Key Factors to Consider for Aimco (AIV) This Earnings Season

Apartment Investment & Management Co. AIV — commonly known as Aimco — is slated to report first-quarter 2020 results on May 7, after market close. While the company’s quarterly funds from operations (FFO) per share are expected to have improved, its revenues are anticipated to have witnessed a year-over-year decline.

In the last reported quarter, the Denver, CO-based residential real estate investment trust (REIT) reported pro forma FFO of 65 cents per share, meeting the Zacks Consensus Estimate. Results benefited from decent growth in same-store property net operating income (N0I), higher occupancy and increase in rents.

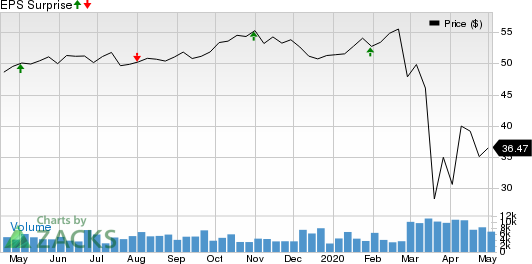

Aimco has a mixed earnings surprise history. Over the trailing four quarters, the company surpassed the Zacks Consensus Estimate on one occasion, missed in one and reported in-line results in the other two. It reported a negative surprise of 0.01%, on average. This is depicted in the chart below:

Apartment Investment and Management Company Price and EPS Surprise

Apartment Investment and Management Company price-eps-surprise | Apartment Investment and Management Company Quote

Let’s see how things have shaped up for this announcement.

Though the coronavirus pandemic jeopardized the latter half of the January-March period, first-quarter 2020 commenced on a positive note, with a resilient economy and decent job-market strength. Therefore, the pandemic’s impact on real estate fundamentals is likely to be more pronounced in the second quarter than in the first.

Usually, demand for apartments slows down during the colder months as renters usually do not prefer to move in winters. However, a report from the real estate technology and analytics firm, RealPage, suggests otherwise. Going by the report, the U.S. apartment rental market’s performance in February was steady, with national apartment occupancy in the month remaining at 95.5%, in line with the January figure but up 30 basis points (bps) from the year-ago figure. Rent growth of 2.9% was also in line with the three-year average.

The favorable numbers posted by the U.S rental apartment market are indicative of Aimco's encouraging performance in the January-March period.

The company’s portfolio is diversified, both in terms of geography and price point, and situated in some key markets in the United States. This is expected to have enabled it to witness decent demand in the first quarter amid favorable demographics and household formation trends.

Further, the company has been making efforts to enhance the portfolio quality through property sales and reinvestment of the proceeds in select apartment homes with relatively higher projected free cash flow internal rates of return. The revamping efforts are expected to have driven growth in the company’s average revenues per apartment home in the first quarter.

Late in March, providing an update relating to the coronavirus outbreak, the company’s announced that it expects first-quarter results to be in line with estimates provided with fourth-quarter results. Aimco’s balance-sheet position remained solid in the quarter, with the loan to value (LTV) at 32%. To have access to liquidity during the current downturn, the company informed that it “drew down” $300 million under its credit facility. Also, Aimco has access to an asset pool of $2.4 billion, without any debt encumbrances, and delayed its planned capital expenditure of around $150 million in the first quarter.

However, apartment deliveries are expected to have remained elevated in a number of the company’s markets. Continued supply is anticipated to have been concerning as it curtails landlords’ ability to command more rent and result in lesser absorption. Such an environment is expected to have led to aggressive rental concessions and moderated Aimco’s pricing power for the quarter under review. This is likely to have hindered the company’s top-line growth.

Notably, the Zacks Consensus Estimate for first-quarter revenues is pegged at $228.6 million, indicating a decline of 0.7% from the year-ago quarter’s reported figure.

Moreover, the Zacks Consensus Estimate for Aimco’s first-quarter 2020 FFO per share has been unchanged over the past 30 days at 66 cents. For first-quarter 2020, the company expects pro forma FFO per share of 64-68 cents.

Here is What Our Quantitative Model Predicts

Our proven model does not predict a positive surprise in terms of FFO per share for Aimco this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of a beat. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Aimco currently carries a Zacks Rank of 3 and has an Earnings ESP of 0.00%.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks That Warrant a Look

Here are a few stocks in the REIT sector that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this quarter:

Extra Space Storage Inc. EXR, slated to release first-quarter earnings on May 6, has an Earnings ESP of +0.21% and a Zacks Rank of 3 at present.

SBA Communications Corporation SBAC, set to report quarterly numbers on May 5, currently has an Earnings ESP of +0.67% and a Zacks Rank of 3.

Americold Realty Trust COLD, expected to release earnings results on May 7, currently has an Earnings ESP of +9.74% and a Zacks Rank #3.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apartment Investment and Management Company (AIV) : Free Stock Analysis Report

SBA Communications Corporation (SBAC) : Free Stock Analysis Report

Extra Space Storage Inc (EXR) : Free Stock Analysis Report

Americold Realty Trust (COLD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance