Landstar System (LSTR) Q4 Earnings & Revenues Lag, Down Y/Y

Landstar System, Inc. LSTR reported disappointing fourth-quarter 2022 results wherein earnings and revenues missed the Zacks Consensus Estimate.

Quarterly earnings of $2.60 per share missed the Zacks Consensus Estimate of $2.62 and fell 13% year over year. The reported figure met the lower end of the guided range of $2.60-$2.70.

Revenues of $1,674.8 million missed the Zacks Consensus Estimate of $1,768.5 million and declined 13.9% year over year. The reported figure was below the guided range of $1,775-$1,825 million.

Gross profit came in at $180.02 million in the reported quarter, down 14.3% year over year. Operating income fell 16.4% from the prior-year quarter’s figure to $124.33 million. Total costs and expenses (on a reported basis) decreased 13.7% to $1.55 billion.

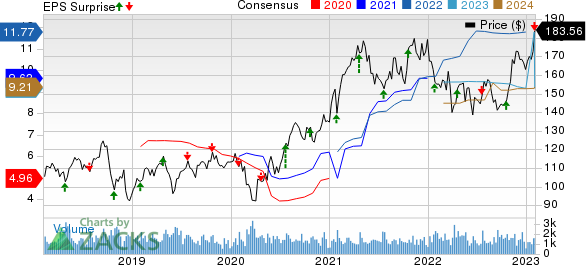

Landstar System, Inc. Price, Consensus and EPS Surprise

Landstar System, Inc. price-consensus-eps-surprise-chart | Landstar System, Inc. Quote

Total revenues in the truck transportation segment — contributing to 91.5% of the top line — amounted to $1.53 billion, down 12.1% from the year-ago quarter’s figure. Rail intermodal revenues of $31.25 million decreased 20.7% from the figure recorded in fourth-quarter 2021.

Revenues in the ocean and air-cargo carrier segments declined 37.9% year over year to $83.83 million. Other revenues increased 2.1% to $26.09 million.

Liquidity

At the end of fourth-quarter 2022, Landstar had cash and cash equivalents of $339.58 million compared with $177.79 million recorded at the end of September 2022. Additionally, long-term debt (excluding current maturities) totaled $67.22 million at the end of the fourth quarter compared with $72.09 million at the end of September 2022.

Q1 Outlook

Landstar anticipates first-quarter 2023 revenues in the range of $1.40 billion to $1.45 billion. The Zacks Consensus Estimate of $1.55 billion lies above the guidance.

Earnings per share for the first quarter are estimated to be in the band of $2.05 to $2.15. The Zacks Consensus Estimate for the same is currently pegged at $2.27 per share, which lies above the guidance.

Currently, Landstar carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Transportation Companies

United Airlines’ UAL fourth-quarter 2022 earnings of $2.46 per share beat the Zacks Consensus Estimate of $2.07. In the year-ago quarter, UAL incurred a loss of $1.60 per share when air-travel demand was not as buoyant as in the current scenario. The fourth quarter of 2022 was the third consecutive profitable quarter at UAL since the onset of the pandemic.

Operating revenues of $12,400 million beat the Zacks Consensus Estimate of $12,230 million. UAL’s revenues increased 51.37% year over year owing to upbeat air-travel demand. The optimistic air-travel demand scenario is also evident from the fact that total operating revenues increased 13.9% from fourth-quarter 2019 (pre-coronavirus) levels.

Delta Air Lines’ DAL fourth-quarter 2022 earnings (excluding 19 cents from non-recurring items) of $1.48 per share beat the Zacks Consensus Estimate of $1.29 per share. DAL reported earnings of 22 cents per share a year ago, dull in comparison to the current scenario, as air-travel demand was not so buoyant then.

DAL reported revenues of $13,435 million, which also surpassed the Zacks Consensus Estimate of $13,030.3 million. Driven by the high air-travel demand, total revenues increased more than 41.87% on a year-over-year basis.

J.B. Hunt Transport Services, Inc.’s JBHT fourth-quarter 2022 earnings of $1.92 per share missed the Zacks Consensus Estimate of $2.45 and declined 16% year over year.

JBHT’s total operating revenues of $3,649.62 million also lagged the Zacks Consensus Estimate of $3,796.8 million. The top line jumped 4.4% year over year. Total operating revenues, excluding fuel surcharges, fell 2.9% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Landstar System, Inc. (LSTR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance