Kevin Carmichael: Slower inflation means the Bank of Canada's 'March break' is back on

The Bank of Canada will take its March break from raising interest rates after all.

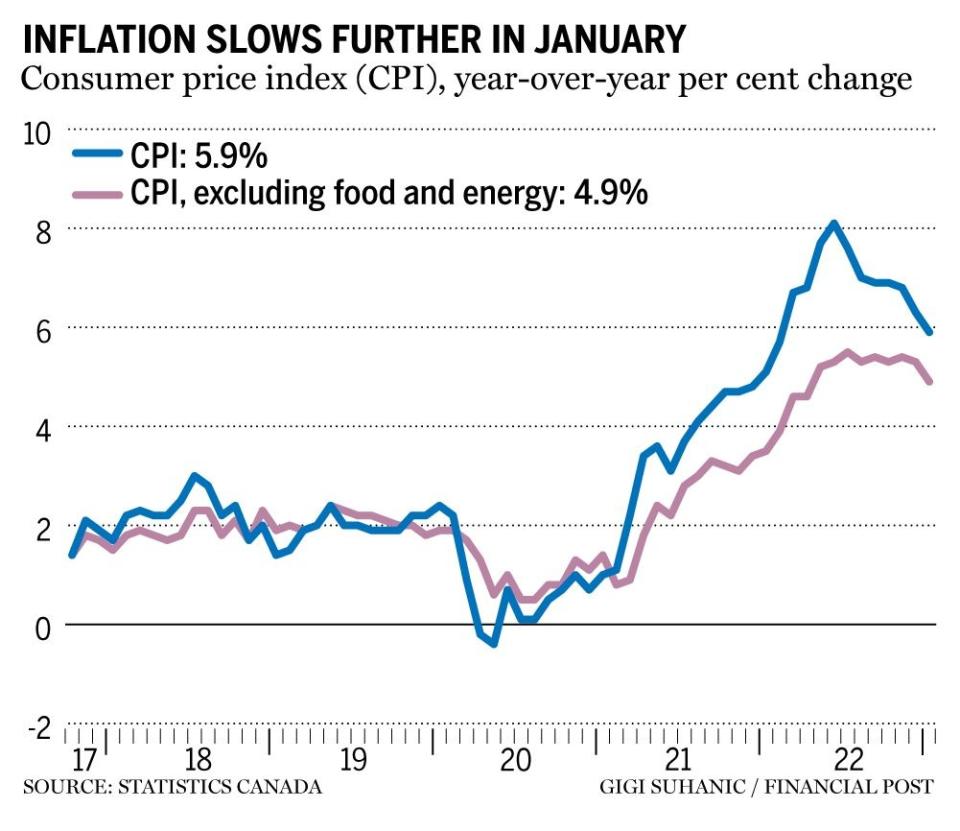

Statistics Canada’s consumer price index rose 5.9 per cent in January from a year earlier, a significant decline from 6.3 per cent in December that supports the central bank’s bet that the worst inflation outbreak since the 1980s might be over.

The drop is significant because Bay Street was starting to wonder whether Bank of Canada governor Tiff Macklem was hasty in January when he said he was prepared to stop raising interest rates and assess whether he had done enough to crush price pressures.

A couple of weeks later, new data showed employment surged in January, suggesting the economy still had plenty of momentum even though the central bank had never been more aggressive in trying to cool it down. And last week, evidence emerged that inflation in the United States was hotter than anticipated at the start of the year, raising questions about whether the story would be similar in Canada.

However, the latest numbers from Statistics Canada suggest inflation continues to drift lower, much as the Bank of Canada said it would in January, when it raised the benchmark rate a quarter-point while also promising to hold it there, provided incoming data showed inflation was moving back to its target of two per cent.

Inflation is still too high, and Macklem has made it clear that he’s willing to risk a mild recession this year if that’s what it takes to keep expectations of higher prices from becoming entrenched.

But because monetary policy works with a lag, he anticipates his decision to ratchet up borrowing costs by 4.25 percentage points in the span of a year will eventually bite, and possibly hard, given the extent to which households have piled up debt chasing runaway housing prices over the past decade. That risk surfaced in the new inflation numbers, which showed mortgage interest costs increased some 21 per cent in January from a year earlier, the biggest increase since the fall of 1982, Statistics Canada said.

“We’ve raised rates rapidly, historically at a very rapid pace,” Macklem told the House finance committee last week. “It’s time to pause and assess whether we’ve raised interest rates enough. If inflation comes in line with our own forecast, then, yes, we’ve probably done enough,” he added, referring to the central bank’s prediction that headline inflation will end the year at around 2.5 per cent. “It is really important that Canadians see that inflation keeps coming down and restores their confidence that we are going to get back to price stability.”

Excluding food and energy prices, the consumer price index rose 4.9 per cent from January 2022, compared with a year-over-year increase of 5.4 per cent in December. That’s significant because the headline inflation number is often influenced by volatile prices for commodities such as oil, grain and vegetables. “Core” prices, which are indicative of the underlying trend, appear to be falling, albeit not fast enough to dissuade market participants that additional interest rate increases could be necessary to truly crush inflation. Two separate measures of core inflation that the Bank of Canada watches to gauge the trend also were around five per cent, a long way from the central bank’s target.

“The Bank of Canada has clearly telegraphed an imminent pause in its tightening cycle and today’s data should support expectations for a lack of action at the next meeting” on March 8, Karl Schamotta, chief market strategist at Cambridge Mercantile Corp., said in a note to clients. “But core price pressures remain well above the institution’s target range, making another quarter-point interest rate hike reasonably possible in the coming months.”

The headline number looked better to a certain extent by what Statistics Canada called a “base-year effect.” In January 2022, the consumer price index jumped 0.9 per cent from the previous month, a relatively big increase caused by higher energy prices amid signs that Russia intended to invade Ukraine. Supply chains were also a mess, and housing prices were rising.

Kevin Carmichael: 3 things the Bank of Canada subtly told us this week

Tiff Macklem is sticking with rate-hike pause despite blowout jobs report — for now

Kevin Carmichael: Canada's 'blowout' jobs report raises questions about the path of interest rates

This year, conditions are entirely different. Energy and housing costs are lower, and supply chain troubles are easing. The consumer price index increased only 0.5 per cent on the month, so the comparison with the year-ago period is necessarily lower than it was at this time in 2022.

A monthly increase of 0.5 per cent represents a big jump from December, when the consumer price index declined 0.6 per cent from the previous month. Statistics Canada said a 4.7 per cent jump in gasoline prices was mostly to blame, so the sudden upward pressure should dissipate as the winter storm Elliot caused a momentary supply shock by forcing the closure of refineries in the southwestern United States.

Some Bay Street economists said they will be paying closer attention to monthly changes in the consumer price index this year because those base-year effects will confuse the signal being sent by the year-over-year changes. Charles St-Arnaud, chief economist at Alberta Central, observed that the three-month moving average has dropped to an annual rate of less than three per cent, a positive sign because that’s within the central bank’s comfort zone of one per cent to three per cent.

At the same time, the former Bank of Canada economist calculated that the cost of more than half of the hundreds of goods and services Statistics Canada measures were growing at annual rates of more than five per cent, evidence that inflation could get stuck at an elevated level.

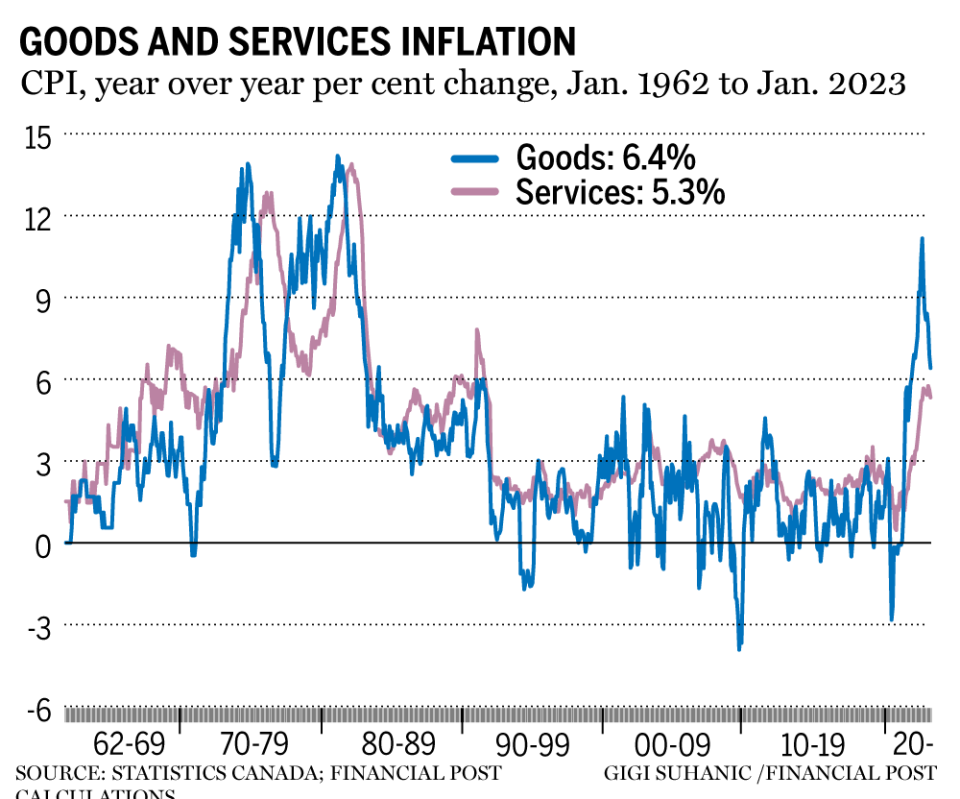

Perhaps the most helpful signal in the latest inflation data when it comes to predicting the trajectory of interest rates is Statistics Canada’s assessment of the cost of services, which became unmoored last year and — unlike goods prices — continued to climb over the second half of last year.

Macklem last week told lawmakers that service price inflation “needs to cool” or else higher interest rates will probably be necessary. Statistics Canada said the cost of services increased 5.3 per cent from January 2022, down from 5.6 per cent the previous month and the slowest since June 2022.

That’s enough to keep higher borrowing costs at bay for now.

• Email: kcarmichael@postmedia.com | Twitter: carmichaelkevin

Yahoo Finance

Yahoo Finance