Lamar (LAMR) Q1 FFO Misses, Revenues Beat Estimates, Stock Up

Lamar Advertising Company LAMR reported funds from operations (FFO) per share of $1.12 for the first quarter, up 13.3% from the prior-year quarter’s 99 cents. However, the figure narrowly missed the Zacks Consensus Estimate of $1.13.

This year-over-year improvement reflects healthy net revenue growth.

Net revenues for the quarter came in at $406.6 million, marking a 5.8% increase from the prior-year quarter. Moreover, the revenue figure surpassed the Zacks Consensus Estimate of $390.2 million.

In addition, shares of Lamar Advertising appreciated 18.40% during Thursday’s regular trading session, reflecting upbeat investor sentiment.

Quarter in Detail

Acquisition-adjusted net revenues for the first quarter increased 4.4% year on year to $406.6 million, while acquisition-adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) grew 8.7% to $159.8 million.

Operating income improved 6.4% from the prior-year quarter to $96.6 million, while adjusted EBITDA went up 9.4% to $159.8 million. Additionally, free cash flow of $97.1 million in the March-end quarter improved 17.4% year over year.

Balance Sheet

At the end of first-quarter 2020, Lamar Advertising had total liquidity of $608.5 million, of which $111.9 million was available for borrowing under its revolving senior credit facility, and $496.6 million in cash and cash equivalents.

Further, the company made use of $535 million under its revolving credit facility to bolster liquidity. On Feb 6, 2020, the company completed a $2.35-billion refinancing transaction, consisting of the issuance of an additional $1 billion in new senior notes and restatement of senior credit facility.

The company also expects a fall in capital expenditure from $130 million to about $58 million this year.

Outlook

Lamar Advertising has withdrawn its 2020 guidance in the wake of the coronavirus crisis. It intends to reissue the guidance during the second-quarter earnings conference call in August.

The company had earlier projected 2020 AFFO per share of $6.05-$6.20, suggesting 4.3-7% year-over-year growth.

Lamar Advertising currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

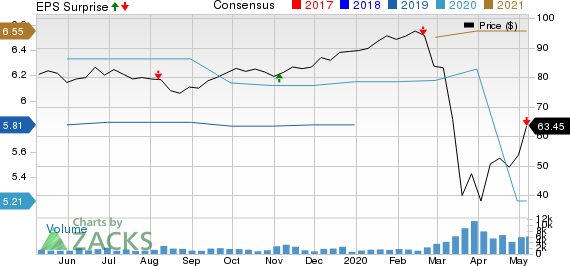

Lamar Advertising Company Price, Consensus and EPS Surprise

Lamar Advertising Company price-consensus-eps-surprise-chart | Lamar Advertising Company Quote

We now look forward to the earnings releases of other REITs like Simon Property Group, Inc. SPG, Park Hotels & Resorts Inc. PK and The Macerich Company MAC. While Simon Property and Park Hotels & Resorts are slated to report quarterly numbers on May 11, The Macerich Company will release results on May 12.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lamar Advertising Company (LAMR) : Free Stock Analysis Report

Macerich Company The (MAC) : Free Stock Analysis Report

Simon Property Group Inc (SPG) : Free Stock Analysis Report

Park Hotels Resorts Inc (PK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance