Kinder Morgan (KMI) Provides Financial Guidance for 2023

Kinder Morgan, Inc. KMI provided a glimpse of its financial guidance for 2023.

For 2023, the leading midstream energy infrastructure provider expects to generate earnings of $1.12 per share, flat to its year-end 2022 estimate.

Kinder Morgan anticipates adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) of $7.7 billion for 2023, up from the $7.5 billion projected for 2022. It expects total segment EBDA of $8.2 billion, up 5% from the 2022 forecast.

To strengthen the balance sheet, KMI plans to end 2023 with a net debt to adjusted EBITDA of 4 times. With this plan, the company is expecting the ratio for 2023 to be lower than its long-term target of roughly 4.5 times.

Kinder Morgan plans to invest $2.1 billion in expansion projects, joint ventures, or discretionary capital expenditures, of which 80% will be allocated to low-carbon projects. KMI aims to generate higher returns for shareholders through an anticipated $1.13 per share dividend (annualized) and share repurchases.

Higher commodity prices have encouraged oil and gas producers to boost production, favoring pipeline operators such as Kinder Morgan. The key area where the company has commodity price sensitivity is in the CO2 segment. KMI hedged most of its next 12 months of crude production to minimize the sensitivity.

Oil and gas demand has increased significantly after Russia’s invasion of Ukraine as sanctions imposed against Moscow left Europe scrambling to find alternative supplies, resulting in record U.S. liquefied natural gas export volumes. Kinder Morgan expects higher adjusted core earnings for 2023 as it banks on the higher demand for transporting crude oil, gas liquids and carbon dioxide.

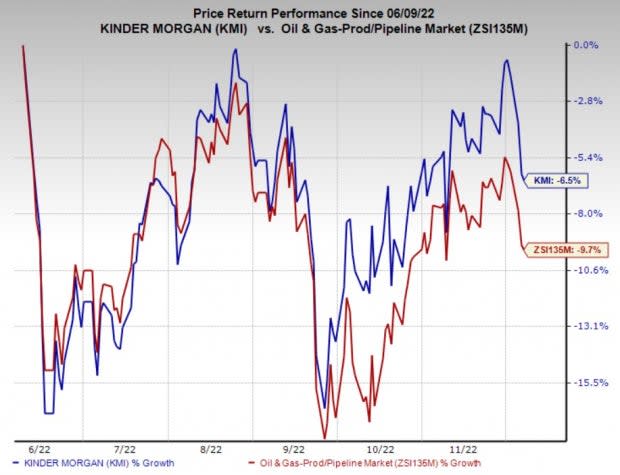

Price Performance

Shares of the company have outperformed the industry in the past six months. The stock has lost 6.5% compared with the industry’s 9.7% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Kinder Morgan currently has a Zack Rank #3 (Hold).

Investors interested in the energy sector might look at the following companies that presently carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Cactus, Inc. WHD is involved in manufacturing, designing and selling wellhead and pressure control equipment. WHD’s third-quarter adjusted earnings of 52 cents per share beat the Zacks Consensus Estimate of 49 cents.

Cactus is expected to see an earnings surge of 147% in 2022. At the third-quarter end, WHD had cash and cash equivalents of $320.6 million. It had no bank debt outstanding as of Sept 30, 2022.

RPC Inc. RES is among the leading providers of advanced oilfield services and equipment to almost all prospective oil and gas shale plays in the United States. RES’ adjusted earnings of 32 cents per share in the third quarter beat the Zacks Consensus Estimate of 25 cents.

RPC is expected to see an earnings surge of 2,933.3% in 2022. With no debt load, RPC had cash and cash equivalents of $35.9 million at the third-quarter end. This reflects the company’s strong balance sheet, providing it with massive financial flexibility and allowing it to remain afloat during tough times.

MPLX LP MPLX is a master limited partnership that provides a wide range of midstream energy services, including fuel distribution solutions. MPLX’s third-quarter earnings of 96 cents per unit beat the Zacks Consensus Estimate of 81 cents.

MPLX is expected to see an earnings rise of 29.7% in 2022. MPLX’s distribution per unit was 77.5 cents for the third quarter, indicating a 10% hike from the prior distribution of 70.5 cents. The distribution will be paid out on Nov 22, 2022, to common unitholders of record as of Nov 15, 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kinder Morgan, Inc. (KMI) : Free Stock Analysis Report

MPLX LP (MPLX) : Free Stock Analysis Report

RPC, Inc. (RES) : Free Stock Analysis Report

Cactus, Inc. (WHD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance