Kroger (KR) Queued for Q1 Earnings: Factors to Consider

The Kroger Co. KR is likely to register a decline in the top line when it reports first-quarter fiscal 2021 results on Jun 17, before the market opens. The Zacks Consensus Estimate for revenues is pegged at $39,222 million, indicating a decline of 5.6% from the prior-year reported figure.

Further, the bottom line of this operator of supermarket chain is expected to decrease year over year. We note that the Zacks Consensus Estimate for earnings for the quarter under review has been stable at 99 cents over the past 30 days. The figure suggests a decline from $1.22 per share reported in the year-ago period.

Notably, the company has a trailing four-quarter earnings surprise of 19.3%, on average. In the last reported quarter, this Cincinnati, OH-based company’s bottom line surpassed the Zacks Consensus Estimate by 17.4%.

Key Factors to Note

Kroger is likely to have faced tough year-over-year comparisons in sales, as COVID-19 benefits are lapped. Industry experts believe that lower at-home consumption activities and a drop in pantry-loading trends might have hurt the company’s first-quarter top-line performance.

Apart from this, stiff competition in the grocery segment remained a significant headwind. Again, costs related to additional employee payments and benefits, and investments undertaken to preserve safety and health of customers and team members amid the coronavirus crisis might have weighed on the to-be-reported quarter’s margins.

While aforementioned factors do raise concerns, we cannot ignore the efforts undertaken by Kroger to strengthen position not only with respect to products but also in terms of the way consumers prefer shopping. The company has been making significant investments to enhance product freshness and quality, and expand digital capabilities. Impressively, Kroger has been introducing new items under its “Our Brands” portfolio. Cumulatively, these are likely to have aided the company’s first-quarter performance.

The company’s “Restock Kroger” program involving investments in omni-channel platform, identifying margin-rich alternative profit streams, merchandise optimization, and lowering of expenses have been gaining traction. Realizing the need of the hour, the company has been offering a no-contact delivery option, low-contact pickup service and ship-to-home orders.

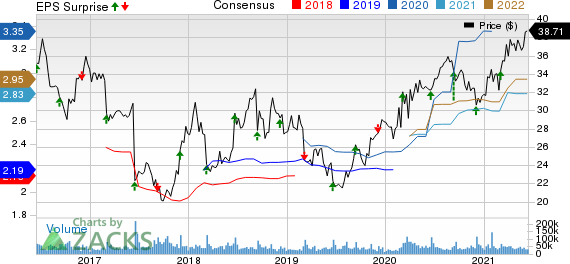

The Kroger Co. Price, Consensus and EPS Surprise

The Kroger Co. price-consensus-eps-surprise-chart | The Kroger Co. Quote

What the Zacks Model Unveils

Our proven model does not conclusively predict a beat for Kroger this earnings season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Kroger has a Zacks Rank #3 but an Earnings ESP of 0.00%.

Stocks With Favorable Combination

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

KB Home KBH has an Earnings ESP of +1.87% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

General Mills GIS has an Earnings ESP of +2.06% and a Zacks Rank #3.

Darden Restaurants DRI has an Earnings ESP of +17.46% and a Zacks Rank #3.

Bitcoin, Like the Internet Itself, Could Change Everything

Blockchain and cryptocurrency has sparked one of the most exciting discussion topics of a generation. Some call it the “Internet of Money” and predict it could change the way money works forever. If true, it could do to banks what Netflix did to Blockbuster and Amazon did to Sears. Experts agree we’re still in the early stages of this technology, and as it grows, it will create several investing opportunities.

Zacks’ has just revealed 3 companies that can help investors capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 3 crypto-related stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Darden Restaurants, Inc. (DRI) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

KB Home (KBH) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance