Why the labor market is key to the Fed's next move

Federal Reserve Chairman Jerome Powell has signaled to markets that a rate cut is on the table, but said the timing of a cut would depend on getting a “clearer picture of things.” A clearer picture could come with the only jobs report that the Fed will receive before the next policy-setting meeting on July 30-31.

The Fed is now acknowledging that it is undershooting its 2% inflation target, but said the labor market “remains strong” — marking a bright spot in one of the Fed’s dual mandates. A darkening of the outlook on the employment front should, in that case, bolster the case for a rate cut.

JPMorgan Chase’s Michael Feroli wrote to clients that Powell’s commentary has already pushed his team to pull forward expectations for cuts to July and September of this year. But a bad reading on employment data could reinforce the case for steeper cuts.

“While the risk of more than 50bp of cuts is still not our baseline outlook, any further evidence of deterioration in labor market activity should motivate well more than 50bp of total cuts this cycle,” Feroli wrote June 19.

The Bureau of Labor Statistics will release the next jobs report, covering the month of June, on July 5.

The employment situation

The Fed has a dual mandate: stable prices and maximum employment.

Since the May 1 meeting, the Fed has acknowledged that it is “running below” its 2% inflation target, which Powell said was the result of “weaker global growth” that is baked into policymakers’ worries over near-term economic conditions. Translation: the Fed is having issues with its price mandate, making the case for more accommodative policy.

But things have looked far better on its labor market mandate. The Fed has continued to refer to labor markets as “strong,” the same language that it used as it notched rates up between 2017 and 2018.

Asked by Yahoo Finance if the labor market is now closer or farther from maximum employment, Powell said Wednesday “we have to be closer,” citing more job creation.

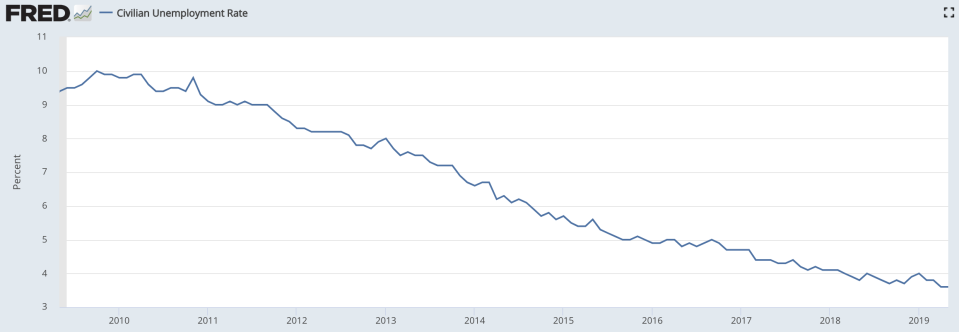

“The unemployment rate is lower. You know, by just lots and lots of numbers, the labor market is in a good place,” Powell said.

But Fed Vice Chairman Richard Clarida told Bloomberg Friday that he did see a “soft print” on the jobs report for May, when the economy added only 75,000 non-farm jobs compared to expectations for 175,000.

Simona Mocuta, an economist at State Street Global Advisors, told Yahoo Finance that the June jobs report will be closely watched, in addition to any developments on the trade front as world leaders meet at the G-20 next week.

“The labor market plays into the timing of the cut,” Mocuta said. “I think you get 50 basis points in July only if it coincides with a bad trade outcome out of G20 and bad jobs.”

Mocuta said a “bad” jobs report would be an outright decline in month-over-month job gains, which she does not expect.

How much slack?

One challenge with the labor market: policymakers have been wrong about where the labor market’s true bottom is.

In June of last year the Fed’s median estimate for the longer-run unemployment rate was 4.5%. Projections from Wednesday’s meeting brought that median estimate down to 4.2%, showing that some see structural changes that are allowing the labor market to tighten beyond previous expectations.

The unemployment rate is currently at 3.6%, a 49-year low. Policymakers have also brought down their estimates for where the unemployment rate will be by the end of this year, from 3.7% (in the March survey) to 3.6%.

Minneapolis Fed President Neel Kashkari acknowledged this in a blog post Friday.

“Over the past few years, some people repeatedly declared that we had reached maximum employment and that no further gains were possible without triggering higher inflation,” Kashkari wrote. “And, repeatedly, the labor market proved otherwise.”

That raises questions about whether or not the Fed underestimated the true amount of slack in the labor market during its tightening cycle — and surfaces new questions about whether or not the Fed should ease policy to allow the market to pull more workers off of the sidelines.

Kashkari advocated for a 50 basis point cut in Wednesday’s meeting. In tandem with concerns over getting inflation to the Fed’s 2% target, Kashkari said potential slack in the labor market means the central bank should provide accommodation.

Powell nodded to the challenge of guessing labor market slack in his press conference Wednesday, saying that while the labor market has tightened, he has not seen “real signals” that the economy is at maximum employment.

“We watch all this very carefully and I think we're very careful about not assuming that there's no more slack in the labor market,” Powell said.

—

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Lael Brainard: Regulators may be 'whittling away' at financial stability

Congress may have accidentally freed nearly all banks from the Volcker Rule

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance onTwitter,Facebook,Instagram,Flipboard,SmartNews,LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance