Landstar (LSTR) Q1 Earnings, Revenues Beat Estimates, Down Y/Y

Landstar System, Inc. (LSTR) first-quarter 2024 earnings per share (EPS) of $1.32 beat the Zacks Consensus Estimate of $1.28 but fell 39.2% year over year. Revenues of $1,171 million outpaced the Zacks Consensus Estimate of $1,119.5 million but declined 18.4% year over year.

Operating income fell 40.8% from the prior-year quarter’s figure to $59.96 million. Total costs and expenses (on a reported basis) decreased 16.6% to $1,114.49 million.

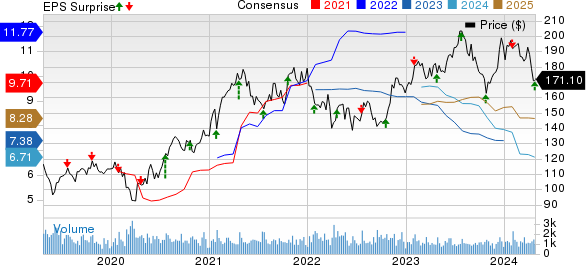

Landstar System, Inc. Price, Consensus and EPS Surprise

Landstar System, Inc. price-consensus-eps-surprise-chart | Landstar System, Inc. Quote

Total revenues in the truck transportation segment — contributing to 91.2% of the top line — amounted to $1,068.93 million, down 19.2% from the year-ago quarter’s figure. The actual figure was higher than our estimate of $1,040.3 million.

Rail intermodal revenues of $22.69 million decreased 11.5% from the figure recorded in first-quarter 2023. The actual figure was higher than our estimate of $17.9 million.

Revenues in the ocean and air-cargo carrier segments declined 11.5% year over year to $54.07 million. The actual figure was higher than our estimate of $30.7 million.

Other revenues increased 0.4% to $25.34 million. The actual figure was higher than our estimate of $24.9 million.

Liquidity, Dividends & Buyback

At the end of first-quarter 2024, Landstar had cash and cash equivalents of $467.67 million compared with $481.04million recorded at the prior-quarter end. Additionally, long-term debt (excluding current maturities) totaled $38.49 million at the end of the first quarter compared with $43.26 million at the fourth-quarter end.

LSTR’s board of directors has declared a quarterly dividend of 33 cents per share, payable on May 24, 2024, to stockholders of record as of the close of business on May 8.

Currently, Landstar carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performances of Other Transportation Companies

Delta Air Lines DAL reported first-quarter 2024 earnings (excluding 39 cents from non-recurring items) of 45 cents per share, which comfortably beat the Zacks Consensus Estimate of 36 cents. Earnings increased 80% on a year-over-year basis.

Revenues of $13.75 billion surpassed the Zacks Consensus Estimate of $12.84 billion and increased 7.75% on a year-over-year basis, driven by strong air-travel demand. Adjusted operating revenues (excluding third-party refinery sales) came in at $12.56 billion, up 6% year over year.

United Airlines Holdings, Inc.UAL reported first-quarter 2024 loss per share (excluding 23 cents from non-recurring items) of 15 cents, which was narrower than the Zacks Consensus Estimate’s loss of 53 cents. In the year-ago reported quarter, UAL reported a loss of 63 cents per share.

Operating revenues of $12,539 million beat the Zacks Consensus Estimate of $12,428.4 million. The top line increased 9.7% year over year due to upbeat air-travel demand. This was driven by a 10.1% rise in passenger revenues (accounting for 90.2% of the top line) to $11,313 million. Almost 39,325 passengers traveled on UAL flights in the first quarter, up 6.8% year over year.

J.B. Hunt Transport Services, Inc.’s JBHT first-quarter 2024 earnings of $1.22 per share missed the Zacks Consensus Estimate of $1.53 and declined 35.5% year over year.

JBHT’s total operating revenues of $2,944 million missed the Zacks Consensus Estimate of $3,117.1 million and fell 8.8% year over year. Total operating revenues, excluding fuel surcharge revenue, fell 7% year over year. The downfall was owing to a 9% decrease in segment gross revenue per load in both Intermodal (JBI) and Truckload (JBT), 22% fewer loads in Integrated Capacity Solution (ICS), and a modest decline in average trucks and productivity in Dedicated Contract Services (DCS). Revenue declines in JBI, ICS, JBT and DCS were partially offset by Final Mile Services (FMS) revenue growth of 2%, primarily driven by new contracts implemented over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delta Air Lines, Inc. (DAL) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Landstar System, Inc. (LSTR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance