KRX Growth Companies With Insider Ownership As High As 38%

The South Korean market has shown robust performance, rising 2.2% in the past week and achieving an 11% increase over the last year, with earnings projected to grow by 30% annually. In such a thriving environment, stocks with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Seojin SystemLtd (KOSDAQ:A178320) | 27.9% | 48.1% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.6% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

Vuno (KOSDAQ:A338220) | 19.5% | 105% |

HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

Techwing (KOSDAQ:A089030) | 18.7% | 77.8% |

Let's explore several standout options from the results in the screener.

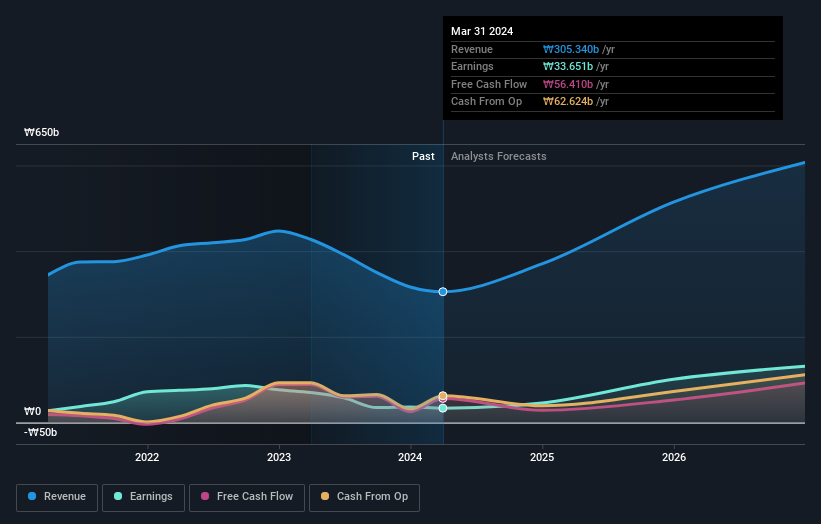

EO Technics

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EO Technics Co., Ltd. is a global manufacturer and supplier of laser processing equipment, with a market capitalization of approximately ₩2.39 billion.

Operations: The company generates its revenue primarily from the global supply of laser processing equipment.

Insider Ownership: 30.7%

EO Technics, a South Korean company, is poised for notable growth with expected revenue and earnings increases of 19.9% and 47% per year respectively, outpacing the broader market. However, its return on equity is projected to be modest at 15.8%. The firm's financial results have been affected by significant one-off items, and it has experienced substantial share price volatility recently. Additionally, profit margins have declined from last year's 16.4% to 11%. There are no recent insider transactions reported.

Click to explore a detailed breakdown of our findings in EO Technics' earnings growth report.

The valuation report we've compiled suggests that EO Technics' current price could be inflated.

ST PharmLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ST Pharm Co., Ltd. specializes in custom manufacturing services for active pharmaceutical ingredients and intermediates, operating both in South Korea and internationally, with a market capitalization of approximately ₩1.79 trillion.

Operations: ST Pharm's revenue is generated from two primary segments: ₩251.86 billion from raw drug manufacturing and ₩34.40 billion from clinical trial site consignment research institute services.

Insider Ownership: 13%

ST PharmLtd, a South Korean growth company with high insider ownership, is trading at 58.8% below its estimated fair value, presenting a potentially undervalued opportunity. The company's revenue is expected to increase by 16.5% annually, surpassing the national market growth rate of 10.7%. However, shareholder dilution occurred over the past year and earnings quality has been impacted by large one-off items. Despite these concerns, earnings are projected to grow significantly at 34.2% per year over the next three years, outperforming the broader Korean market's forecast of 29.6%. Recent governance changes include appointments to its board and audit committee which could influence future strategic directions.

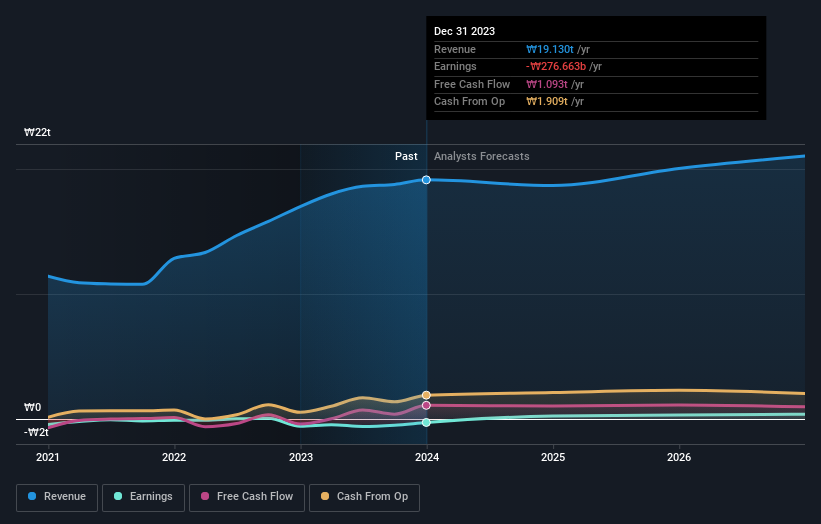

Doosan

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Doosan Corporation operates in heavy industry, machinery manufacturing, and apartment construction across various global markets including South Korea, the United States, Asia, the Middle East, and Europe, with a market capitalization of approximately ₩3.40 billion.

Operations: The company generates revenue through segments focused on heavy industry, machinery manufacturing, and apartment construction.

Insider Ownership: 38.9%

Doosan Corporation, a South Korean entity with high insider ownership, reported a significant turnaround in Q1 2024, transitioning from a substantial net loss to a profit of KRW 4.98 billion. Despite this positive shift and an expected annual earnings growth of 72.89%, the company's revenue growth forecast at 3.6% annually lags behind the broader market expectation of 10.7%. Additionally, its share price has been highly volatile over the past three months, and it trades at 57.3% below its estimated fair value, suggesting potential undervaluation or underlying concerns about stability and growth consistency.

Click here and access our complete growth analysis report to understand the dynamics of Doosan.

Upon reviewing our latest valuation report, Doosan's share price might be too pessimistic.

Turning Ideas Into Actions

Unlock more gems! Our Fast Growing KRX Companies With High Insider Ownership screener has unearthed 81 more companies for you to explore.Click here to unveil our expertly curated list of 84 Fast Growing KRX Companies With High Insider Ownership.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A039030KOSDAQ:A237690 and KOSE:A000150

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance