Kraft Heinz's (KHC) Latest Move to Aid Portfolio Optimization

The Kraft Heinz Company KHC is leaving no stone unturned to optimize its portfolio. Moving along these lines, the company signed a definitive agreement to offload its B2B powdered cheese business to Kerry Group — a global food, beverage and pharma manufacturer.

We note that the proposed divestiture includes Kraft Heinz’s B2B powdered cheese products, which are sold via its Ingredients business. The transaction also includes the Albany, Minn. production unit. Management envisions closing the transaction in the back half of 2022.

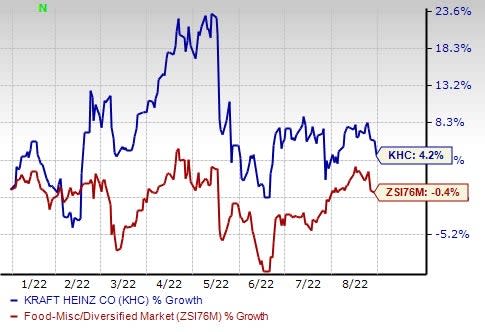

Shares of the Zacks Rank #3 (Hold) company have increased 4.2% year to date against the industry’s decline of 0.4%.You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Image Source: Zacks Investment Research

What Else Should You Know?

Kraft Heinz is focused on transforming its business to unleash its full potential. The company is committed to accelerating its profit and enhancing long-term shareholders’ value. As part of its next transformation phase, management unveiled AGILE@SCALE in February 2022. The strategy will help Kraft Heinz to enhance its agile expertise and capabilities via partnerships with technology giants and cutting-edge innovators. The company will leverage its financial flexibility to take over other capabilities.

Kraft Heinz’s top-line momentum is driven by three pillars of growth, including Consumer Platforms, Foodservice opportunities and further expansion in Emerging Markets. In its second-quarter 2022 earnings call, management highlighted that it witnessed solid growth across the portfolio, including the GROW platforms.

With respect to growing the Emerging Markets, management is on track to expand its presence through a sustainable and repeatable Go-To-Market model. In April 2022, Kraft Heinz acquired a majority stake in a Brazil-based condiments and sauces company — Companhia Hemmer Industria e Comercio ("Hemmer"). The buyout widens Kraft Heinz's International Taste Elevation platform with its focus on condiments and sauces. In January 2022, Kraft Heinz acquired an 85% stake in Germany-based Just Spices GmbH (“Just Spices”). The buyout enhances its direct-to-consumer operations and go-to-market expansion. Management acquired a sauces-focused business — Assan Foods — from the privately-held Turkish conglomerate Kibar Holding in October 2021. Through this buyout, the company expects to accelerate its retail and foodservice growth across Europe, the Middle East and Africa.

Other Food Players Gaining on Buyouts

Several other companies in the food space, like Post Holdings, Inc. POST, Hormel Foods Corporation HRL and McCormick & Company, Incorporated MKC, are benefiting from acquisitions.

During the second quarter of fiscal 2022, Post Holdings’ top line included $102.1 million in net sales from acquisitions. These acquisitions include the Private label ready-to-eat (PL RTE) cereal business, the Egg Beaters liquid egg brand, the Almark Foods business and related assets and the Peter Pan nut butter brand. On Apr 5, 2022, POST acquired Lacka Foods Limited, a U.K.-based marketer of high protein, ready-to-drink (RTD) shakes under the UFIT brand.

Hormel Foods is strengthening its business through strategic acquisitions. In June, HRL acquired the Planters snacking portfolio from Kraft Heinz. Prior to this, it acquired Texas-based pit-smoked meats company Sadler's Smokehouse in March 2020. The buyout is in sync with Hormel Foods’ initiatives to strengthen its position in the foodservice space.

McCormick strategically increased its presence through acquisitions, which have been strengthening its portfolio. In December 2020, MKC bought a 100% stake in FONA International, LLC and some of its affiliates. FONA’s diverse portfolio helps McCormick bolster its value-add offerings and expand the flavor solutions segment into attractive categories. In November 2020, McCormick acquired the parent company of Cholula Hot Sauce — a premium Mexico-based hot sauce brand.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hormel Foods Corporation (HRL) : Free Stock Analysis Report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

The Kraft Heinz Company (KHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance