KLX Energy Services Holdings, Inc. Just Reported A Surprise Loss: Here's What Analysts Think Will Happen Next

It's been a pretty great week for KLX Energy Services Holdings, Inc. (NASDAQ:KLXE) shareholders, with its shares surging 18% to US$6.54 in the week since its latest third-quarter results. It looks like a pretty bad result, given that revenues fell 17% short of analyst estimates at US$135m, and the company reported a loss of US$3.10 per share instead of the profit that analysts had been forecasting. Following the result, analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we gathered the latest post-earnings forecasts to see what analysts are forecasting for next year.

View our latest analysis for KLX Energy Services Holdings

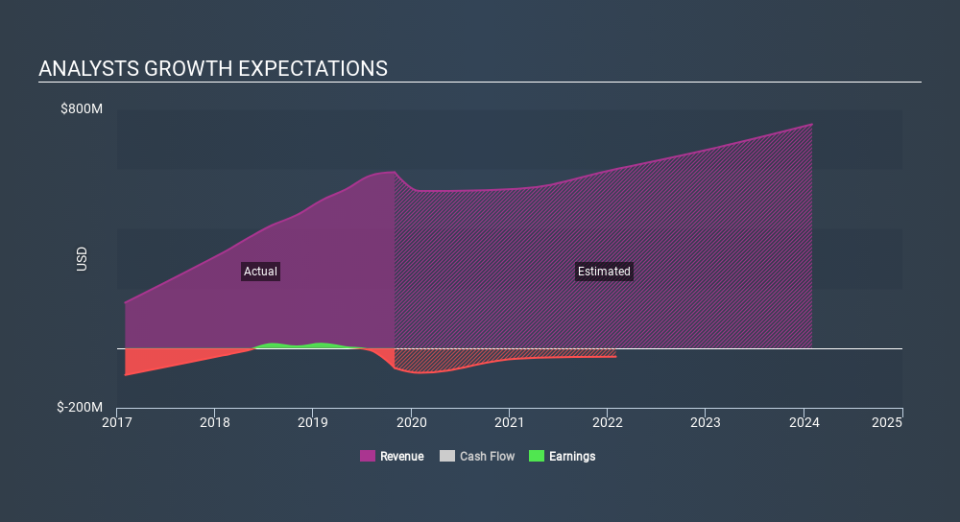

After the latest results, the consensus from KLX Energy Services Holdings's twin analysts is for revenues of US$533.8m in 2021, which would reflect a chunky 9.4% decline in sales compared to the last year of performance. Per-share losses are expected to explode, reaching US$1.56 per share. Before this earnings report, analysts had been forecasting revenues of US$601.5m and earnings per share (EPS) of US$0.03 in 2021. There looks to have been a major change in sentiment regarding KLX Energy Services Holdings's prospects following the latest results, with a real cut to to revenues and analysts now forecasting a loss instead of a profit.

The average analyst price target fell 42% to US$7.75, implicitly signalling that lower earnings per share are a leading indicator for KLX Energy Services Holdings's valuation.

It can be useful to take a broader overview by seeing how analyst forecasts compare, both to the KLX Energy Services Holdings's past performance and to peers in the same market. We would highlight that sales are expected to reverse, with the forecast 9.4% revenue decline a notable change from historical growth of 38% over the last three years. Compare this with our data, which suggests that other companies in the same market are, in aggregate, expected to see their revenue grow 4.2% next year. It's pretty clear that KLX Energy Services Holdings's revenues are expected to perform substantially worse than the wider market.

The Bottom Line

The biggest low-light for us was that the forecasts for KLX Energy Services Holdings dropped from profits to a loss next year. On the negative side, they also downgraded their revenue estimates, and forecasts imply revenues will perform worse than the wider market. Analysts also downgraded their price target, suggesting that the latest news has led analysts to become more pessimistic about the intrinsic value of the business.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At least one analyst has provided forecasts out to 2024, which can be seen for free on our platform here.

You can also view our analysis of KLX Energy Services Holdings's balance sheet, and whether we think KLX Energy Services Holdings is carrying too much debt, for free on our platform here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

Yahoo Finance

Yahoo Finance