Kratos (KTOS) Buys ISR Provider for $80M, Boosts Portfolio

Kratos Defense & Security Solutions, Inc.KTOS recently revealed that it acquired Alabama-based Southern Research’s Engineering division ("SRE"). Considering the increased funding for the fiscal 2023 defense budget, this buyout should bolster Kratos’ growth in the defense market.

The move comes in sync with the company’s intent to grow and expand its business through meaningful and strategic acquisitions.

Details of the Acquisition

Kratos acquired SRE for a consideration of $80 million, which comprises $75 million in cash and $5 million in the shares of Kratos common stock. KTOS aims to generate value through this opportunistic acquisition by acquiring its 54-acre campus with varied facilities and machinery and equipment to perform various tasks, which comprise 25% of the buyout price.

Moreover, Kratos intends to carry out the operations of this newly formed business unit, Kratos SRE, under its Kratos Defense and Rocket Support Services Division.

Benefits of the Acquisition

SRE’s expertise and excellence in developing multi-faceted defense products like hypersonic, space, missile, missile defense, strategic deterrence, propulsion systems and energy applications as well as the Intelligence Surveillance and Reconnaissance sensor must play a major catalyst for Kratos’ growth in the strategic weapon system arena.

Moreover, the acquisition will aid the company in winning more contracts from the Pentagon, with the fiscal 2023 US defense budget proposing an investment of $773 billion for the Department of Defense (DoD), which implies a 4.1% increase from fiscal 2022’s enacted amount.

Furthermore, the acquisition provides a platform for expansion for Kratos, with the customer acceptance of certain SRE products already in development and nearing completion.

In the light of the aforementioned factors, we believe that the recent acquisition by the company is a prudent one as it is likely to be accretive to its organic growth trajectory going forward. This, in turn, may bolster its revenue generation prospects from a diverse range of products.

Peer Prospects

Considering the increased investment proposal for DoD in 2022, other defense majors that are likely to benefit are:

Lockheed Martin LMT is the world’s largest defense contractor and the largest military aircraft manufacturer and the prime contractor of the F-35 Joint Strike Fighter Program. Other notable products include the F-16 Fighting Falcon and the C-130 Hercules.

Lockheed Martin’s long-term earnings growth rate is pegged at 5.7%. LMT shares have returned 15.3% in the past year.

Northrop Grumman NOC is one of the top U.S. defense contractors in terms of revenues. Its product line is well-positioned in high-priority categories, such as defense electronics, unmanned aircraft and missile defense. Some of its notable products are the B-2 Spirit strategic bomber, the E-8C Joint STARS surveillance aircraft, the RQ-4 Global Hawk and the T-38 Talon supersonic trainer.

Northrop Grumman has a long-term earnings growth rate of 6.1%. NOC’s investors have gained 28.4% in the past year.

Raytheon Technologies RTX researches, develops and manufactures advanced technology products in the aerospace and defense industry, including aircraft engines, avionics, aerostructures, cybersecurity, guided missiles, air defense systems, satellites and drones. Some of its defense product ranges include the Advanced Medium Range Air-to-Air Missile, the TOW Weapon System, U.S. Navy's SPY-6 Radars, Javelin Missile and the SkyCeptor missile.

Raytheon Technologies has a long-term earnings growth rate of 10.5%. Shares of RTX have returned 7.7% in the past year.

Price Movement

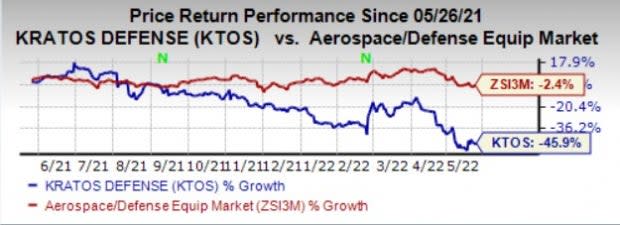

In the past year, shares of Kratos have declined 45.9% compared with the industry’s decline of 2.4%.

Image Source: Zacks Investment Research

Zacks Rank

Kratoscurrently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lockheed Martin Corporation (LMT) : Free Stock Analysis Report

Northrop Grumman Corporation (NOC) : Free Stock Analysis Report

Kratos Defense & Security Solutions, Inc. (KTOS) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance