Landstar (LSTR) Rides on Dividends & Buyback, Expenses Ail

Landstar System, Inc. LSTR benefits from higher truck transportation revenues and shareholder-friendly initiatives.

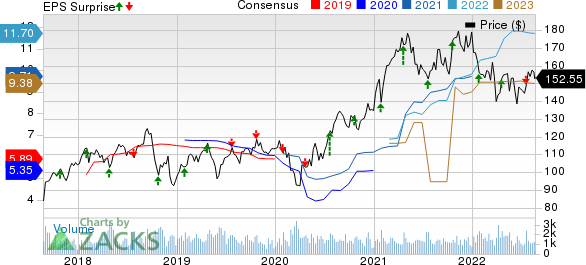

The company recently reported second-quarter 2022 earnings of $3.05 per share, which missed the Zacks Consensus Estimate of $3.25. However, the bottom line surged 27% year over year. Revenues of $1,975.1 million also missed the Zacks Consensus Estimate of $2,017.4 million. The top line soared 26% year over year.

Landstar System, Inc. Price, Consensus and EPS Surprise

Landstar System, Inc. price-consensus-eps-surprise-chart | Landstar System, Inc. Quote

How is Landstar Doing?

Landstar’s efforts to reward its shareholders through dividends and share buybacks even in the current uncertain scenario deserve praise. Concurrent with the second-quarter 2022 earnings release in July 2022, Landstar’s board of directors announced a dividend hike of 20%, thereby raising the quarterly cash dividend from 25 cents per share to 30 cents. The raised dividend will be paid on Aug 26, 2022, to stockholders of record at the closure of business on Aug 8, 2022. During the reported quarter, Landstar purchased almost 703,000 shares for $103.3 million. Such shareholder-friendly moves indicate the company’s commitment to create value for shareholders and underline its confidence in its business. These initiatives not only instill investors’ confidence but positively impact earnings per share.

Landstar continues to benefit from improved freight market conditions. Higher truck transportation revenues, owing to strong demand in the van truckload business are boosting the company’s top line. In second-quarter 2022, total revenues in the truck transportation segment — contributing to 88.5% of the top line — amounted to $1.75 billion, up 20.9% from the year-ago quarter’s figure.

However, the company continues to grapple with rising operating expenses, which have the potential to limit Landstar’s bottom-line growth. In second-quarter 2022, total costs and expenses increased 25.9% year over year to $1.83 billion, primarily due to the 25.8% increase in purchased transportation expenses.

Zacks Rank and Stocks to Consider

Currently, Landstar carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the broader Zacks Transportation sector that investors can consider are GATX Corporation GATX, Triton International Limited TRTN and Teekay Tankers Ltd. TNK, each carrying a Zacks Rank #2 (Buy) as well.

GATX Corporation has an expected earnings growth rate of 17.8% for the current year. GATX delivered a trailing four-quarter earnings surprise of 28.9%, on average.

The Zacks Consensus Estimate for GATX’s current-year earnings has improved 2.1% over the past 90 days. Shares of GATX have gained 16% over the past year.

Triton has an expected earnings growth rate of 22.4% for the current year. TRTN delivered a trailing four-quarter earnings surprise of 7.5%, on average.

The Zacks Consensus Estimate for TRTN’s current-year earnings has improved 4.2% over the past 90 days. Shares of TRTN have gained 21.5% over the past year.

Teekay Tankers has an expected earnings growth rate of 140.1% for the current year. TNK delivered a trailing four-quarter earnings surprise of 46.1%, on average.

The Zacks Consensus Estimate for TNK’s current-year earnings has improved more than 100% over the past 90 days. Shares of TNK have gained 122.6% over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Teekay Tankers Ltd. (TNK) : Free Stock Analysis Report

Landstar System, Inc. (LSTR) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Triton International Limited (TRTN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance