensus Estimate of a loss of 43 cents. In the prior-year quarter, the company had reported break-even earnings.

Total revenues were $270.6 million, lagging the Zacks Consensus Estimate of $285 million. The top line also declined 8.5% year over year. Revenues were hurt by dismal performance of new vehicle retail, pre-owned vehicle retail as well as service, body, and parts and other.

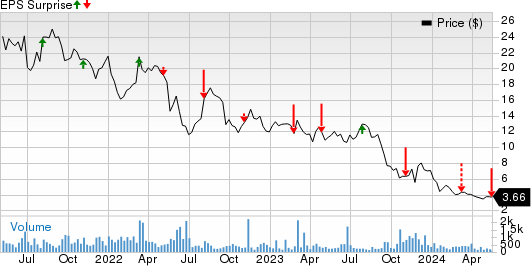

LAZYDAYS HOLDINGS, INC. Price and EPS Surprise

LAZYDAYS HOLDINGS, INC. price-eps-surprise | LAZYDAYS HOLDINGS, INC. Quote

Results of Operations

New vehicle retail sales declined 13.6% year over year to $152.7 million. Pre-owned vehicle retail as well as service, body, and parts and other revenues declined 6.1% and 11.6% year over year to $79.6 million and $13.7 million, respectively.

The company’s gross margin contracted 760 basis points (bps) to 14%. New vehicle retail and pre-owned vehicle retail gross margin declined 950 and 850 basis points to 3.7% and 11.8%.

Balance Sheet

As of Mar 31, 2024, cash totaled $39.4 million compared with $58.1 million as of fiscal 2023-end. Long-term debt, non-current portion, net amounted to $27.8 million compared with $28.1 million as of fiscal 2023-end.

GORV currently has a Zacks Rank #2 (Buy).

Other Stocks to Consider

Here are some other top-ranked stocks from the Consumer Discretionary sector.

Strategic Education, Inc. STRA currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

STRA has a trailing four-quarter earnings surprise of 36.2%, on average. The stock has risen 50.2% in the past year. The Zacks Consensus Estimate for STRA’s 2024 sales and EPS indicates an increase of 6% and 32%, respectively, from the year-ago levels.

Netflix, Inc. NFLX presently flaunts a Zacks Rank of 1. NFLX has a trailing four-quarter earnings surprise of 9.3%, on average. The stock has risen 81.5% in the past year.

The Zacks Consensus Estimate for NFLX’s 2024 sales and EPS implies a rise of 14.7% and 52.1%, respectively, from the year-earlier actuals.

Royal Caribbean Cruises Ltd. RCL currently sports a Zacks Rank of 1. RCL has a trailing four-quarter earnings surprise of 18.3%, on average. The stock has risen 86.6% in the past year.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS suggests growth of 16.9% and 59.5%, respectively, from the prior-year figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Netflix, Inc. (NFLX) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Strategic Education Inc. (STRA) : Free Stock Analysis Report

LAZYDAYS HOLDINGS, INC. (GORV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance