Is Kraton (NYSE:KRA) A Risky Investment?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Kraton Corporation (NYSE:KRA) does use debt in its business. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Kraton

How Much Debt Does Kraton Carry?

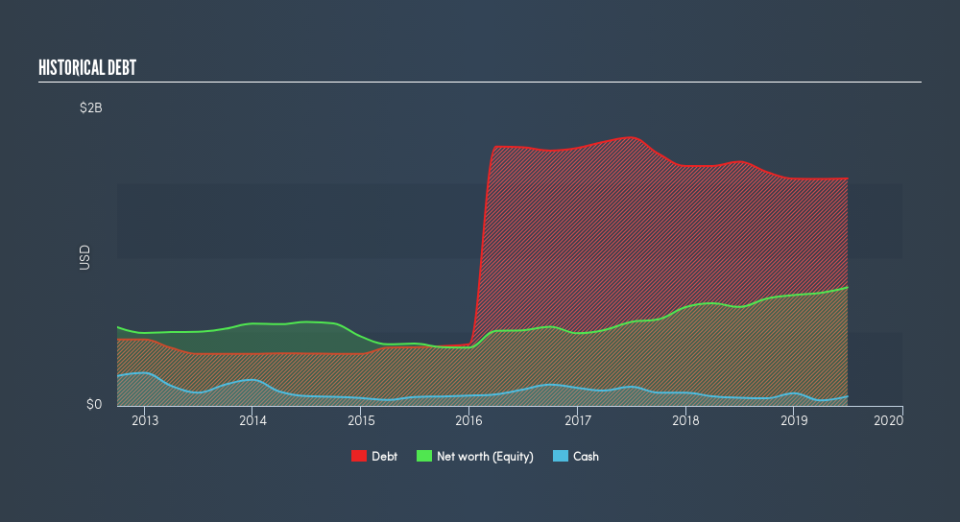

As you can see below, Kraton had US$1.53b of debt at June 2019, down from US$1.65b a year prior. However, it does have US$63.9m in cash offsetting this, leading to net debt of about US$1.47b.

How Strong Is Kraton's Balance Sheet?

We can see from the most recent balance sheet that Kraton had liabilities of US$434.5m falling due within a year, and liabilities of US$1.77b due beyond that. On the other hand, it had cash of US$63.9m and US$262.2m worth of receivables due within a year. So it has liabilities totalling US$1.88b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the US$870.0m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt After all, Kraton would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While we wouldn't worry about Kraton's net debt to EBITDA ratio of 4.6, we think its super-low interest cover of 2.4 times is a sign of high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. Another concern for investors might be that Kraton's EBIT fell 19% in the last year. If that's the way things keep going handling the debt load will be like delivering hot coffees on a pogo stick. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Kraton's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Looking at the most recent three years, Kraton recorded free cash flow of 44% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

On the face of it, Kraton's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least its conversion of EBIT to free cash flow is not so bad. Taking into account all the aforementioned factors, it looks like Kraton has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. Given our concerns about Kraton's debt levels, it seems only prudent to check if insiders have been ditching the stock.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance