Landstar System (LSTR) Stock Down 2.3% on Q2 Earnings Miss

Landstar System, Inc. LSTR stock has lost 2.3% since its second-quarter 2022 earnings release on Jul 20. The downfall can be attributed to lower-than-expected earnings and revenue performance.

Quarterly earnings of $3.05 per share missed the Zacks Consensus Estimate of $3.25. However, the bottom line surged 27% year over year. The reported figure lies below the guided range of $3.22 to $3.32.

Revenues of $1,975.1 million also missed the Zacks Consensus Estimate of $2,017.4 million. The top line soared 26% year over year.

Total revenues in the truck transportation segment — contributing to 88.5% of the top line — amounted to $1.75 billion, up 20.9% from the year-ago quarter’s figure. Rail intermodal revenues of $43.4 million decreased 2.1% from the figure recorded in second-quarter 2021. Revenues in the ocean and air-cargo carrier segments skyrocketed more than 100% year over year to $158.8 million. Other revenues increased 16.7% to $25.6 million.

Gross profit came in at $208.1 million in the reported quarter, up 19.1% year over year. Operating income surged 23% from the prior-year quarter’s figure to $150.42 million. Total costs and expenses (on a reported basis) increased 25.9% to $1.83 billion.

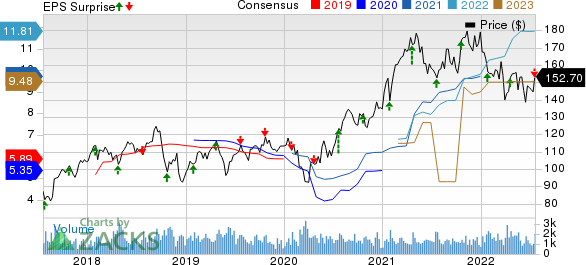

Landstar System, Inc. Price, Consensus and EPS Surprise

Landstar System, Inc. price-consensus-eps-surprise-chart | Landstar System, Inc. Quote

Liquidity, Dividends & Buyback

At the end of the second quarter of 2022, Landstar had cash and cash equivalents of $78.22 million compared with $146.03 million recorded at the end of March 2022. Additionally, long-term debt (excluding current maturities) totaled $73.99 million at the end of the 2022 June quarter compared with $137.29 million at the end of March 2022.

Concurrent with the earnings release, Landstar’s board of directors announced a dividend hike of 20%, thereby raising the quarterly cash dividend from 25 cents per share to 30 cents. The raised dividend will be paid on Aug 26, 2022, to stockholders of record at the closure of business on Aug 8, 2022.

During the reported quarter, Landstar purchased almost 703,000 shares for $103.3 million.

Outlook

Landstar anticipates third-quarter 2022 revenues in the range of $1.80-$1.85 billion. The Zacks Consensus Estimate of $1.76 billion lies below the guidance.

Earnings per share for the September quarter are estimated in the band of $2.75-$2.85. The Zacks Consensus Estimate for the same is currently pegged at $2.65 per share, which lies below the guidance.

Currently, Landstar carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Transportation Companies

Delta AirLines’ DAL second-quarter 2022 earnings (excluding 29 cents from non-recurring items) of $1.44 per share fell short of the Zacks Consensus Estimate of $1.71. Escalated operating expenses induced the earnings miss. Multiple flight cancellations in May and June also hurt results. The earnings miss disappointed investors, resulting in the stock shedding value in early trading. In the year-ago quarter, Delta incurred a loss of $1.07 per share when air-travel demand was not as buoyant as in the current scenario.

DAL’s revenues came in at $13,824 million, which not only beat the Zacks Consensus Estimate of $13,608.9 million but also soared 94% from the year-ago quarter’s figure as air-travel demand rebounded from the pandemic lows. The uptick in air-travel demand in the United States can be gauged from the fact that 75.9% of second-quarter 2022 passenger revenues came from domestic markets.

J.B. Hunt Transport Services, Inc. JBHT reported better-than-expected second-quarter 2022 results, wherein both earnings and revenues outperformed the Zacks Consensus Estimate.

JBHT’s quarterly earnings of $2.42 per share surpassed the Zacks Consensus Estimate of $1.61 and improved 50.3% year over year.

JBHT’s total operating revenues of $3,837.53 million also outperformed the Zacks Consensus Estimate of $2,908.37 million. The top line jumped 32% year over year on the back of strength across all segments. JBHT’s total operating revenues, excluding fuel surcharges, rose 21.2% year over year.

CSX Corporation (CSX) reported better-than-expected second-quarter 2022 results, wherein both earnings and revenues outperformed the Zacks Consensus Estimate.

CSX’s quarterly earnings of 50 cents per share (excluding 4 cents from non-recurring items) beat the Zacks Consensus Estimate of 47 cents and improved 25% year over year.

CSX’s total revenues of $3,815 million outperformed the Zacks Consensus Estimate of $2,990 million. The top line increased 28% year over year on the back of higher revenues in almost all markets, driven by pricing gains, fuel surcharge, and contribution from the acquisition of Quality Carriers. CSX’s overall revenues per unit increased 27%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CSX Corporation (CSX) : Free Stock Analysis Report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Landstar System, Inc. (LSTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance