Lazard's (LAZ) April AUM Improves 1.7% on Positive Markets

Lazard, Inc. LAZ reported its preliminary asset under management (AUM) balance of $245 billion for May 2024. This reflected a 1.7% increase from $240.8 billion as of Apr 30, 2024.

The rise in AUM balance was driven by a market appreciation of $4.4 billion and foreign exchange appreciation of $1.4 billion. These were partially offset by net outflows of $1.6 billion.

In May, Lazard’s equity assets and fixed income increased 1.7% and 2.1% from the prior month’s level to $190.8 billion and $46.4 billion, respectively. Other assets rose marginally to $7.8 billion from the previous month.

LAD’s strong AUM balance, coupled with innovative investment strategies and solutions, is expected to support its top line. We project average AUM and revenues to rise 9.7% and 18%, respectively, in 2024. A well-laddered debt maturity profile and impressive cost-control efforts are other positives. However, the current challenging macroeconomic environment and high reliance on financial advisory fees for most of its revenues are major concerns.

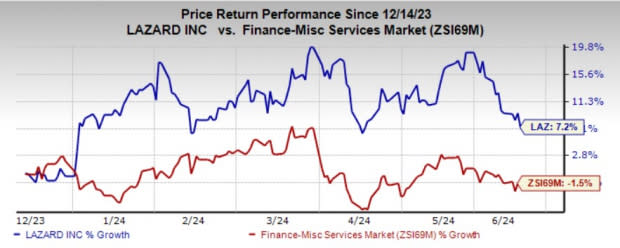

Over the past six months, shares of Lazard have gained 7.2% against the industry’s decline of 1.5%.

Image Source: Zacks Investment Research

LAZ currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Asset Managers

Franklin Resources, Inc. BEN reported its preliminary AUM of $1.64 trillion as of May 31, 2024. This reflected an increase of 2% from the prior month’s level.

The improvement in BEN’s AUM balance was primarily due to the impact of positive markets, partially offset by long-term net outflows.

Virtus Investment Partners, Inc. VRTS recorded a sequential increase of 1.9% in its preliminary AUM balance for May 2024. The company reported a month-end AUM of $173.3 billion, indicating a rise from the Apr 31, 2024, level of $170.1 billion.

VRTS offered services to $2.6 billion of other fee-earning assets. This was excluded from the above-mentioned AUM balance.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

Lazard, Inc. (LAZ) : Free Stock Analysis Report

Virtus Investment Partners, Inc. (VRTS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance