KRX Growth Leaders: Spotlight On EO Technics And Two More Stocks With High Insider Ownership

The South Korean market has shown robust growth, climbing 2.0% in the last week and achieving an 11% increase over the past year, with earnings expected to grow by 30% annually. In such a thriving environment, stocks like EO Technics that combine high insider ownership with substantial growth prospects stand out as particularly compelling opportunities for investors.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Seojin SystemLtd (KOSDAQ:A178320) | 27.9% | 54% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.6% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

Vuno (KOSDAQ:A338220) | 19.5% | 105% |

HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

Let's uncover some gems from our specialized screener.

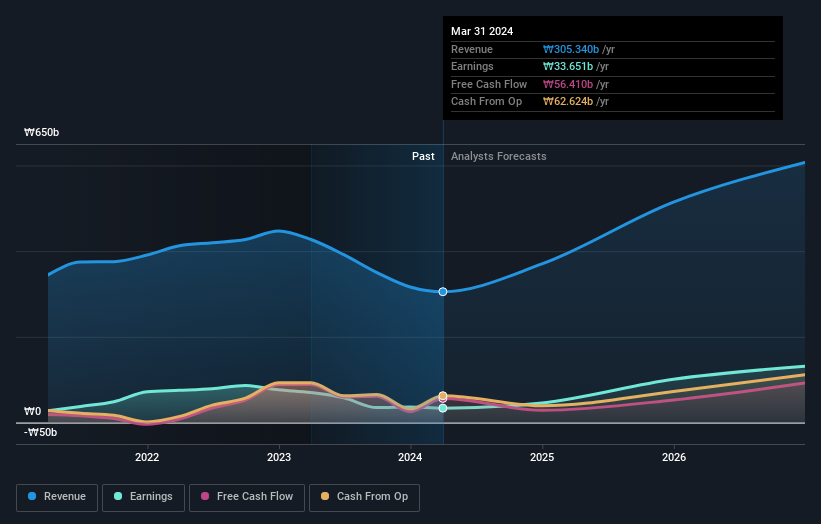

EO Technics

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EO Technics Co., Ltd. is a global manufacturer and supplier of laser processing equipment, with a market capitalization of approximately ₩2.54 billion.

Operations: The company generates its revenue primarily from the production and distribution of laser processing equipment on a global scale.

Insider Ownership: 30.7%

Earnings Growth Forecast: 47% p.a.

EO Technics, a South Korean company, exhibits strong growth potential with earnings expected to increase by 47% annually, outpacing the local market's 29.5%. Despite this robust forecast, its profit margins have dipped from 16.4% to 11% over the past year. The firm's revenue growth projection of 19.9% also slightly misses the high-growth benchmark of 20%. Additionally, recent financial results have been affected by significant one-off items, suggesting some earnings quality concerns. Insider trading activity has been negligible in recent months.

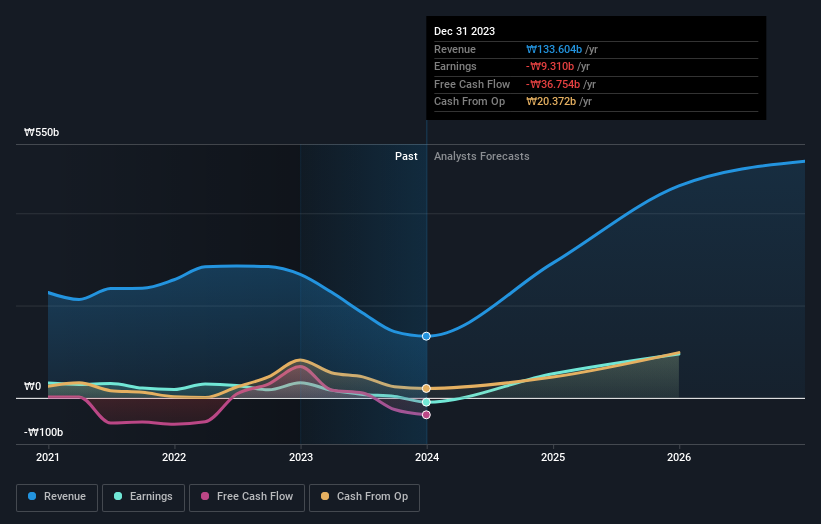

Techwing

Simply Wall St Growth Rating: ★★★★★★

Overview: Techwing, Inc. specializes in developing, manufacturing, selling, and servicing semiconductor inspection equipment both domestically in South Korea and internationally, with a market capitalization of approximately ₩2.44 billion.

Operations: The firm generates its revenue primarily from the development, manufacture, sale, and service of semiconductor inspection equipment across global markets.

Insider Ownership: 18.7%

Earnings Growth Forecast: 77.8% p.a.

Techwing, a South Korean company, is poised for substantial growth with expected revenue increases of 47.2% annually, significantly outstripping the local market's average. Although its share price has been highly volatile recently, it is forecast to achieve profitability within three years and anticipates an exceptionally high Return on Equity at 43.4%. However, financial challenges persist as earnings do not sufficiently cover interest payments, indicating potential risks in its financial health.

Click to explore a detailed breakdown of our findings in Techwing's earnings growth report.

The valuation report we've compiled suggests that Techwing's current price could be inflated.

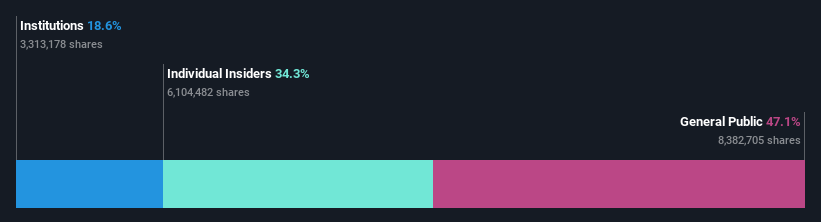

Doosan

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doosan Corporation operates in sectors including heavy industry, machinery manufacturing, and apartment construction across regions such as South Korea, the United States, Asia, the Middle East, and Europe with a market capitalization of approximately ₩3.56 billion.

Operations: The company generates revenue through segments in heavy industry, machinery manufacturing, and apartment construction across various global markets.

Insider Ownership: 38.9%

Earnings Growth Forecast: 72.9% p.a.

Doosan Corporation, while trading at 56.8% below its estimated fair value, shows promising signs with a forecast to turn profitable within three years, significantly outpacing average market growth. Despite this potential, its revenue growth at 3.6% annually lags behind South Korea's market average of 10.8%. Recent earnings reflect a substantial recovery, transitioning from a net loss to reporting KRW 4.98 billion in net income and stabilizing earnings per share at KRW 280 in Q1 2024.

Taking Advantage

Embark on your investment journey to our 83 Fast Growing KRX Companies With High Insider Ownership selection here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A039030 KOSDAQ:A089030 and KOSE:A000150.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance