Lagarde Says ECB Needs More Data to Reassure It on Inflation

(Bloomberg) -- The European Central Bank requires additional reassurance that inflation is headed back to the 2% target before it lowers interest rates further, according to President Christine Lagarde.

Most Read from Bloomberg

Kamala Harris Is Having a Surprise Resurgence as Biden’s Campaign Unravels

Biden’s Fourth of July Shrouded by Pressure to Drop 2024 Bid

Singapore Couples Are Marrying Earlier to Buy Homes, Leading Some to Regret

Newsom Shocks California Politics by Scrapping Crime Measure

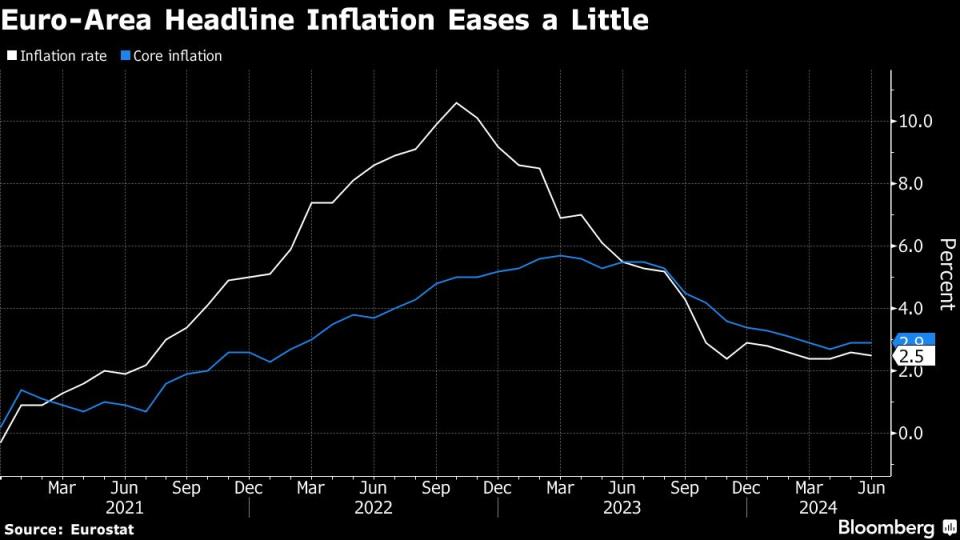

While disinflation is continuing in the euro zone, officials must stay alert, Lagarde said Thursday. A particular focus is the growth in services prices, which is being driven by elevated gains in wages, she said.

“We have to remain vigilant and we have to be confident that inflation is continuously down and that the data that we receive on wages, on profit, on activity, reinforce our confidence that we are on a path to win the fight,” Lagarde told Portuguese TV station RTP.

ECB officials are in no rush to follow their initial reduction in borrowing costs last month with another. Most are cautiously endorsing one or two more cuts this year, though nothing is likely to happen at their meeting on July 17-18.

While inflation slowed a touch last month, many fret about rapid pay growth and geopolitical stresses. Lagarde told the ECB’s annual retreat in Sintra, Portugal, on Monday that time is needed to asses lingering uncertainties over the path for consumer prices.

Several Governing Council members have said decisions to shift rates should be taken when there’s more information available — referring to the quarterly gatherings for which fresh economic projections are compiled.

Lagarde appeared to back up such signaling.

“We need a lot of data — I’m not sure that we are getting those data at every single monetary-policy Governing Council meeting that we have,” she said. “In theory,” however, “it could happen at any of our meetings. But on the basis of a strong set of data.”

Most Read from Bloomberg Businessweek

Dragons and Sex Are Now a $610 Million Business Sweeping Publishing

For Tesla, a Smaller Drop in Sales Is Something to Celebrate

The Fried Chicken Sandwich Wars Are More Cutthroat Than Ever Before

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance